Question: HW 2 - Histroical PV and Net Realized Value Question 1: Company A sells machinery to Company B. Company B agrees to pay Company A

HW 2 - Histroical PV and Net Realized Value

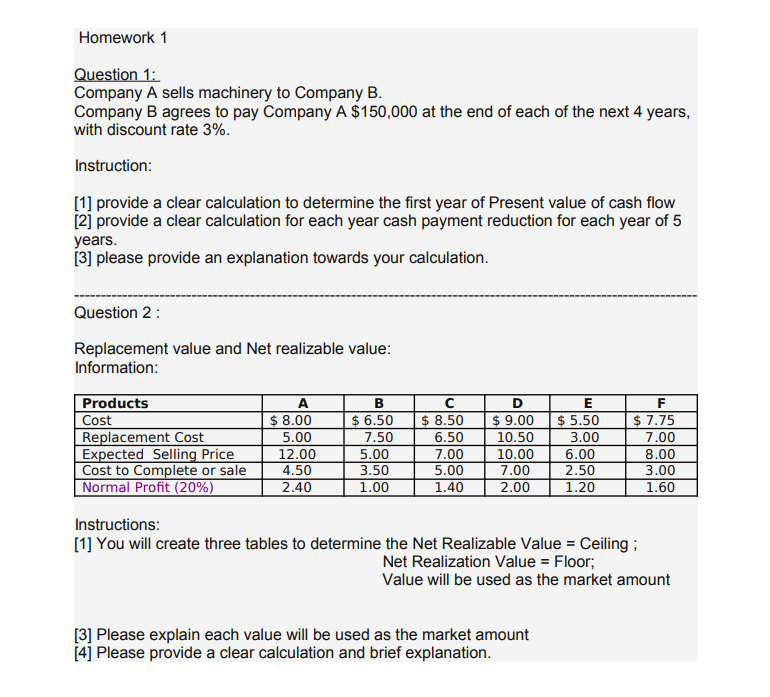

Question 1: Company A sells machinery to Company B. Company B agrees to pay Company A $150,000 at the end of each of the next 4 years, with discount rate 3%. Instruction: [1] provide a clear calculation to determine the first year of Present value of cash flow [2] provide a clear calculation for each year cash payment reduction for each year of 5 years. [3] please provide an explanation towards your calculation. ----------------------------------------------------------------------------------

Question 2 : Replacement value and Net realizable value: Information:

Homework 1 Question 1: Company A sells machinery to Company B. Company B agrees to pay Company A $150,000 at the end of each of the next 4 years, with discount rate 3%. Instruction: [1] provide a clear calculation to determine the first year of Present value of cash flow [2] provide a clear calculation for each year cash payment reduction for each year of 5 years. [3] please provide an explanation towards your calculation. Question 2: Replacement value and Net realizable value: Information: Products Cost Replacement Cost Expected Selling Price Cost to Complete or sale Normal Profit (20%) $ 8.00 5.00 12.00 4.50 2.40 B $ 6.50 7.50 5.00 3.50 1.00 $ 8.50 6.50 7.00 5.00 1.40 D $ 9.00 10.50 10.00 7.00 2.00 E $ 5.50 3.00 6.00 2.50 1.20 F $ 7.75 00 8.00 3.00 1.60 Instructions: [1] You will create three tables to determine the Net Realizable Value = Ceiling ; Net Realization Value = Floor; Value will be used as the market amount [3] Please explain each value will be used as the market amount [4] Please provide a clear calculation and brief explanation. Homework 1 Question 1: Company A sells machinery to Company B. Company B agrees to pay Company A $150,000 at the end of each of the next 4 years, with discount rate 3%. Instruction: [1] provide a clear calculation to determine the first year of Present value of cash flow [2] provide a clear calculation for each year cash payment reduction for each year of 5 years. [3] please provide an explanation towards your calculation. Question 2: Replacement value and Net realizable value: Information: Products Cost Replacement Cost Expected Selling Price Cost to Complete or sale Normal Profit (20%) $ 8.00 5.00 12.00 4.50 2.40 B $ 6.50 7.50 5.00 3.50 1.00 $ 8.50 6.50 7.00 5.00 1.40 D $ 9.00 10.50 10.00 7.00 2.00 E $ 5.50 3.00 6.00 2.50 1.20 F $ 7.75 00 8.00 3.00 1.60 Instructions: [1] You will create three tables to determine the Net Realizable Value = Ceiling ; Net Realization Value = Floor; Value will be used as the market amount [3] Please explain each value will be used as the market amount [4] Please provide a clear calculation and brief explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts