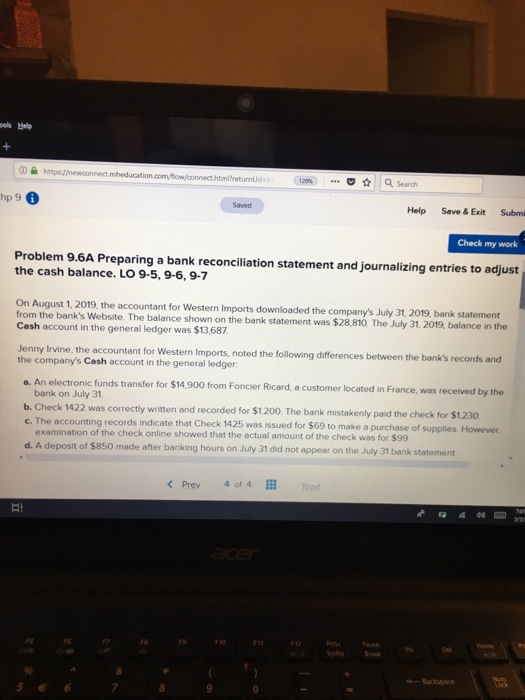

Question: htmFreturnUr 120% laSearch hp 9 6 Help Save& Exit Submi Saved Check my work Problem 9.6A Preparing a bank reconcillation statement and journalizing entries to

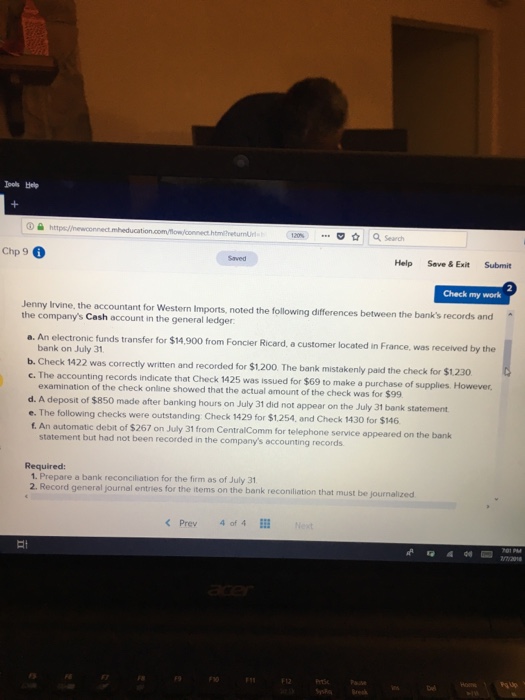

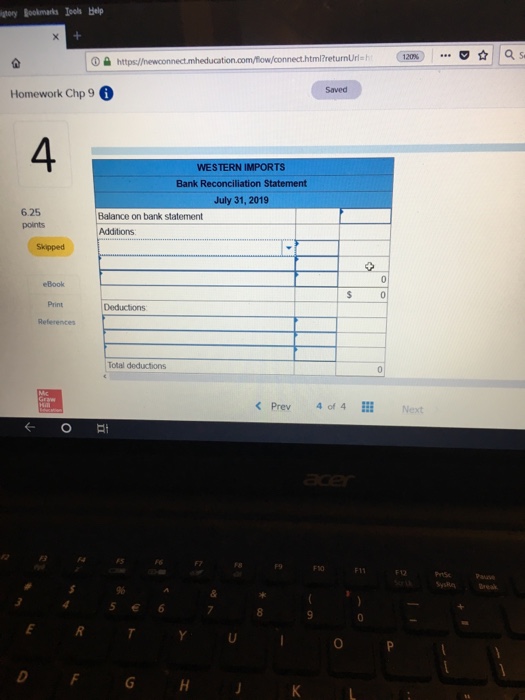

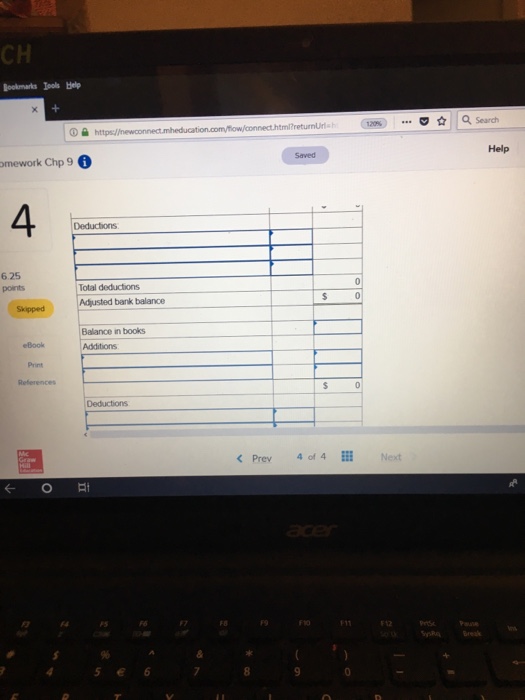

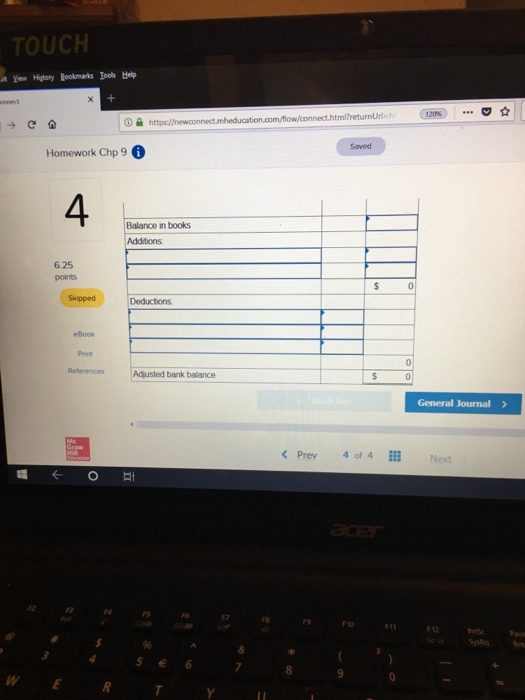

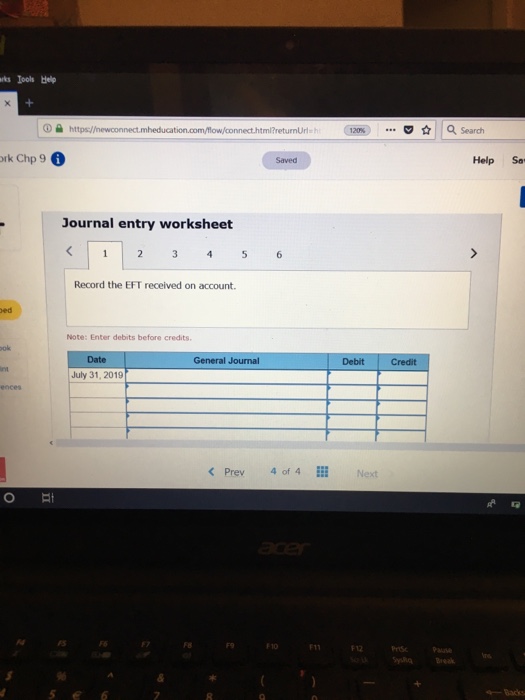

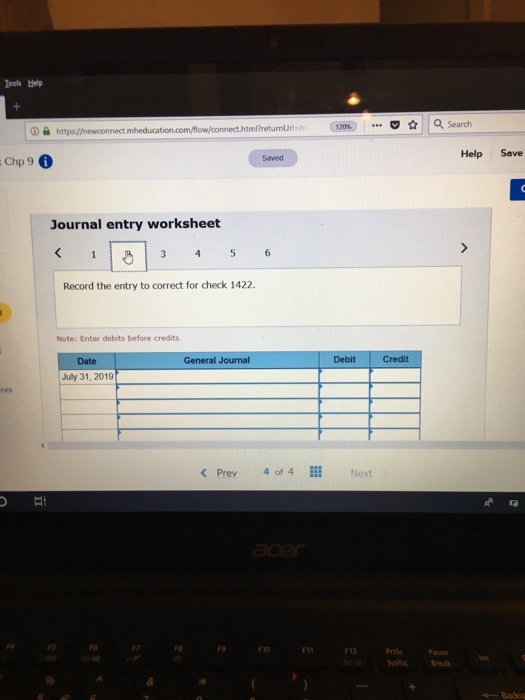

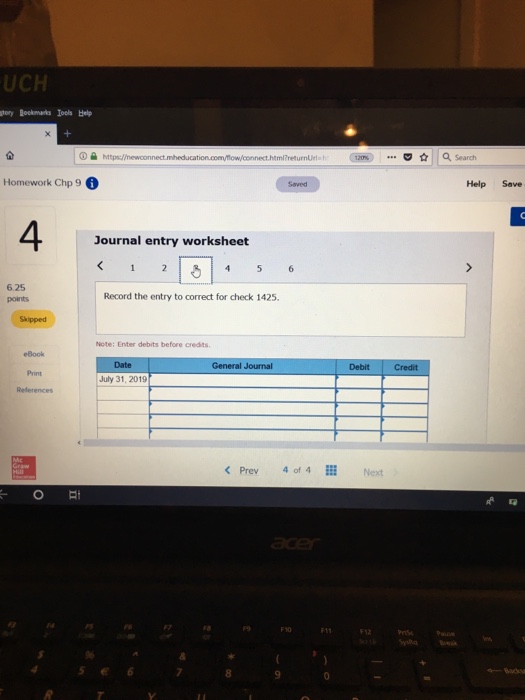

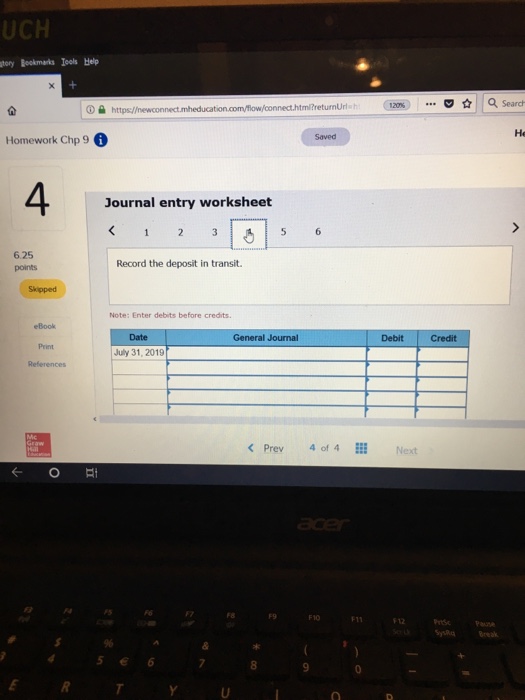

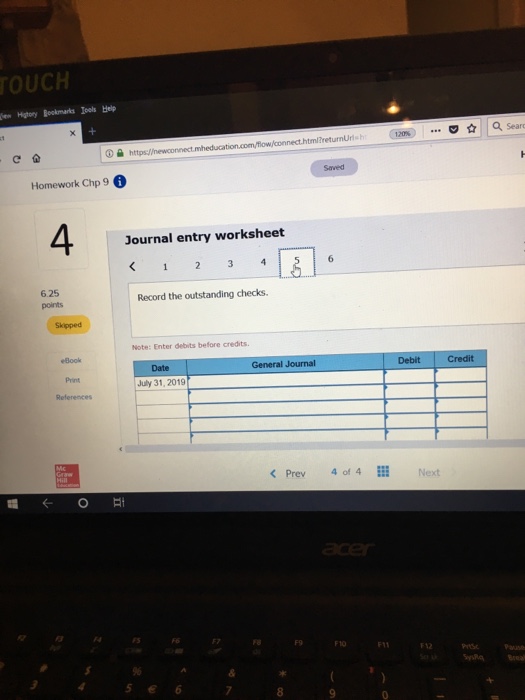

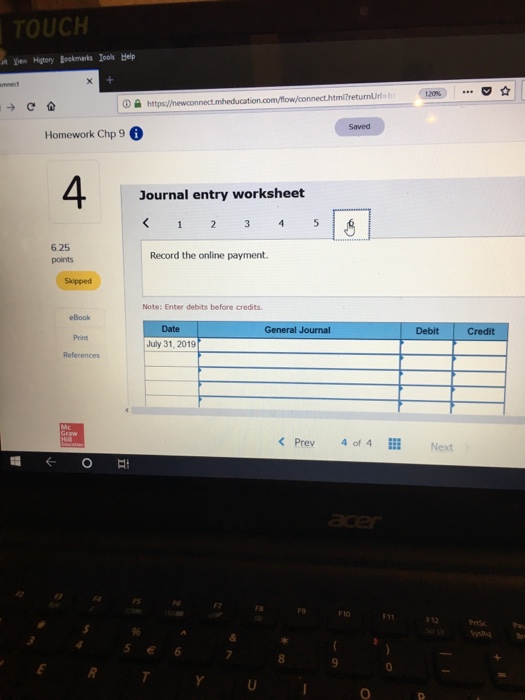

htmFreturnUr 120% laSearch hp 9 6 Help Save& Exit Submi Saved Check my work Problem 9.6A Preparing a bank reconcillation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6, 9-7 On August 1, 2019, the accountant for Western Imports downloaded the company's July 31, 2019, bank statement from the banks Website. The balance shown on the bank statement was $28.810. The July 31, 2019, balance in the Cash account in the general ledger was $13,687 noted the following differences between the bank's records and Jenny lrvine, the accountant for Western Imports, the company's Cash account in the general ledger a. An electronic funds transfer for $14,900 from Foncier Ricard, a customer located in France, was received by the bank on July 31 b. Check 1422 was correctly written and recorded for $1.200. The bank mistakenly paid the check for $1.230 c. The accounting records indicate that Check 1425 was iss sued for $69 to make a purchase of supplies. However examination of the check online showed that the actual amount of the check was for $99 d. A deposit of $850 made after banking hours on July 31 did not appear on the July 31 bank

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts