Question: https://venus.cs.qc.cuny.edu/~smane/cs365/lectures/CS365_765_lecture2.pdf -0.12305670 1 Question 1 Consider a bond with a maturity of four years. Suppose the bond pays semiannual coupons (two coupons per year) Hence

https://venus.cs.qc.cuny.edu/~smane/cs365/lectures/CS365_765_lecture2.pdf

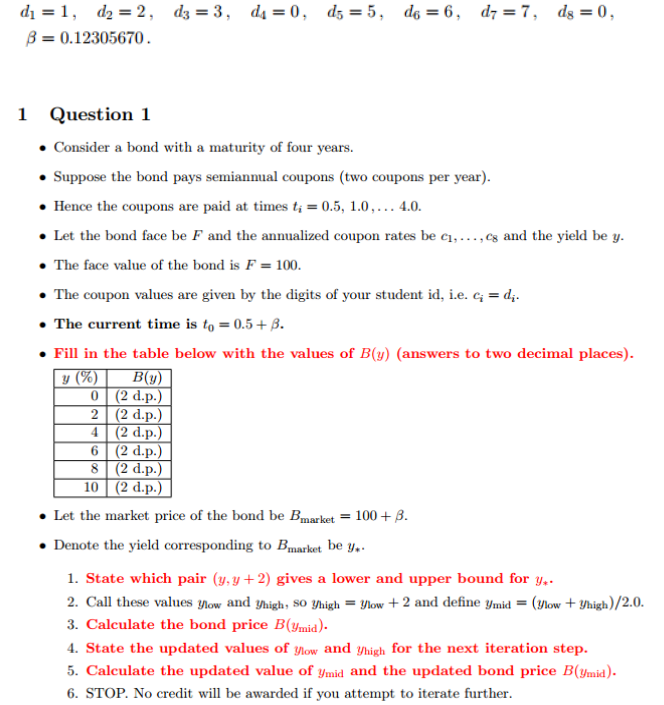

-0.12305670 1 Question 1 Consider a bond with a maturity of four years. Suppose the bond pays semiannual coupons (two coupons per year) Hence the coupons are paid at times t-0.5, 1.0,... 4.0 Let the bond face be F and the annualized coupon rates be ci,..., cs and the yield be y . The face value of the bond is F 100 . The coupon values are given by the digits of your student id, i.e. cid . The current time is to= 0.5+3. . Fill in the table below with the values of B((answers to two decimal places). 2 (2 d.p 8 (2 d.]p . Let the market price of the bond be Bmarket 100+ B Denote the yield corresponding to Bmarket be y. I. State which pair (y,y+2) gives a lower and upper bound for y*. 2. Call these values ow and high,SO highl2 and define ymid-(now yhigh)/2.0. 3. Calculate the bond price B(ymid). State the updated values of yow and yhigh for t 5. Calculate the updated value of ymid and the updated bond price B(mid). 6. STOP. No credit will be awarded if you attempt to iterate further the next iteration step. -0.12305670 1 Question 1 Consider a bond with a maturity of four years. Suppose the bond pays semiannual coupons (two coupons per year) Hence the coupons are paid at times t-0.5, 1.0,... 4.0 Let the bond face be F and the annualized coupon rates be ci,..., cs and the yield be y . The face value of the bond is F 100 . The coupon values are given by the digits of your student id, i.e. cid . The current time is to= 0.5+3. . Fill in the table below with the values of B((answers to two decimal places). 2 (2 d.p 8 (2 d.]p . Let the market price of the bond be Bmarket 100+ B Denote the yield corresponding to Bmarket be y. I. State which pair (y,y+2) gives a lower and upper bound for y*. 2. Call these values ow and high,SO highl2 and define ymid-(now yhigh)/2.0. 3. Calculate the bond price B(ymid). State the updated values of yow and yhigh for t 5. Calculate the updated value of ymid and the updated bond price B(mid). 6. STOP. No credit will be awarded if you attempt to iterate further the next iteration step

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts