Question: https://www.chegg.com/homework-help/Basic-Finance-12th-edition-chapter-11-problem-5P-solution-9781337691017 Basic Finance (12th Edition) See this solution in the app Chapter 11, Problem 5P Bookmark Show all steps: ON Problem Jersey Jewel Mining has

https://www.chegg.com/homework-help/Basic-Finance-12th-edition-chapter-11-problem-5P-solution-9781337691017

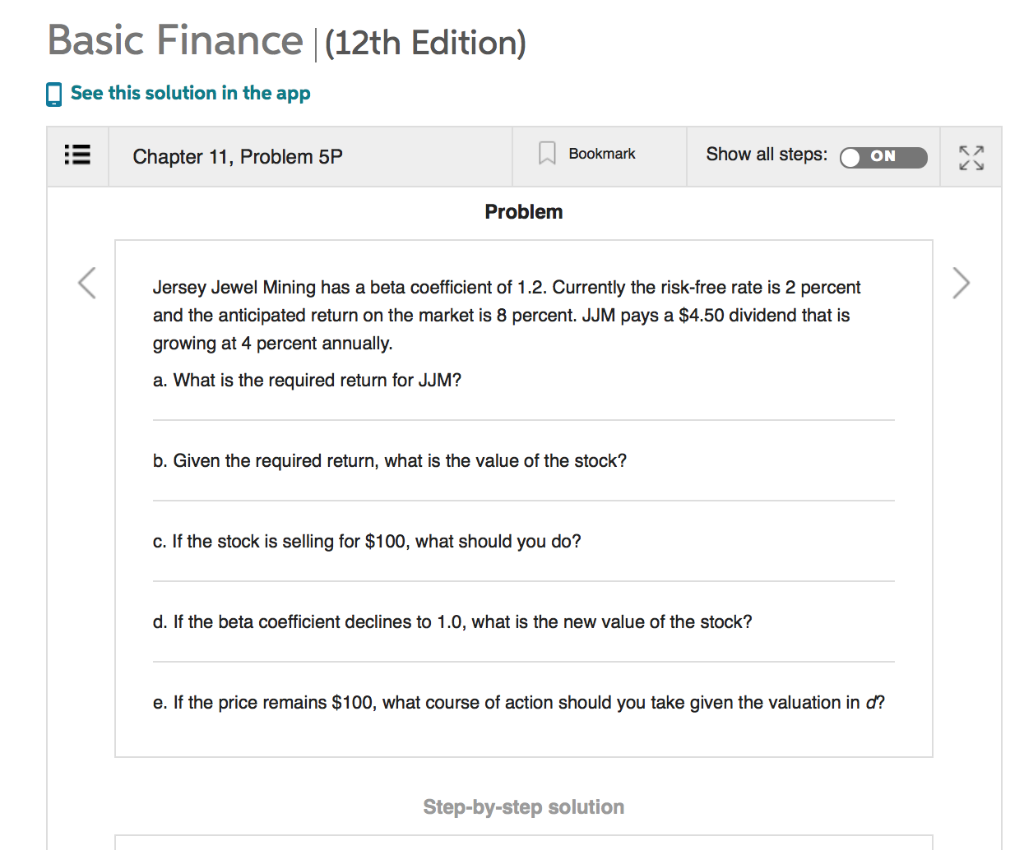

Basic Finance (12th Edition) See this solution in the app Chapter 11, Problem 5P Bookmark Show all steps: ON Problem Jersey Jewel Mining has a beta coefficient of 1.2. Currently the risk-free rate is 2 percent and the anticipated return on the market is 8 percent. JJM pays a $4.50 dividend that is growing at 4 percent annually. a. What is the required return for JJM? b. Given the required return, what is the value of the stock? c. If the stock is selling for $100, what should you do? d. If the beta coefficient declines to 1.0, what is the new value of the stock? e. If the price remains $100, what course of action should you take given the valuation in d? Step-by-step solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts