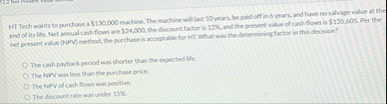

Question: HTT Tech wants to purchane a $ 1 3 0 , 0 0 0 machine. The machine will but 1 0 years be paid off

HTT Tech wants to purchane a $ machine. The machine will but years be paid off in years, and have no whage value at the end of its life. Net annual cash flows are $ the discount lactor is and the present value of cash flows is $ Per the eet present value NPM method, the purchase is acceptable for stc What was the determining factor in thin decision?

The canh payback period was whorter the the expected le

The NPV was less than the purchase price.

The NEW of canh flows was positive.

The discount rate was under

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock