Question: https://elearning.theincometaxschool.com/pluginfile.php/82285/mod_resource.. ZOOM LINK - gigi@jacktaxes com - Alakazam Apps Mail 18. Lisa and John are married with one child, age 6. Lisa did not have

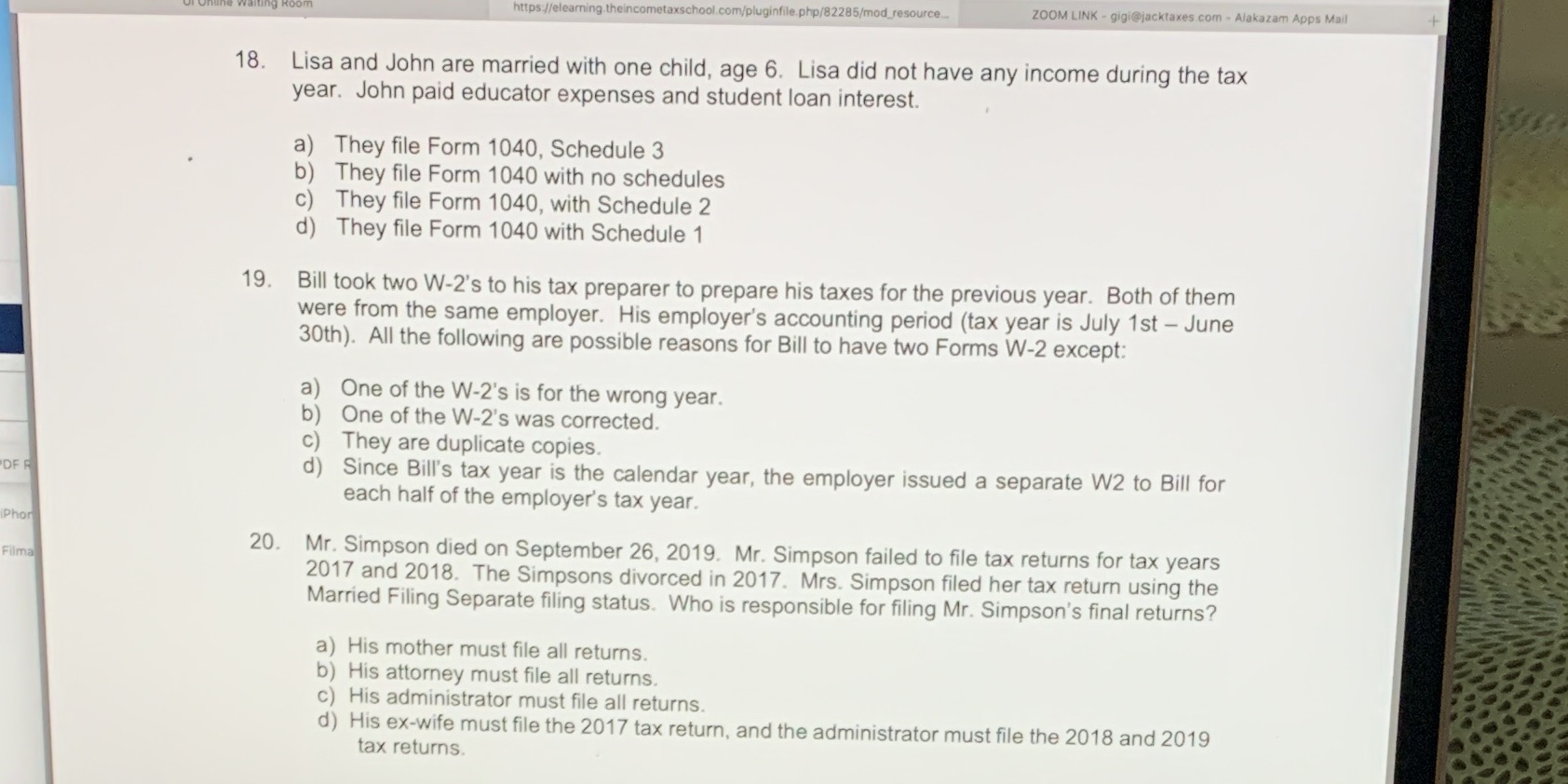

https://elearning.theincometaxschool.com/pluginfile.php/82285/mod_resource.. ZOOM LINK - gigi@jacktaxes com - Alakazam Apps Mail 18. Lisa and John are married with one child, age 6. Lisa did not have any income during the tax year. John paid educator expenses and student loan interest. a) They file Form 1040, Schedule 3 b) They file Form 1040 with no schedules C) They file Form 1040, with Schedule 2 d) They file Form 1040 with Schedule 1 19. Bill took two W-2's to his tax preparer to prepare his taxes for the previous year. Both of them were from the same employer. His employer's accounting period (tax year is July 1st - June 30th). All the following are possible reasons for Bill to have two Forms W-2 except: a) One of the W-2's is for the wrong year. b) One of the W-2's was corrected. C) They are duplicate copies. OF R d) Since Bill's tax year is the calendar year, the employer issued a separate W2 to Bill for each half of the employer's tax year. Phor 20. Mr. Simpson died on September 26, 2019. Mr. Simpson failed to file tax returns for tax years Filma 2017 and 2018. The Simpsons divorced in 2017. Mrs. Simpson filed her tax return using the Married Filing Separate filing status. Who is responsible for filing Mr. Simpson's final returns? a) His mother must file all returns. b) His attorney must file all returns. c) His administrator must file all returns. d) His ex-wife must file the 2017 tax return, and the administrator must file the 2018 and 2019 tax returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts