Question: HW 8 ( CH 1 2 ) - Linear optimization 2 . 3 . Blair & Rosen, Inc. ( B&R ) is a brokerage firm

HWCH Linear optimization

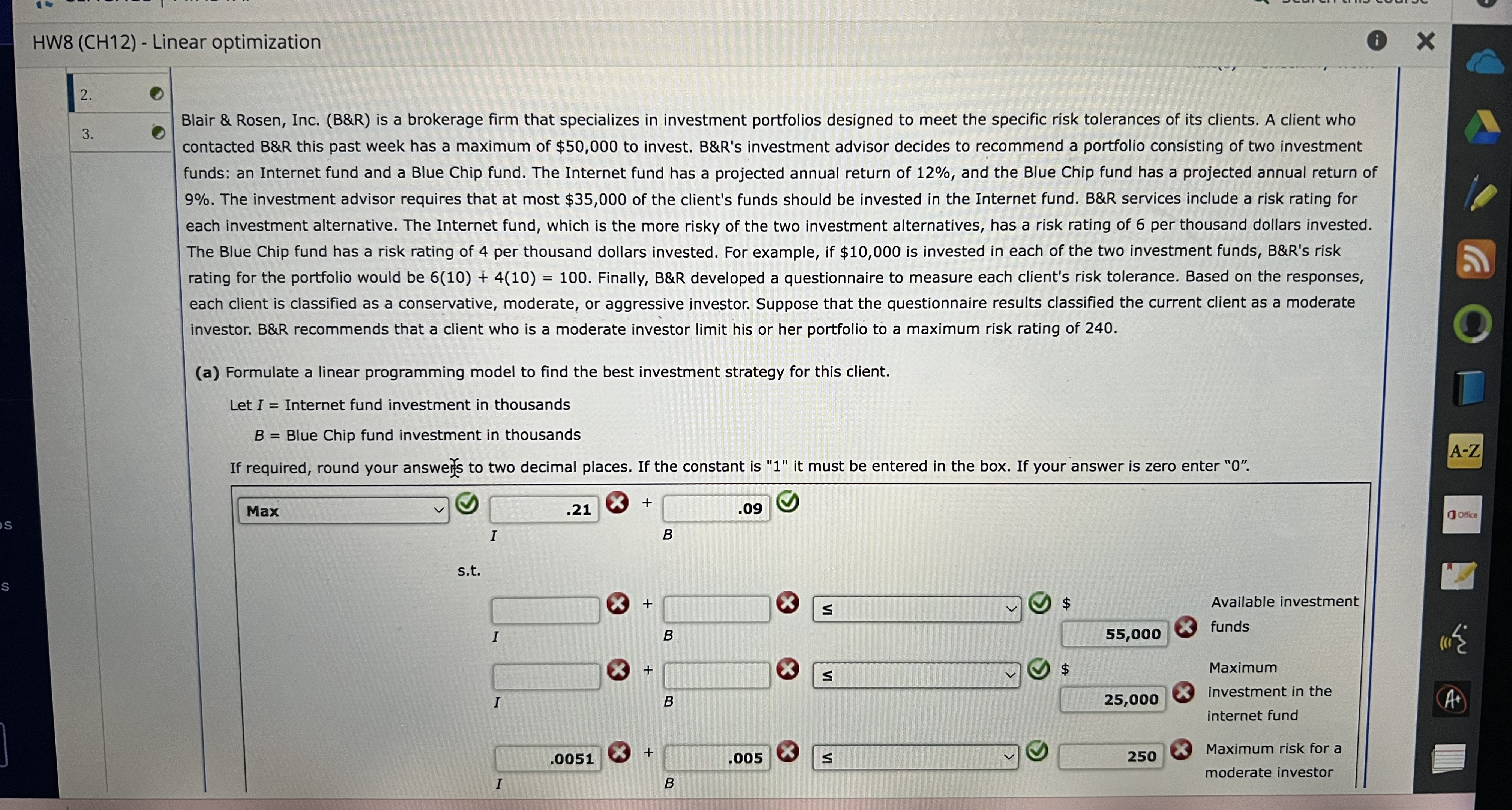

Blair & Rosen, Inc. B&R is a brokerage firm that specializes in investment portfolios designed to meet the specific risk tolerances of its clients. A client who contacted B&R this past week has a maximum of $ to invest. B&Rs investment advisor decides to recommend a portfolio consisting of two investment funds: an Internet fund and a Blue Chip fund. The Internet fund has a projected annual return of and the Blue Chip fund has a projected annual return of The investment advisor requires that at most $ of the client's funds should be invested in the Internet fund. B&R services include a risk rating for each investment alternative. The Internet fund, which is the more risky of the two investment alternatives, has a risk rating of per thousand dollars invested. The Blue Chip fund has a risk rating of per thousand dollars invested. For example, if $ is invested in each of the two investment funds, B&Rs risk rating for the portfolio would be Finally, B&R developed a questionnaire to measure each client's risk tolerance. Based on the responses, each client is classified as a conservative, moderate, or aggressive investor. Suppose that the questionnaire results classified the current client as a moderate investor. B&R recommends that a client who is a moderate investor limit his or her portfolio to a maximum risk rating of

a Formulate a linear programming model to find the best investment strategy for this client.

Let Internet fund investment in thousands

Blue Chip fund investment in thousands

If required, round your answers to two decimal places. If the constant is it must be entered in the box. If your answer is zero enter

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock