Question: HW 1 (cash flow discounting) Solve the following problems using both your calculator and spreadsheet software. 1. If I invest $500 initially and the investment

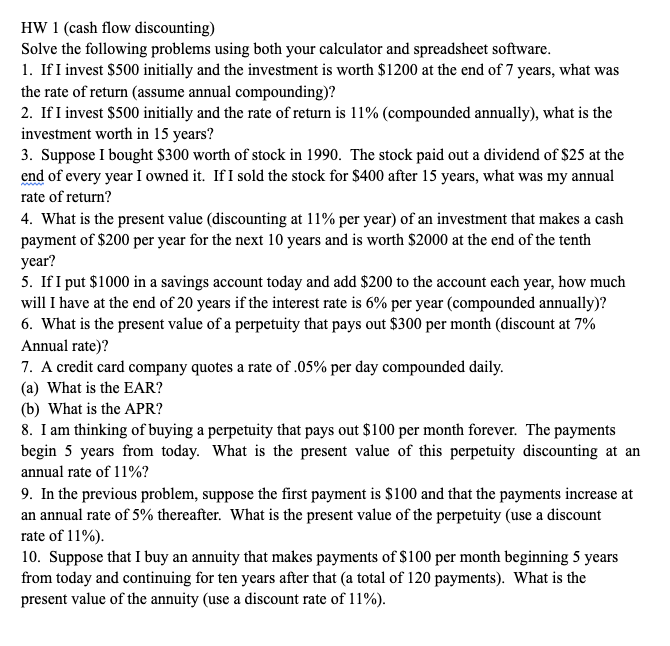

HW 1 (cash flow discounting) Solve the following problems using both your calculator and spreadsheet software. 1. If I invest $500 initially and the investment is worth $1200 at the end of 7 years, what was the rate of return (assume annual compounding)? 2. If I invest $500 initially and the rate of return is 11% (compounded annually), what is the investment worth in 15 years? 3. Suppose I bought $300 worth of stock in 1990. The stock paid out a dividend of $25 at the end of every year I owned it. If I sold the stock for $400 after 15 years, what was my annual rate of return? 4. What is the present value (discounting at 11% per year) of an investment that makes a cash payment of $200 per year for the next 10 years and is worth $2000 at the end of the tenth year? 5. If I put $1000 in a savings account today and add $200 to the account each year, how much will I have at the end of 20 years if the interest rate is 6% per year (compounded annually)? 6. What is the present value of a perpetuity that pays out $300 per month (discount at 7% Annual rate)? 7. A credit card company quotes a rate of .05% per day compounded daily. (a) What is the EAR? (b) What is the APR? 8. I am thinking of buying a perpetuity that pays out $100 per month forever. The payments begin 5 years from today. What is the present value of this perpetuity discounting at an annual rate of 11%? 9. In the previous problem, suppose the first payment is $100 and that the payments increase at an annual rate of 5% thereafter. What is the present value of the perpetuity (use a discount rate of 11%). 10. Suppose that I buy an annuity that makes payments of $100 per month beginning 5 years from today and continuing for ten years after that (a total of 120 payments). What is the present value of the annuity (use a discount rate of 11%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts