Question: hrblock.csod.com / Evaluations / EvalLaunch . aspx?loid = beae 5 0 2 d - ead 8 - 4 3 5 8 - 8 e 0

hrblock.csod.comEvaluationsEvalLaunchaspx?loidbeaedeadedcbab&evalLvl&redirecturlFphnxFdrit

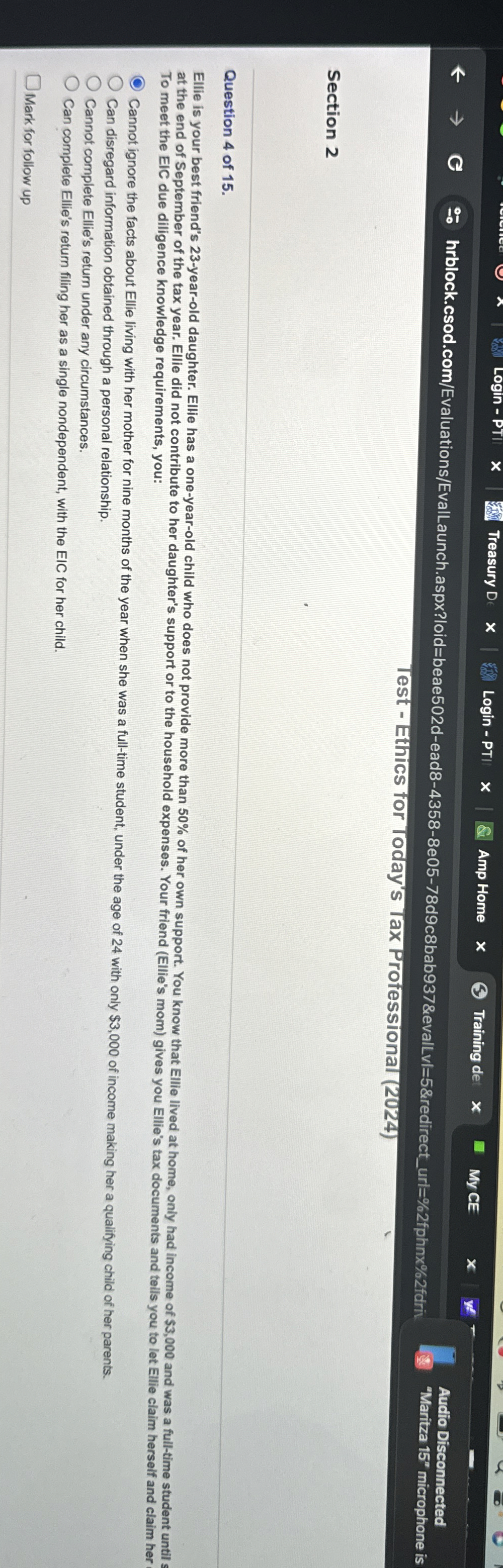

Test Ethics for Today's Tax Professional

Section

Question of

Ellie is your best friend's yearold daughter. Ellie has a oneyearold child who does not provide more than of her own support. You know that Ellie lived at home, only had income of $ and was a fulltime student untill s at the end of September of the tax year. Ellie did not contribute to her daughter's support or to the household expenses. Your friend Ellies mom gives you Ellie's tax documents and tells you to let Ellie claim herself and claim her

To meet the EIC due diligence knowledge requirements, you:

Cannot ignore the facts about Ellie living with her mother for nine months of the year when she was a fulltime student, under the age of with only $ of income making her a qualifying child of her parents.

Can disregard information obtained through a personal relationship.

Cannot complete Ellie's return under any circumstances.

Can complete Ellie's return fliling her as a single nondependent, with the EIC for her child.

Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock