Question: 3. You wish to make a one-year investment and have two choices: i. ii. Invest in a one-year zero-coupon bond and earn the one-year

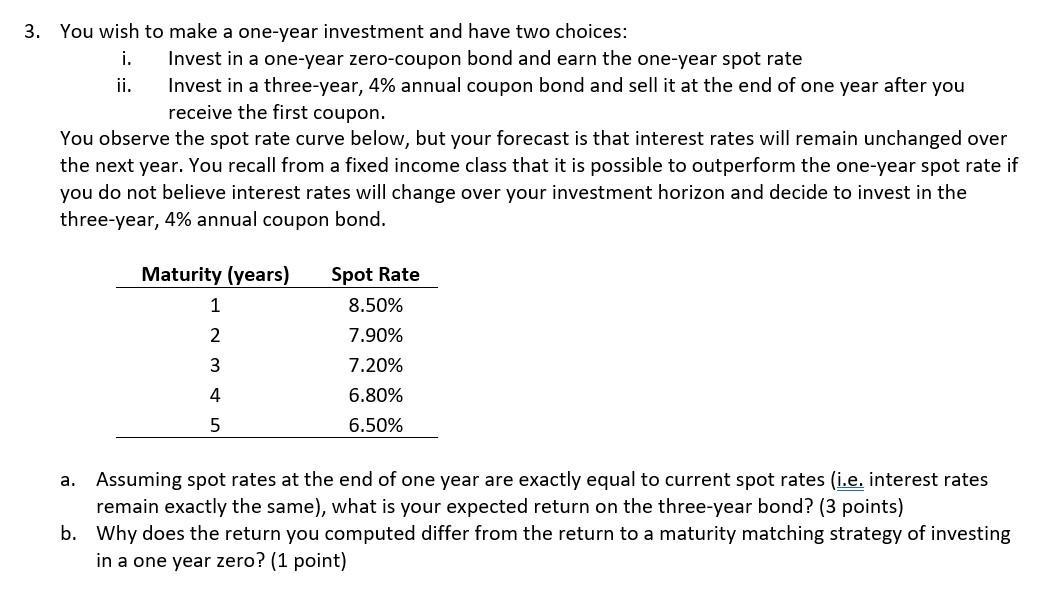

3. You wish to make a one-year investment and have two choices: i. ii. Invest in a one-year zero-coupon bond and earn the one-year spot rate Invest in a three-year, 4% annual coupon bond and sell it at the end of one year after you receive the first coupon. You observe the spot rate curve below, but your forecast is that interest rates will remain unchanged over the next year. You recall from a fixed income class that it is possible to outperform the one-year spot rate if you do not believe interest rates will change over your investment horizon and decide to invest in the three-year, 4% annual coupon bond. a. Maturity (years) 1 2 3 4 5 Spot Rate 8.50% 7.90% 7.20% 6.80% 6.50% Assuming spot rates at the end of one year are exactly equal to current spot rates (i.e. interest rates remain exactly the same), what is your expected return on the three-year bond? (3 points) b. Why does the return you computed differ from the return to a maturity matching strategy of investing in a one year zero? (1 point)

Step by Step Solution

There are 3 Steps involved in it

a The expected return on the threeyear bond can be calculated using the present value of the bonds cash flows which is equal to the bonds face value plus the present value of the coupon payments The p... View full answer

Get step-by-step solutions from verified subject matter experts