Question: Hunter, Folgers, and Tulip have been partners while sharing net income and loss in a 5-23 ratio (in percents: Hunter, 50%: Folgers, 20%; and Tulip.

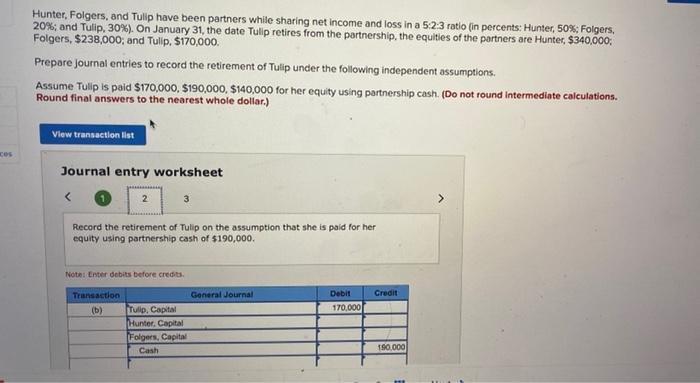

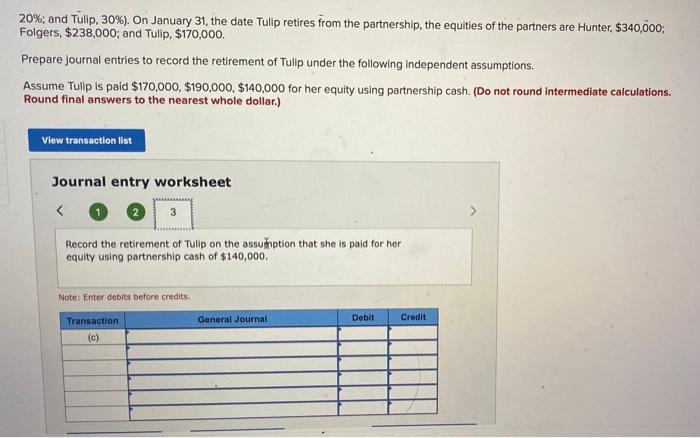

Hunter, Folgers, and Tulip have been partners while sharing net income and loss in a 5-23 ratio (in percents: Hunter, 50%: Folgers, 20%; and Tulip. 30%). On January 31, the date Tulip retires from the partnership, the equities of the partners are Hunter, $340,000 Folgers, $238,000, and Tulip. $170,000 Prepare Journal entries to record the retirement of Tulip under the following independent assumptions. Assume Tulip is paid $170,000, $190,000, $140,000 for her equity using partnership cash. (Do not found intermediate calculations. Round final answers to the nearest whole dollar.) View transaction list cos Journal entry worksheet > Record the retirement of Tulip on the assumption that she is paid for her equity using partnership cash of $190,000 Note: Enter debits before credits Credit Transaction (b) Debit 170,000 General Journal Tulip, Capital Hunter, Capital Folgers, Capital Cash 190.000 20%; and Tulip, 30%). On January 31, the date Tulip retires from the partnership, the equities of the partners are Hunter, $340,000 Folgers, $238,000; and Tulip, $170,000. Prepare journal entries to record the retirement of Tulip under the following independent assumptions. Assume Tulip is paid $170,000, $190,000 $140,000 for her equity using partnership cash (Do not round intermediate calculations. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts