Question: HRMG 4405 - Designing an incentive plan case study The Redi-Rentals Company rents and sells heavy duty equipment, such as backhoes, bulldozers and excavators to

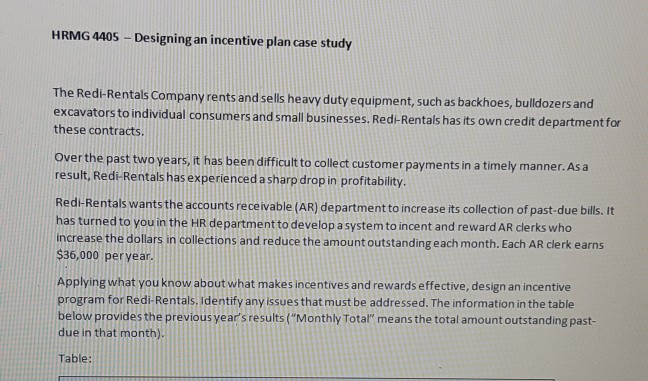

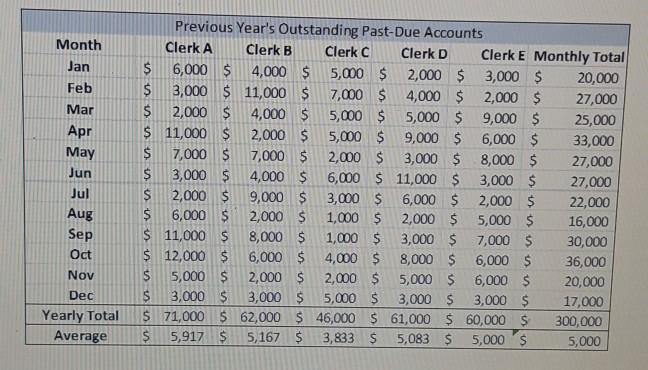

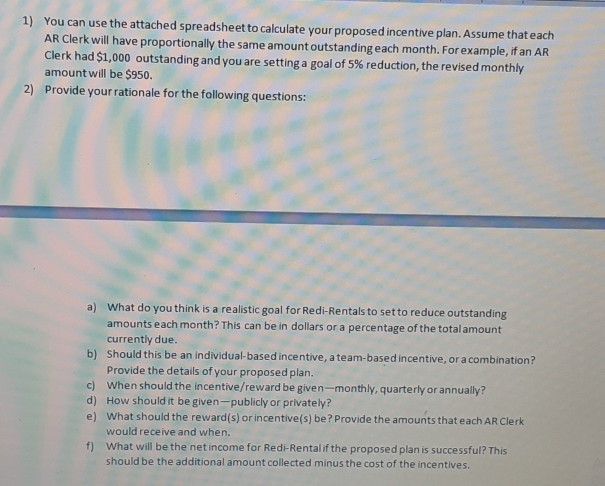

HRMG 4405 - Designing an incentive plan case study The Redi-Rentals Company rents and sells heavy duty equipment, such as backhoes, bulldozers and excavators to individual consumers and small businesses. Redi-Rentals has its own credit department for these contracts. Over the past two years, it has been difficult to collect customer payments in a timely manner. As a result, Redi-Rentals has experienced a sharp drop in profitability. Redi-Rentals wants the accounts receivable (AR) department to increase its collection of past-due bills. It has turned to you in the HR department to develop a system to incent and reward AR clerks who increase the dollars in collections and reduce the amount outstanding each month. Each AR clerk earns $36,000 per year. Applying what you know about what makes incentives and rewards effective, design an incentive program for Redi-Rentals. Identify any issues that must be addressed. The information in the table below provides the previous year's results ("Monthly Total" means the total amount outstanding past- due in that month). Table: Month Jan Feb Mar Apr May Jun Previous Year's Outstanding Past-Due Accounts Clerk A Clerk B Clerk C Clerk D Clerk E Monthly Total $ 6,000 $ 4,000 $ 5,000 $ 2,000 $ 3,000 $ 20,000 $ 3,000 $ 11,000 $ 7,000 $ 4,000 $ 2,000 $ 27,000 $ 2,000 $ 4,000 $ 5,000 $ 5,000 $ 9,000 $ 25,000 $ 11,000 $ 2,000 $ 5,000 $ 9,000 $ 6,000 $ 33,000 $ 7,000 $ 7,000 $ 2,000 $ 3,000 $ 8,000 $ 27,000 3,000 $ 4,000 $ 6,000 $ 11,000 $ 3,000 $ 27,000 2,000 $ 9,000 $ 3,000 $ 6,000 $ 2,000 $ 22,000 $ 6,000 $ 2,000 $ 1,000 $ 2,000 $ 5,000 $ 16,000 $ 11,000 $ 8,000 $ 1,000 $ 3,000 $ 7,000 $ 30,000 $ 12,000 $ 6,000 $ 4,000 $ 8,000 $ 6,000 $ 36,000 $ 5,000 $ 2,000 $ 2,000 $ 5,000 $ 6,000 $ 20,000 $ 3,000 $ 3,000 $ 5,000 $ 3,000 $ 3,000 $ 17,000 $ 71,000 $ 62,000 $ 46,000 $ 61,000 $ 60,000 $ 300,000 $ 5,917 $ 5,167 $ 3,833 $ 5,083 $ 5,000 $ 5,000 Jul Aug Sep Oct Nov Dec Yearly Total Average 1) You can use the attached spreadsheet to calculate your proposed incentive plan. Assume that each AR Clerk will have proportionally the same amount outstanding each month. For example, if an AR Clerk had $1,000 outstanding and you are setting a goal of 5% reduction, the revised monthly amount will be $950. 2) Provide your rationale for the following questions: a) What do you think is a realistic goal for Redi-Rentals to set to reduce outstanding amounts each month? This can be in dollars or a percentage of the total amount currently due. b) Should this be an individual-based incentive, a team-based incentive, or a combination? Provide the details of your proposed plan. c) When should the incentive/reward be given-monthly, quarterly or annually? d) How should it be given-publicly or privately? e) What should the reward(s) or incentive(s) be? Provide the amounts that each AR Clerk would receive and when. 1) What will be the net income for Red-Rental if the proposed plan is successful? This should be the additional amount collected minus the cost of the incentives. HRMG 4405 - Designing an incentive plan case study The Redi-Rentals Company rents and sells heavy duty equipment, such as backhoes, bulldozers and excavators to individual consumers and small businesses. Redi-Rentals has its own credit department for these contracts. Over the past two years, it has been difficult to collect customer payments in a timely manner. As a result, Redi-Rentals has experienced a sharp drop in profitability. Redi-Rentals wants the accounts receivable (AR) department to increase its collection of past-due bills. It has turned to you in the HR department to develop a system to incent and reward AR clerks who increase the dollars in collections and reduce the amount outstanding each month. Each AR clerk earns $36,000 per year. Applying what you know about what makes incentives and rewards effective, design an incentive program for Redi-Rentals. Identify any issues that must be addressed. The information in the table below provides the previous year's results ("Monthly Total" means the total amount outstanding past- due in that month). Table: Month Jan Feb Mar Apr May Jun Previous Year's Outstanding Past-Due Accounts Clerk A Clerk B Clerk C Clerk D Clerk E Monthly Total $ 6,000 $ 4,000 $ 5,000 $ 2,000 $ 3,000 $ 20,000 $ 3,000 $ 11,000 $ 7,000 $ 4,000 $ 2,000 $ 27,000 $ 2,000 $ 4,000 $ 5,000 $ 5,000 $ 9,000 $ 25,000 $ 11,000 $ 2,000 $ 5,000 $ 9,000 $ 6,000 $ 33,000 $ 7,000 $ 7,000 $ 2,000 $ 3,000 $ 8,000 $ 27,000 3,000 $ 4,000 $ 6,000 $ 11,000 $ 3,000 $ 27,000 2,000 $ 9,000 $ 3,000 $ 6,000 $ 2,000 $ 22,000 $ 6,000 $ 2,000 $ 1,000 $ 2,000 $ 5,000 $ 16,000 $ 11,000 $ 8,000 $ 1,000 $ 3,000 $ 7,000 $ 30,000 $ 12,000 $ 6,000 $ 4,000 $ 8,000 $ 6,000 $ 36,000 $ 5,000 $ 2,000 $ 2,000 $ 5,000 $ 6,000 $ 20,000 $ 3,000 $ 3,000 $ 5,000 $ 3,000 $ 3,000 $ 17,000 $ 71,000 $ 62,000 $ 46,000 $ 61,000 $ 60,000 $ 300,000 $ 5,917 $ 5,167 $ 3,833 $ 5,083 $ 5,000 $ 5,000 Jul Aug Sep Oct Nov Dec Yearly Total Average 1) You can use the attached spreadsheet to calculate your proposed incentive plan. Assume that each AR Clerk will have proportionally the same amount outstanding each month. For example, if an AR Clerk had $1,000 outstanding and you are setting a goal of 5% reduction, the revised monthly amount will be $950. 2) Provide your rationale for the following questions: a) What do you think is a realistic goal for Redi-Rentals to set to reduce outstanding amounts each month? This can be in dollars or a percentage of the total amount currently due. b) Should this be an individual-based incentive, a team-based incentive, or a combination? Provide the details of your proposed plan. c) When should the incentive/reward be given-monthly, quarterly or annually? d) How should it be given-publicly or privately? e) What should the reward(s) or incentive(s) be? Provide the amounts that each AR Clerk would receive and when. 1) What will be the net income for Red-Rental if the proposed plan is successful? This should be the additional amount collected minus the cost of the incentives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts