Question: https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_DELL_2019.pdf PARTC 1) Explain in details the differences betweenMerger, Consolidation, and Acquisitions Support your answer with one recent example from the real world for each

https://www.annualreports.com/HostedData/AnnualReports/PDF/NYSE_DELL_2019.pdf

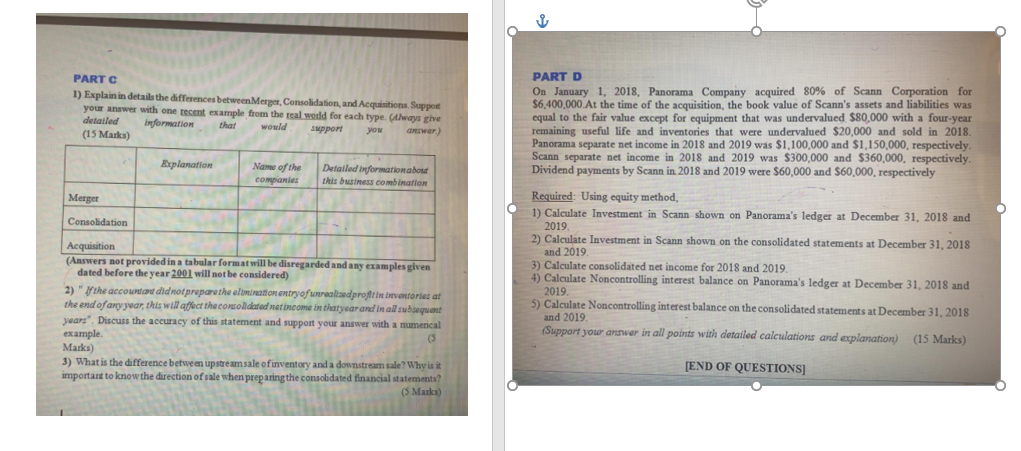

PARTC 1) Explain in details the differences betweenMerger, Consolidation, and Acquisitions Support your answer with one recent example from the real world for each type. (Athays give detailed information that would support YOM (15 Marks) Explanation Name of the companies Detailed information about this business combination Merger PART D On January 1, 2018, Panorama Company acquired 80% of Scann Corporation for $6,400,000. At the time of the acquisition, the book value of Scann's assets and liabilities was equal to the fair value except for equipment that was undervalued $80,000 with a four-year remaining useful life and inventories that were undervalued $20,000 and sold in 2018. Panorama separate net income in 2018 and 2019 was $1,100,000 and $1,150,000, respectively. Scann separate net income in 2018 and 2019 was $300,000 and $360,000, respectively. Dividend payments by Scann in 2018 and 2019 were $60,000 and $60,000, respectively Required: Using equity method, 1) Calculate Investment in Scann shown on Panorama's ledger at December 31, 2018 and 2019. 2) Calculate Investment in Scann shown on the consolidated statements at December 31, 2018 and 2019 3) Calculate consolidated net income for 2018 and 2019. 4) Calculate Noncontrolling interest balance on Panorama's ledger at December 31, 2018 and 2019. 5) Calculate Noncontrolling interest balance on the consolidated statements at December 31, 2018 and 2019. (Support you answer in all points with detailed calculations and explanation) (15 Marks) Consolidation Acquisition (Answers not provided in a tabular format will be disregarded and any examples given dated before the year 2001 will not be considered) 2) " the accountant did not prepare the elimination entry of unrealed profit in barventaries at the end of any year, this will affect the consolidated nat income in thatyear and in all subsequent years". Discuss the accuracy of this statement and support your answer with a numencal example, ( Marks) 3) What is the difference between upstream sale of inventory and a downstream sale? Why is it important to know the direction of sale when preparing the consolidated financial statements? (5 Marks) [END OF QUESTIONS]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts