Question: https://www.chegg.com/homework-help/accounting-for-governmental-nonprofit-entities-18th-edition-chapter-15-problem-17ep-solution-9781260503081 I do not understand the answer to journal transaction #6. the 17,300 is for instructional expense that was exchanged for tuition. Why was the

https://www.chegg.com/homework-help/accounting-for-governmental-nonprofit-entities-18th-edition-chapter-15-problem-17ep-solution-9781260503081

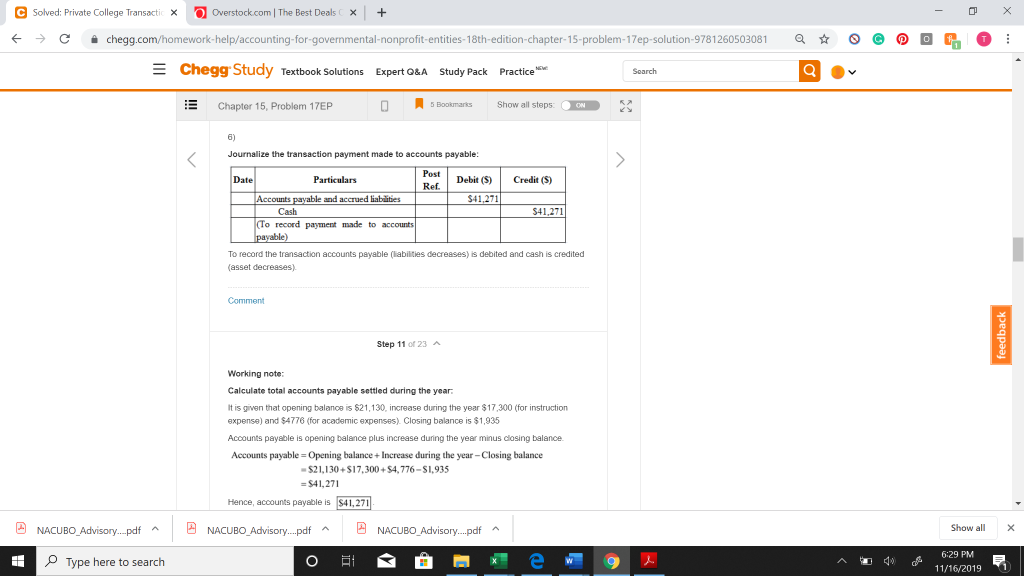

I do not understand the answer to journal transaction #6. the 17,300 is for instructional expense that was exchanged for tuition. Why was the 17,300 included in the cash credit total, who or what is being paid 17,300?

Solved: Private College Transactic X Overstock.com | The Best Deals x + - 0 X C chegg.com/homework-help/accounting-for-governmental-nonprofit-entities-18th-edition-chapter-15-problem-17ep-solution-9781260503081 O O O = Chegg Study Textbook Solutions Expert Q&A Study Pack Practice Search 1 Chapter 15, Problem 17EP 0 5 Bookmarks Show all steps: ON Journalize the transaction payment made to accounts payable: Date Particulars Debit (3) Credit (5) Ref S41.271 Accounts payable and accrued liabilities Cash (To record payment made to accounts payable) To record the transaction accounts payable (liabilities decreases) is debited and cash is credited (asset decreases) Comment feedback Step 11 of 23 A Working note: Calculate total accounts payable settled during the year: It is given that opening balance is $21,130, increase during the year $17,300 (for instruction expense) and $4776 (for academic expenses). Closing balance is $1,935 Accounts payable is opening balance plus increase during the year minus closing balance Accounts payable Opening balance + Increase during the year - Closing balance - $21,130+$17,300+S4,776-S1,935 = $41,271 Hence, accounts payable is $41,271 NACUBO_Advisory...pdf ^ NACUBO Advisory...pdf NACUBO Advisory...pdf A Show all X 6:29 PM Type here to search 40 11/16/2019 Solved: Private College Transactic X Overstock.com | The Best Deals x + - 0 X C chegg.com/homework-help/accounting-for-governmental-nonprofit-entities-18th-edition-chapter-15-problem-17ep-solution-9781260503081 O O O = Chegg Study Textbook Solutions Expert Q&A Study Pack Practice Search 1 Chapter 15, Problem 17EP 0 5 Bookmarks Show all steps: ON Journalize the transaction payment made to accounts payable: Date Particulars Debit (3) Credit (5) Ref S41.271 Accounts payable and accrued liabilities Cash (To record payment made to accounts payable) To record the transaction accounts payable (liabilities decreases) is debited and cash is credited (asset decreases) Comment feedback Step 11 of 23 A Working note: Calculate total accounts payable settled during the year: It is given that opening balance is $21,130, increase during the year $17,300 (for instruction expense) and $4776 (for academic expenses). Closing balance is $1,935 Accounts payable is opening balance plus increase during the year minus closing balance Accounts payable Opening balance + Increase during the year - Closing balance - $21,130+$17,300+S4,776-S1,935 = $41,271 Hence, accounts payable is $41,271 NACUBO_Advisory...pdf ^ NACUBO Advisory...pdf NACUBO Advisory...pdf A Show all X 6:29 PM Type here to search 40 11/16/2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts