Question: https%253A%252F%252Fims.meducation.com%252Fmgmiddleware25 - Required Saved Help Save & Exit Sub On April 12, Hong Company agrees to accept a 60-day, 8%, $4,800 note from Indigo Company

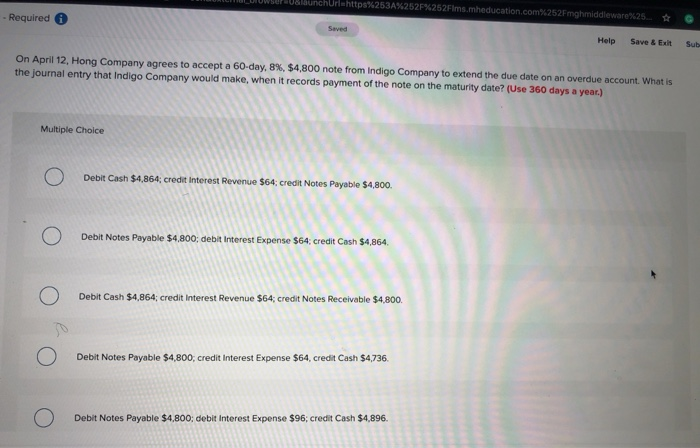

https%253A%252F%252Fims.meducation.com%252Fmgmiddleware25 - Required Saved Help Save & Exit Sub On April 12, Hong Company agrees to accept a 60-day, 8%, $4,800 note from Indigo Company to extend the due date on an overdue account. What is the journal entry that Indigo Company would make, when it records payment of the note on the maturity date? (Use 360 days a year.) Multiple Choice Debit Cash $4,864, credit Interest Revenue $64: credit Notes Payable $4,800. Debit Notes Payable $4,800; debit Interest Expense $64; credit Cash $4,864 Debit Cash $4,864 credit Interest Revenue $64; credit Notes Receivable $4,800. Debit Notes Payable $4,800, credit Interest Expense $64, credit Cash $4,736 Debit Notes Payable $4,800: debit Interest Expense $96, credit Cash $4,896

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts