Question: HW 3 ( from Chapter 5 ) : Market Return Scenarios for the National Economy In reality, there is a continuum of possible returns. The

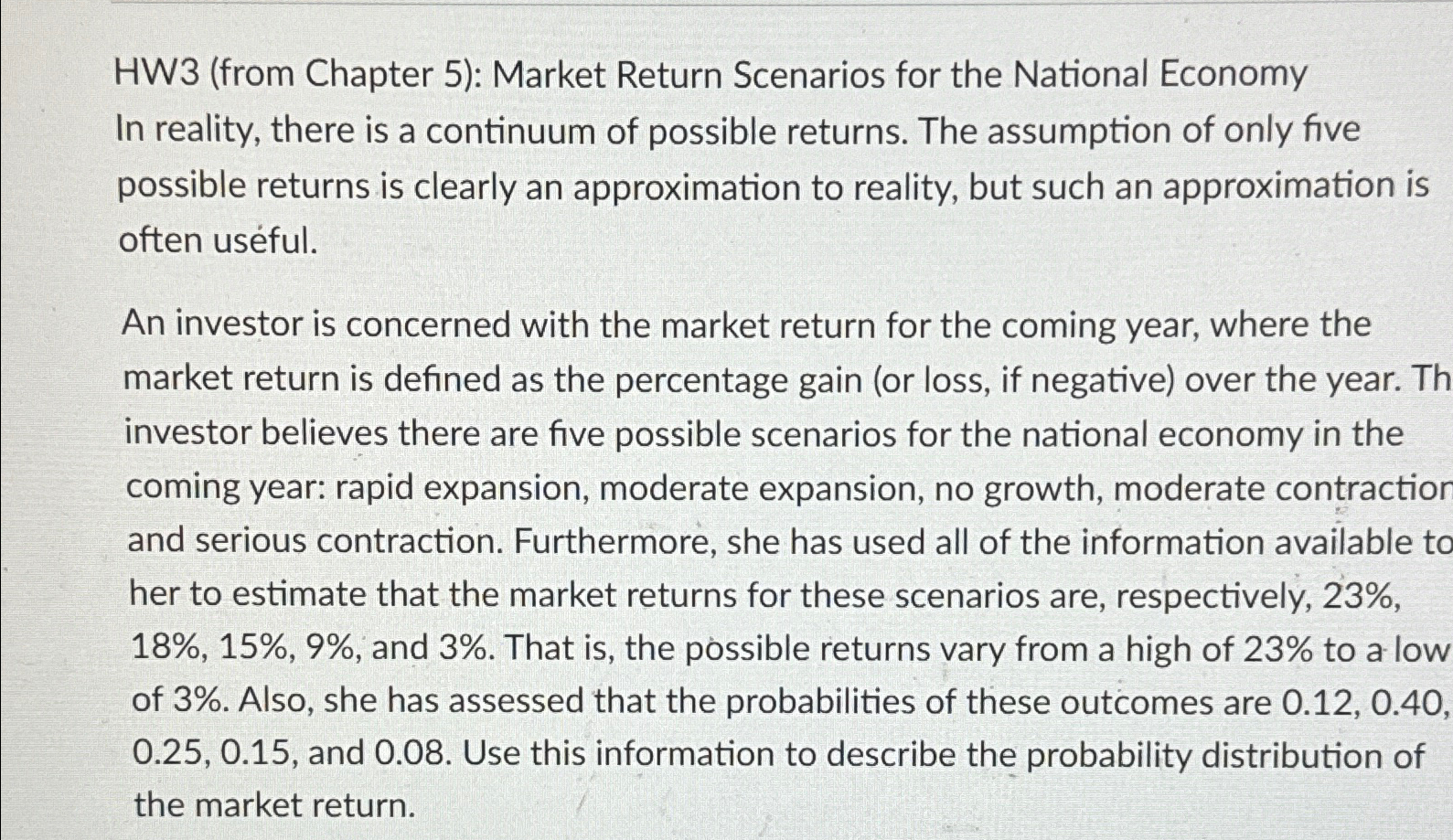

HWfrom Chapter : Market Return Scenarios for the National Economy In reality, there is a continuum of possible returns. The assumption of only five possible returns is clearly an approximation to reality, but such an approximation is often usful

An investor is concerned with the market return for the coming year, where the market return is defined as the percentage gain or loss, if negative over the year. Th investor believes there are five possible scenarios for the national economy in the coming year: rapid expansion, moderate expansion, no growth, moderate contraction and serious contraction. Furthermore, she has used all of the information available to her to estimate that the market returns for these scenarios are, respectively, and That is the possible returns vary from a high of to a low of Also, she has assessed that the probabilities of these outcomes are and Use this information to describe the probability distribution of the market return.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock