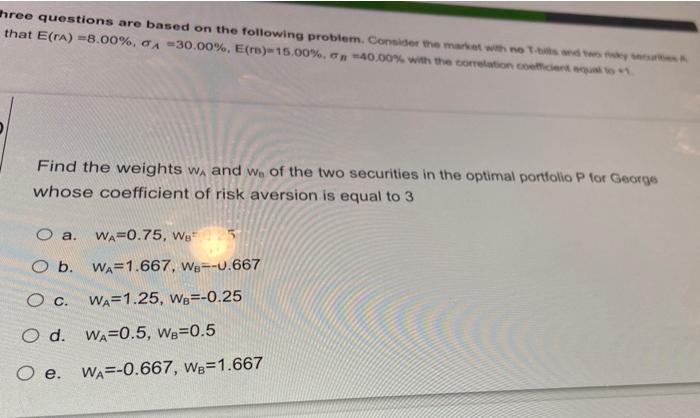

Question: hree questions are based on the following problem. Consider the man who that E(TA) -8.00%, GA 30.00%, E(re)-15.00% -40.00% with the connect Find the weights

hree questions are based on the following problem. Consider the man who that E(TA) -8.00%, GA 30.00%, E(re)-15.00% -40.00% with the connect Find the weights wand wo of the two securities in the optimal portfolio P for George whose coefficient of risk aversion is equal to 3 O a. WA=0.75, W5 O b. WA=1.667, We--0.667 Oc. WA=1.25, Wo=-0.25 O d. wa=0.5, Wg=0.5 WA=-0.667, W3=1.667 O e. hree questions are based on the following problem. Consider the man who that E(TA) -8.00%, GA 30.00%, E(re)-15.00% -40.00% with the connect Find the weights wand wo of the two securities in the optimal portfolio P for George whose coefficient of risk aversion is equal to 3 O a. WA=0.75, W5 O b. WA=1.667, We--0.667 Oc. WA=1.25, Wo=-0.25 O d. wa=0.5, Wg=0.5 WA=-0.667, W3=1.667 O e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts