Question: Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12 percent on

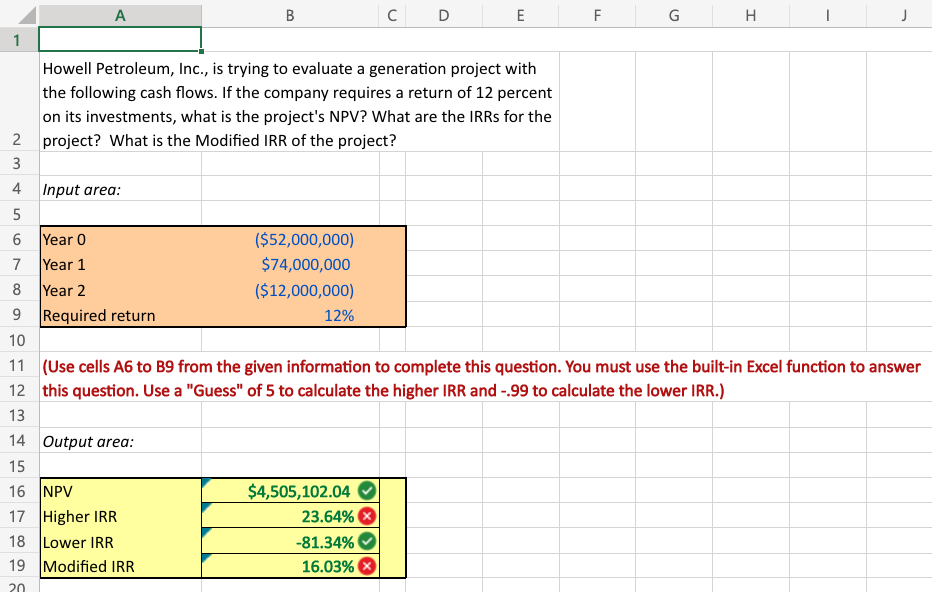

Howell Petroleum, Inc., is trying to evaluate a generation project with the following cash flows. If the company requires a return of 12 percent on its investments, what is the project's NPV? What are the IRRs for the project? What is the Modified IRR of the project? Use cells A6 to B9 from the given information to complete this question. You must use the built-in Excel function to answer this question. Use a "Guess" of 5 to calculate the higher IRR and -.99 to calculate the lower IRR.)

11 (Use cells A6 to B9 from the given information to complete this question. You must use the built-in Excel function to answer this question. Use a "Guess" of 5 to calculate the higher IRR and -.99 to calculate the lower IRR.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts