Question: ( hw ) 1. ldentify whether each investment should be classified as a short-term or long-term investment. For each investinient. Indicni which of the six

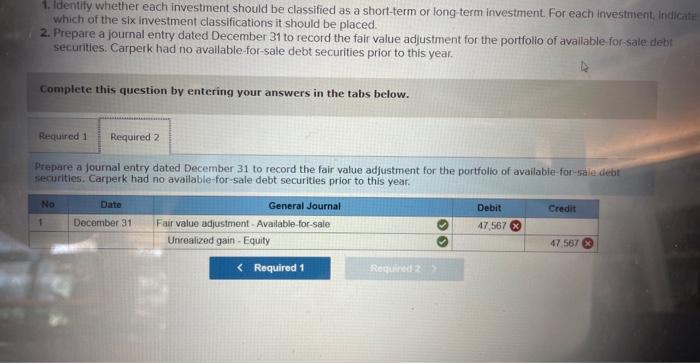

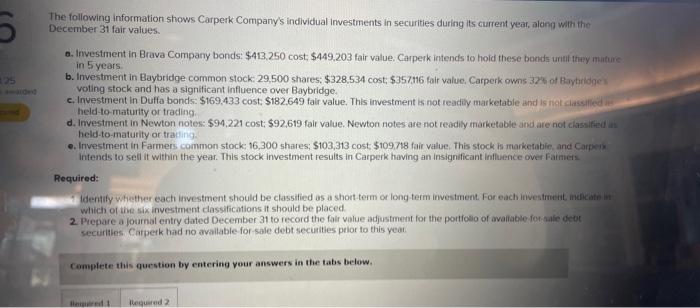

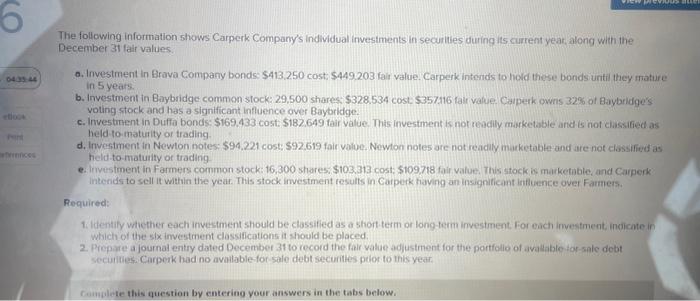

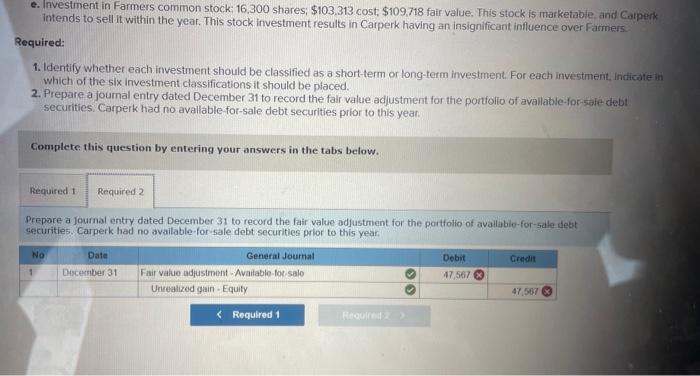

1. ldentify whether each investment should be classified as a short-term or long-term investment. For each investinient. Indicni which of the six investment classifications it should be placed. 2. Prepare a journal entry dated December 31 to record the fair value adjustment for the portfolio of avallable for:sale debt securities. Carperk had no available-for-sale debt securities prior to this year. Complete this question by entering your answers in the tabs below. Prepare a journal entry dated December 31 to record the fair value adjustment for the portfolio of available-for-sale debt securities. Carperk had no available-for-sale debt securities prior to this year. The following information shows Carperk Company's individual investments in securities during its current yeat, along with the December 31 fair values. 0. Investment in Brava Company bonds: $413.250 cost, $449.203 fair value. Carperk intends to hold these bonds urtul they muture in 5 years b. Investment in Baybridge common stock: 29,500 shares; $328,534 cost; $357,116 fair value. Carperk owns 32 . of Boytirldge voting stock and has a significant influence over Baybridge. c. Investment in Duffa bonds: $169,433 cost: $182,649 falr value. This investment is not readily marketable Bnd is rigtalassilied an-1 held-to-maturity or trading. d. Investment in Newton notes: $94,221 cost; $92,619 fair value. Newton notes are not readily marketable and are not classifici ini. held-to-maturity or tracling. e. Investment in Farmers common stock: 16,300 shares; $103,313 cost $109718 fair value: This stock is marketabie, and Carp:1x intends to sell it within the year. This stock investment results in Carperk having an insignificant inflience over Farmers Required: 4 Identify whether each iivestment should be classified as a shont term or long term investment. For each investrient, inciciafi his Which of the six investment classifications it should be placed. 2. Piepare a joumal entry dated December 31 to record the fair volue adjustment for the portiolio of avaliable for anfe cher securities Carperk had no avallable for-sale debt secinities pelor to this yeat. Complete this question by entering your answers in the tabs below. The following information shows Carperk Company's individual investments in securtiles during its current year, along with the December 31 falr values. a. Investment in Erava Company bonds: $413,250 cost, $449,203 fair value. Carperk intends to hold these bonds until they mmature in 5 years. b. Investment in Baybridge common stock: 29,500 shares: $328,534 cost $357.116 falt value Caiperk ownis 32% of Baybridge's voting stock and has a significant influence over Baybridge. c. Investinent in Duffa bonds: $169.433 cost: $182.649 fair value. This investment is not readily marketable and is not ciassified as held to matuity or trading. d. Invectment in Newton notes: $94.221 cost: $92.619 fair value. Nowton notes are not readly marketable and are not classified as held to-matuity or trading e. Iivestment in Famers common stock: 16,300 shares, $103,313 cost: $109718 fair value. This stock is marketable, and Carperk intends to sell it within the year. This stock imvestment results in Carperk having an insigniticant influence over Farmers. Required: 1. Identify whether each investment should be classilied as a short term or long term investment. For each irmestment, indicate in which of the slx imvestment classifications it should be placed. 2. Prepare a journal entry dated December 31 to record the fair value adjustment for the portfolio of avalable tor-sale debt secuities. Carperk had no avillable for sale debt securites peior to this year. e. Investment in Farmers common stock: 16,300 shares; $103,313 cost; $109,718 fair value. This stock is marketabie, and Carperk intends to sell it within the year. This stock investment results in Carperk having an insignificant influegce over Farmers. Required: 1. Identify whether each investment should be classified as a short-term or long-term investment. For each investment, indicate in which of the six investment classifications it should be piaced. 2. Prepare a joumal entry dated December 31 to record the falr value adjustment for the portfolio of avallable-for-sate debt securities, Carperk had no avallable-for-sale debt securities prior to this year. Complete this question by entering your answers in the tabs below. Prepare a joumal entry dated December 31 to record the fair value adjustment for the portfolio of avallable-for-5ale debt securities. Carperk had no available-for-sale debt securities prior to this year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts