Question: https://www.sec.gov/litigation/admin/2019/33-10701.pdf The case: PPG Industries, Inc. (AAER-4094) 2019 UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES ACT OF 1933 Release No. 10701

https://www.sec.gov/litigation/admin/2019/33-10701.pdf

The case: PPG Industries, Inc. (AAER-4094) 2019

UNITED STATES OF AMERICA Before the SECURITIES AND EXCHANGE COMMISSION SECURITIES ACT OF 1933 Release No. 10701 /September 26, 2019 SECURITIES EXCHANGE ACT OF 1934 Release No. 87129 / September 26, 2019 ACCOUNTING AND AUDITING ENFORCEMENT Release No. 4094 / September 26, 2019 ADMINISTRATIVE PROCEEDING File No. 3-19532 ORDER INSTITUTING CEASE-AND- In the Matter of DESIST PROCEEDINGS PURSUANT TO SECTION SA OF THE SECURITIES ACT PPG Industries, Inc. OF 1933 AND SECTION 21C OF THE SECURITIES EXCHANGE ACT OF 1934, Respondent. MAKING FINDINGS, AND IMPOSING A CEASE-AND-DESIST ORDER The Securities and Exchange Commission ("Commission") deems it appropriate that cease- and-desist proceedings be, and hereby are, instituted pursuant to Section 8A of the Securities Act of 1933 ("Securities Act") and Section 21C of the Securities Exchange Act of 1934 ("'Exchange Act"), against PPG Industries, Inc. ("PPG" or "Respondent"). II. In anticipation of the institution of these proceedings, Respondent has submitted an Offer of Settlement (the "Offer") which the Commission has determined to accept. Solely for the purpose of these proceedings and any other proceedings brought by or on behalf of the Commission, or to which the Commission is a party, and without admitting or denying the findings herein, except as to the Commission's jurisdiction over it and the subject matter of these proceedings, which are admitted, Respondent consents to the entry of this Order Instituting Cease- and-Desist Proceedings Pursuant to Section 8A of the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934, Making Findings, and Imposing a Cease-and-Desist Order ("Order"), as set forth below.III. On the basis of this Order and Respondent's Offer, the Commission finds' that: Summary 1 . PPG manufactures paint and other specialty industrial, automotive and architectural coating materials. From December 2016 through April 2018 (the "relevant period"), PPG maintained materially inaccurate books and records and insufficient internal accounting controls. The misstatements resulted from the conduct of a PPG senior accounting officer ("Officer A") and employees within PPG's finance division who manipulated accounting entries. The misstatements were designed to enable PPG to meet, or come closer to meeting, analysts' consensus earnings estimates. 2. Officer A made improper accounting determinations and directed subordinate personnel to delay recording or not to record certain expense accruals, and to misclassify certain income as from continuing operations, in contravention of generally accepted accounting principles ("GAAP"). As a result, PPG's income from continuing operations in its published financial results was inflated for the years ended December 31, 2016 and December 31, 2017, and for certain quarters within that period. PPG included its misleading financial results in press releases and its filings with the Commission. Because of similar accounting misconduct, PPG's books and records contained intentional inaccuracies during the closing period for the first quarter of 2018; these inaccuracies were later corrected in PPG's Form 10-Q for that quarter. 3. PPG restated its financial statements for the relevant period on June 28, 2018 (the "Restatement"). The Restatement disclosed 14 instances of accounting misconduct during the relevant period, reduced PPG's previously reported GAAP pretax income from continuing operations by a cumulative $6 million for 2016 and 2017, and identified a material weakness in PPG's internal control over financial reporting 4. Based on the foregoing and the conduct described below, PPG violated Section 17(a) of the Securities Act and Sections 10(b), 13(a), 13(b)(2)(A) and 13(b)(2)(B) of the Exchange Act and Rules 10b-5, 12b-20, 13a-1, 13a-11, and 13a-13 thereunder.Respondent 5. PPG is a Pennsylvania corporation based in Pittsburgh, PA. PPG's securities are registered with the Commission under Section 12(b) of the Exchange Act and trade under the symbol "PPG" on the New York Stock Exchange. PPG files periodic reports, including Forms 10- K and 10-Q, with the Commission pursuant to Section 13(a) of the Exchange Act and related rules thereunder. Facts 6. During the relevant period, Officer A and subordinates who carried out his directives exploited deficiencies in PPG's internal accounting controls to delay recognition of, or misclassify, known expenses and liabilities, and to overstate income from continuing operations in certain fiscal quarters. Officer A's conduct involved tracking earnings and determining whether, and how, to record certain accounting entries, often late in the closing process, based on the entries" potential to move income from continuing operations positively or negatively in order to meet analysts' consensus expected earnings, or to narrow a gap. This resulted in fourteen identified instances of intentionally erroneous accounting entries during five period-end reporting processes, as described below. Understated Expense Accruals in 04 2016. 02 2017, and Q3 2017 7 . 04 2016 RSU Accrual Reduction: PPG records an initial accrual for performance- based Restricted Stock Units ("RSUs") based on a methodology related to performance factors and adjusts the accrual over the vesting period. In January 2017, several days into the Q4 2016 closing process, Officer A, acting without a reasonable basis, reduced an input to the performance factor methodology in order to adjust the accrual, resulting in an inappropriate reduction of the accrual by $6.8 million for Q4 2016. 8. 02 2017 Healthcare Reserve Accrual: PPG is self-insured and retains a reserve for healthcare claims that have been incurred but not yet reported. It records an accrual every month and evaluates and adjusts, if necessary, the reserve on a quarterly basis. At the end of Q2 2017, the reserve for healthcare claims was underaccrued by $3.5 million, based on actual claims incurred to that date. Officer A directed a subordinate not to make the $3.5 million accrual in Q2 2017, but instead to delay the accrual until Q3 2017. 9. 02 2017 Compensation Expense Accrual: Pursuant to a contract requiring compensation payments to a PPG employee who departed in Q2 2017, PPG should have recorded a $4.8 million accrual in that quarter. Instead, at Officer A's direction and without a reasonable basis, PPG recorded only $1.3 million in Q2 2017 and spread the remaining $3.5 million accrual over the rest of the year.02 and (3 2017 Vacation Pay Accruals: During Q2 2017, a policy change related to employee vacation pay required the accrual of $3.5 million ratably over the rest of 2017. At Officer A's direction, no expense was recorded in Q2 or Q3 2017. While the full amount was accrued in Q4 2017, PPG was underaccrued by $0.885 million and $1.329 million in Q2 2017 and Q3 2017, respectively. 11. 03 2017 Fiberglass Pension Accrual: During the closing process for Q3 2017, Officer A's staff discovered that an entry recorded to a pension expense related to PPG's fiberglass business was inaccurate. Officer A directed PPG staff to reduce the necessary accrual adjustments by $1 million, with the remainder distributed over Q4 2017. 12. The accrual entries described in Paragraphs 7-11 were made or omitted in contravention of GAAP. Improperly Classified Adjustments to Income 13. 04 2016 Restructuring Reserve Release: In Q)4 2016, PPG released $3.4 million of restructuring reserves which, at Officer A's direction, was improperly classified as an increase to "other income." This treatment was inconsistent with PPGG's accounting practices; the effect was to improperly increase, by $3.4 million, PPG's adjusted income from continuing operations, a non-GAAP measure that was a component of PPG's reported EPS for the quarter. 14. 02 2017 Release of Reserves for Discontinued Operations: PPG determined to release $2 million of reserve related to a supply contract following the sale of an overseas fiberglass business and $400,000 of reserve established in relation to a sale of a flat glass plant. Both of these were discontinued businesses, but at Officer A's direction the gains were misclassified as gains to continuing operations. 15. 04 2017 Release of Reserves for Discontinued Operations: In Q4 2017, PPG determined to release $2 million of reserve related to the demolition of a former PPG facility used in the flat glass line of business, and $2.7 million of reserve related to a workers compensation contingency connected to the sale of the U.S. fiberglass business. Despite the fact that these were discontinued businesses, Officer A directed his subordinates to misclassify the gains as income from continuing operations. 16. According to GAAP, the entries described in Paragraphs 14 and 15 should have been classified as income from discontinued operations. Fraudulent Entries in the First Quarter of 2018 17. Legal Expenses and Property Tax Accruals: During the closing process for Q1 2018. Officer A directed subordinates not to record certain legal and property tax accruals for the quarter, and instead to put them off until Q2. The proper GAAP accounting is to recognize expenses when they are incurred or the benefit received. This improper failure to record expenses of $311 684 was reflected in PPG's hooks and records for 01 2018 as of mid-April18. Incentive Compensation/Management Award Plan Accrual: PPG has an incentive compensation plan that is based on performance factors. PPG adjusts its accrual for this annual expense based on changes in the factors, followed by a true-up in March of the following year to account for differences between the accrued amount and the final amount approved for payout. During the Q1 2018 closing process, Officer A directed his staff not to record the true-up, a $963,021 expense, but instead to delay it to Q2 2018, in contravention of GAAP. 19. Reserve for Healthcare Claims: At the end of Q1 2018, Officer A directed that approximately $445,000 of a reserve for healthcare claims be released, without a reasonable basis and contrary to GAAP. 20. Amortization Expense: In March 2018, a PPG business unit discovered that it had inadvertently failed to record monthly amortization in connection to a certain intangible asset for a number of years. The unit determined that it was necessary to make an entry of $1.4 million in that quarter. However, Officer A directed his staff not to make the entry but instead inappropriately spread the amortization amount over the remaining life of the asset. 21. Inventory Undervaluation: PPG's practice was to conduct inventory revaluations for the Company's overseas business units only once each quarter. However, at the end of Q4 2017, Officer A had a second, off-cycle inventory revaluation conducted and waited until the third workday of the closing process, in January 2018, to direct the regions to record the resulting increased valuations for Q4 2017. In the following quarter, Q1 2018, Officer A again directed inventory revaluations, but directed that a positive adjustment be recorded only for one region despite that a second region also merited an adjustment. Selectively recording such revaluations was inappropriate. 22. The improper entries described in paragraphs 17-21 caused PPG's books and records to be inaccurate as of mid-April 2018. However, as described below, prior to filing its Form 10-Q for Q1 2018, PPG identified and corrected these errors. The Restatement, Impact of the Fraud, and Material Internal Accounting Controls Weaknesses 23. On or about April 16, 2018, PPG received a report through its internal reporting system detailing some of the Q1 2018 accounting misconduct detailed above. After commencing an internal investigation and before filing its Form 10-Q for Q1 2018, PPG disclosed in a press release on April 19, 2018 that it had identified $1.4 million in understated expenses for Q1 2018, and further disclosed that its internal investigation would continue. 24. On June 28, 2018, PPG filed its Form 10-Q for Q1 2018 and a Form 10-K/A for 2017. These filings restated PPG's previously issued financial statements for 2016 and 2017 and quarterly results for the fourth quarter of 2016 through the fourth quarter of 2017. The Form 10- K/A disclosed the fourteen intentional misstatements described above and other inadvertent errors detected over the course of the internal investigation. PPG disclosed the cumulativePeriod Restated Income Restated Earnings per (Quarter, Year, Months Ended) Share ("EPS") QE 12/31/2016 decreased by $4 million decreased by $0.01 YE 12/31/2016 decreased by $4 million decreased by $0.01 QE 03/31/2017 increased by $3 million increased by $0.01 OE 6/30/2017 decreased by $7 million decreased by $0.03 Six months ended 06/30/2017 decreased by $4 million decreased by $0.02 QE 9/30/2017 increased by $1 million zero cents Nine months ended 09/30/2017 decreased by $3 million decreased by $0.01 QE 12/31/2017 increased by $1 million zero cents YE 12/31/2017 decreased by $2 million decreased by $0.01 25. The contemporaneous impact (fe., excluding the cumulative effect on subsequent quarters and the impact of inadvertent errors) of PPG's fraudulent accounting entries on PPG's EPS was to artificially increase PPG's reported EPS such that it met analysts' consensus EPS, or narrowed a gap, as shown below: Period (Quarter Ended) Contemporaneous Impact Contemporaneous Impact to Pre-Tax Income to EPS QE 12/31/2016 increased by $6.8 million* increased by $.03 QE 6/30/2017 increased by $10.34 million increased by $.03 QE 9/30/2017 increased by $2.33 million increased by $.01 QE 12/31/2017 increased by $4.7 million increased by $.02 PPG's reported EPS was based on adjusted income from continuing operations, a non-GAAP measure, for Q4 2016, Q2 2016 and Q4 2017. PPG made no adjustments to its income from continuing operations in Q3 2017; its reported EPS was calculated based on continuing income. Although PPG restated its financial results for the quarter ended March 31, 2017 based on cumulative effects of the Q4 2016 misstatement, it did not report any intentional accounting manipulations first arising in Q1 2017. This amount does not include the $3.4 million improper entry described in Paragraph 13, which had no impact to pre-tax income from continuing operations. The cumulative impact to pre-tax26. As set forth in the Restatement, PPG's internal control over financial reporting suffered from a material weakness "because the Company did not maintain effective controls within its financial close process. Specifically, [Officer A] directed his subordinates to improperly override the Company's internal controls during the Company's financial close process, which directions were followed and not disclosed to others in senior management, the Audit Committee or the Company's independent registered public accounting firm and not otherwise detected by the Company's internal controls. These actions often occurred after the end of a quarter and close to the end of the financial close process for the quarter and had the effect of positively impacting income from continuing operations reported for such quarter." 27. Officer A's ability to repeatedly improperly influence accounting entries was facilitated by inadequate controls over certain accounting areas: significant recurring accruals subject to management estimate, especially related to compensation; discontinued operations accounting; inventory cost revaluation; and the period-end financial reporting process. Certain deficiencies in the organization of PPG's corporate finance function also exacerbated the control weakness noted in the Restatement, including insufficient segregation of the financial planning and accounting functions, inadequately trained financial personnel, and poorly documented accounting policies and procedures. Violations 28. As a result of the conduct described above: a. PPG violated Section 10(b) of the Exchange Act and Rule 10b-5 thereunder, which prohibit fraudulent conduct in connection with the purchase or sale of securities. b. PPG violated Section 17(a) of the Securities Act, which prohibit fraudulent conduct in connection with the offer or sale of securities. C. PPG violated Section 13(a) of the Exchange Act and Rules 13a-1, 13a-11, 13a-13 and 12b-20 thereunder, which require every issuer of a security registered pursuant to Section 12 of the Exchange Act to file with the Commission information, documents, and annual and quarterly reports as the Commission may require, and mandate that periodic reports contain such further material information as may be necessary to make the required statements not misleading. d. PPG violated Section 13(b)(2)(A) of the Exchange Act, which requires issuers with securities registered under Section 12 of the Exchange Act to make and keep books, records and accounts which, in reasonable detail, accurately and fairly reflect the transactions and dispositions of assets of the issuer; and e. PPG violated Section 13(b)(2)(B) of the Exchange Act, which requiresand maintain a system of internal accounting controls sufficient to provide reasonable assurances that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles. PPG's Self-Reporting. Cooperation and Remedial Efforts 29. In determining to accept the Offer, the Commission considered remedial acts promptly undertaken by Respondent, and cooperation afforded the Commission staff, as described below. 30. PPG promptly self-reported to the Commission staff and, in its earnings release for the first quarter of 2018, disclosed to investors the allegations in the internal report and that it was conducting an internal investigation. 31. PPG provided timely updates to the Commission staff and voluntarily produced documents, reports and other materials. After issuing the Restatement, PPG has continued to cooperate with the Commission staff's investigation. 32. PPG undertook remedial measures beginning immediately upon learning of the improper conduct. In addition to taking disciplinary actions with respect to individuals in the finance area involved in the conduct described above, PPG's management has enhanced review in the finance area, adjusted its organizational design by formally separating its financial forecasting process from its financial accounting process, and instituted enhanced training, policies and procedures to standardize and increase oversight in the high risk accounting areas where control weaknesses were identified. IV. In view of the foregoing, the Commission deems it appropriate to impose the sanctions agreed to in Respondent PPG's Offer. Accordingly, it is hereby ORDERED that: A. Pursuant to Section 8A of the Securities Act and Section 21C of the Exchange Act, Respondent PPG cease and desist from committing or causing any violations and any future violations of Section 17(a) of the Securities Act and Sections 10(b), 13(a), 13(b)(2)(A), and 13(b)(2)(B) of the Exchange Act and Rules 10b-5, 12b-20, 13a-1, 13a-11, and 13a-13 thereunder. B. Respondent acknowledges that the Commission is not imposing a civil penalty based in part upon its substantial cooperation in a Commission investigation and related enforcement action. If at any time following the entry of the Order, the Division of Enforcement ("Division") obtains information indicating that Respondent knowingly provided materially falseviolations of Section 17(a) of the Securities Act and Sections 10(b), 13(a), 13(b)(2)(A), and 13(b)(2)(B) of the Exchange Act and Rules 10b-5, 12b-20, 13a-1, 13a-11, and 13a-13 thereunder. B. Respondent acknowledges that the Commission is not imposing a civil penalty based in part upon its substantial cooperation in a Commission investigation and related enforcement action. If at any time following the entry of the Order, the Division of Enforcement ("Division") obtains information indicating that Respondent knowingly provided materially false or misleading information or materials to the Commission, or in a related proceeding, the Division may, at its sole discretion and with prior notice to the Respondent, petition the Commission to 8 reopen this matter and seek an order directing that the Respondent pay a civil money penalty. Respondent may contest by way of defense in any resulting administrative proceeding whether it knowingly provided materially false or misleading information, but may not: (1) contest the findings in the Order, or (2) assert any defense to liability or remedy, including, but not limited to, any statute of limitations defense. By the Commission. Vanessa A. Countryman Secretary

Step by Step Solution

There are 3 Steps involved in it

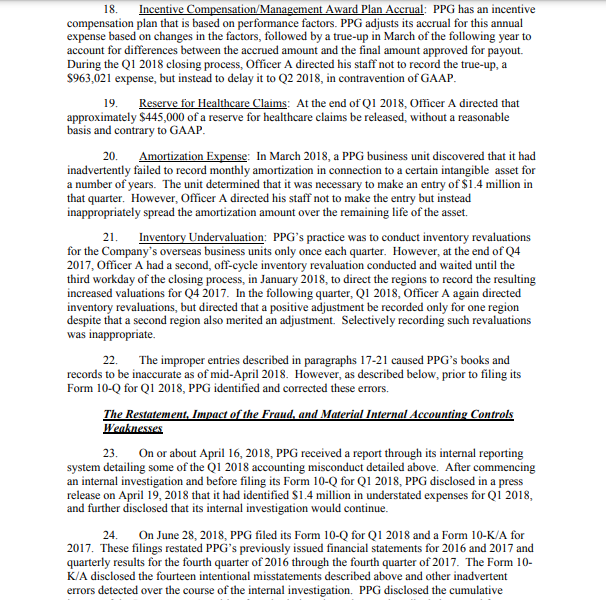

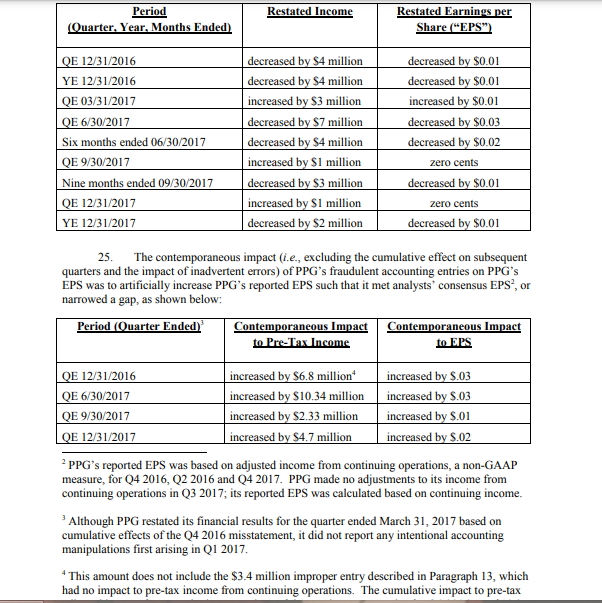

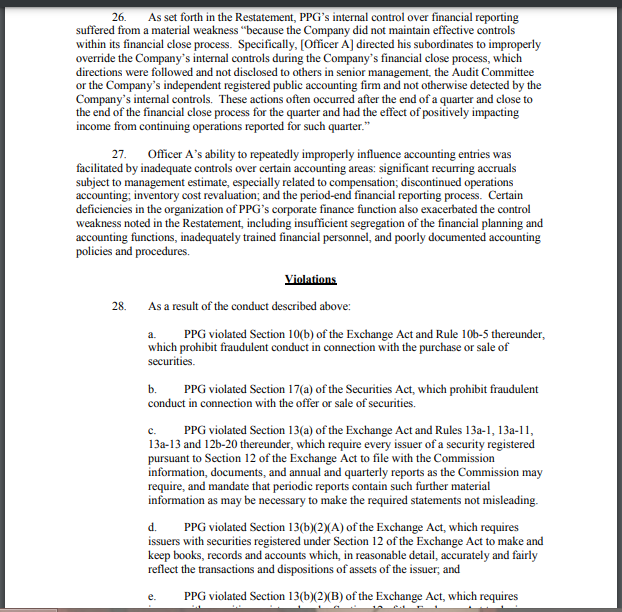

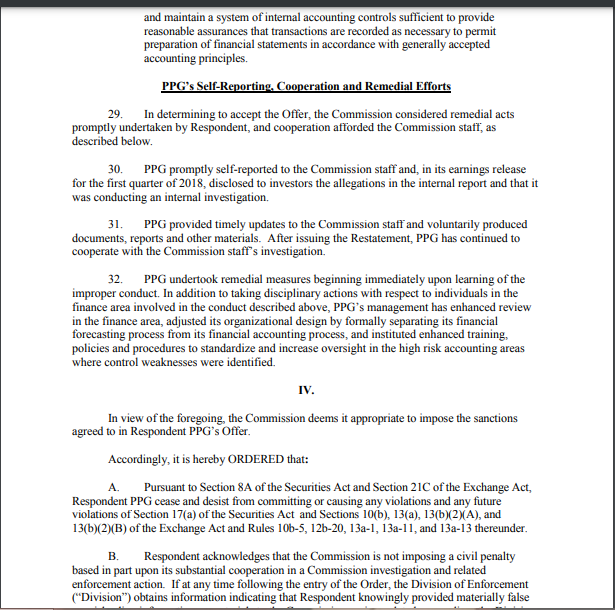

Get step-by-step solutions from verified subject matter experts