Question: https://ezto-cf-media.mheducatic x + ezto.mheducation.com/ext/map/index.html?_con=con&ext... [ D -> c d ezto-cf-media.mheducation.com/Media/Connect_Production.. State Uni.. Cengage login BLAW f Facebook Other bookmarks Apps T Louisiana State Uni. Cengage

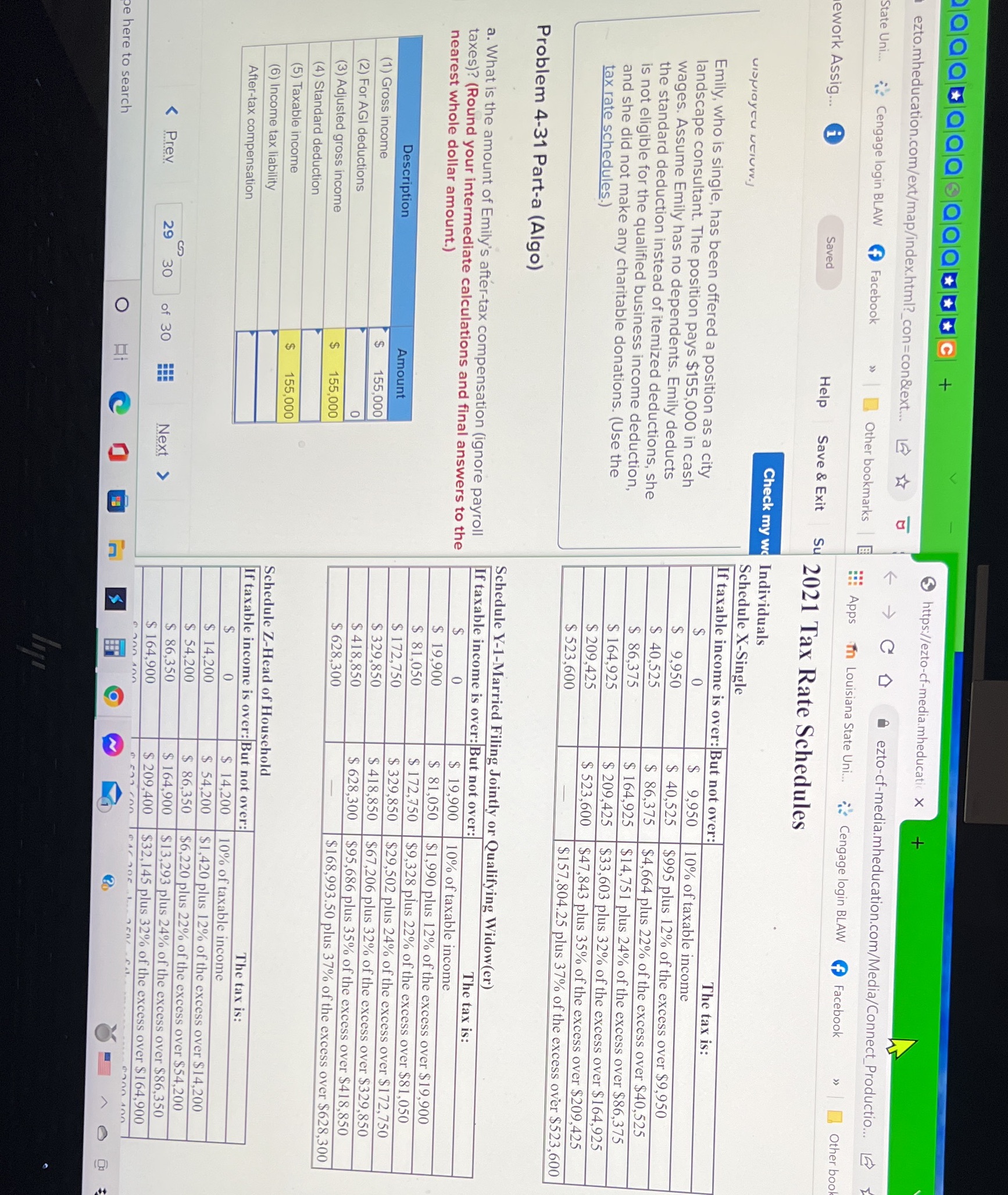

https://ezto-cf-media.mheducatic x + ezto.mheducation.com/ext/map/index.html?_con=con&ext... [ D -> c d ezto-cf-media.mheducation.com/Media/Connect_Production.. State Uni.. Cengage login BLAW f Facebook Other bookmarks Apps T Louisiana State Uni. Cengage login BLAW f Facebook Other boo ework Assig.. Saved Help Save & Exit Su 2021 Tax Rate Schedules Check my wo Individuals uIsplayEu WEIUM. Schedule X-Single If taxable income is over: But not over: The tax is: Emily, who is single, has been offered a position as a city $ 9,950 10% of taxable income landscape consultant. The position pays $155,000 in cash $ 9,950 wages. Assume Emily has no dependents. Emily deducts $ 40,525 $995 plus 12% of the excess over $9,950 the standard deduction instead of itemized deductions, she $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 is not eligible for the qualified business income deduction, $ 86,375 $ 164,925 $14,751 plus 24% of the excess over $86,375 and she did not make any charitable donations. (Use the $ 164,925 $ 209,425 $33,603 plus 32% of the excess over $164,925 tax rate schedules.) $ 209,425 $ 523,600 $47,843 plus 35% of the excess over $209,425 $ 523,600 $157,804.25 plus 37% of the excess over $523,600 Problem 4-31 Part-a (Algo) Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) a. What is the amount of Emily's after-tax compensation (ignore payroll If taxable income is over: But not over: The tax is: taxes)? (Round your intermediate calculations and final answers to the $ 19,900 10% of taxable income nearest whole dollar amount.) $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $ 172,750 $9,328 plus 22% of the excess over $81,050 Description Amount $ 172,750 $ 329,850 $29,502 plus 24% of the excess over $172, 750 $ 418,850 (1) Gross income $ 155,000 $ 329,850 $67,206 plus 32% of the excess over $329,850 $ 628,300 $95,686 plus 35% of the excess over $418,850 (2) For AGI deductions $ 418,850 $ 628,300 $168,993.50 plus 37% of the excess over $628,300 (3) Adjusted gross income 155,000 (4) Standard deduction (5) Taxable income $ 155,000 Schedule Z-Head of Household (6) Income tax liability If taxable income is over: But not over: The tax is: After-tax compensation $ 14,200 10% of taxable income $ 14,200 $ 54,200 $1,420 plus 12% of the excess over $14,200 $ 54,200 $ 86,350 $6,220 plus 22% of the excess over $54,200 $ 86,350 $ 164,900 $13,293 plus 24% of the excess over $86,350 $ 164,900 $ 209,400 $32,145 plus 32% of the excess over $164,900 tens con Tear of . e here to search O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts