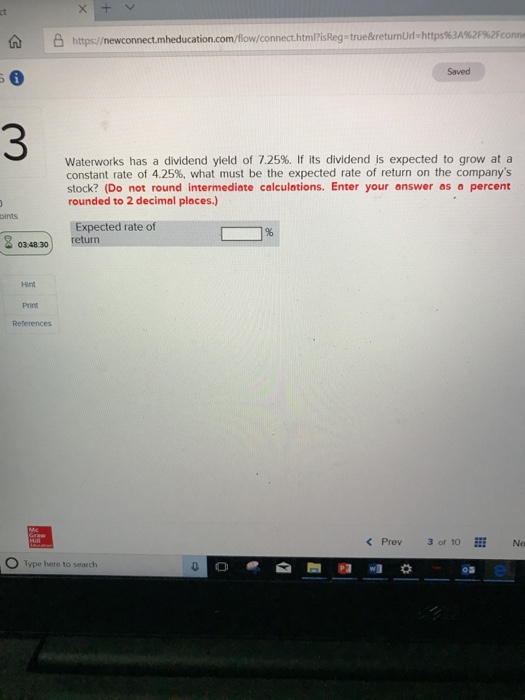

Question: https:/ewconnectrh educationcomflow/connect.htmi? sRegetrue&returnUrl.https%3A%2F%2foonn Saved 3 waterworks has a dividend yield of 7.25%. If its dividend is expected to grow at a constant rate of 4.25%,

https:/ewconnectrh educationcomflow/connect.htmi? sRegetrue&returnUrl.https%3A%2F%2foonn Saved 3 waterworks has a dividend yield of 7.25%. If its dividend is expected to grow at a constant rate of 4.25%, what must be the expected rate of return on the company's stock? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) ints Expected rate of 034830 return Hint Print Reterences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts