Question: HW 8: Ch. 8 A Saved Help Save & Exit Submit [The following information applies to the questions displayed below.) 5 In 2020, Nadia has

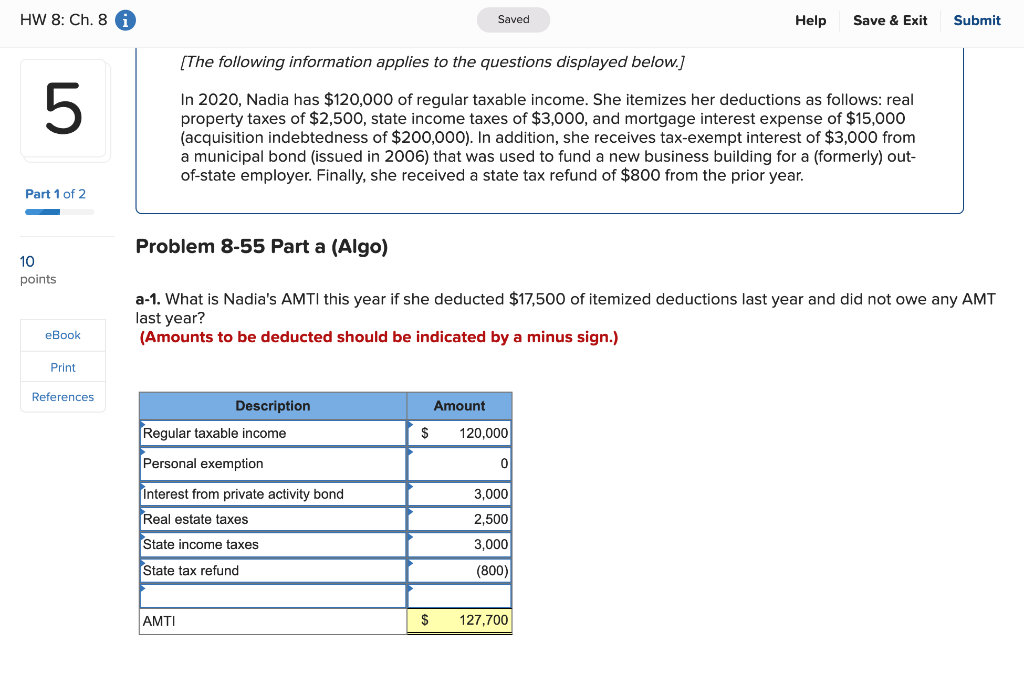

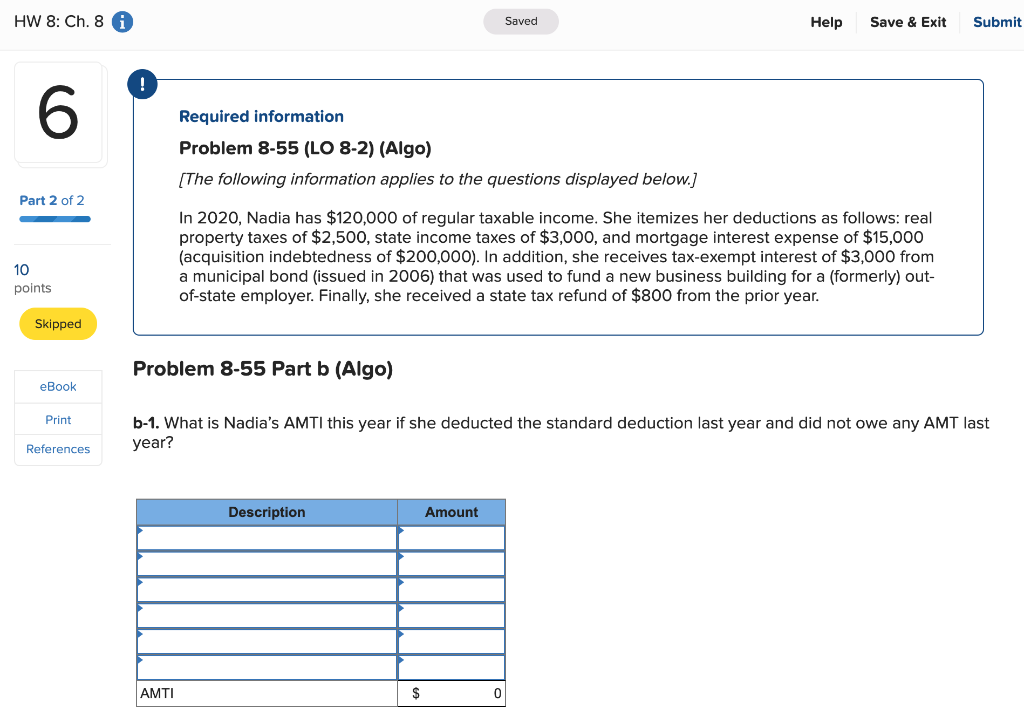

HW 8: Ch. 8 A Saved Help Save & Exit Submit [The following information applies to the questions displayed below.) 5 In 2020, Nadia has $120,000 of regular taxable income. She itemizes her deductions as follows: real property taxes of $2,500, state income taxes of $3,000, and mortgage interest expense of $15,000 (acquisition indebtedness of $200,000). In addition, she receives tax-exempt interest of $3,000 from a municipal bond (issued in 2006) that was used to fund a new business building for a (formerly) out- of-state employer. Finally, she received a state tax refund of $800 from the prior year. Part 1 of 2 Problem 8-55 Part a (Algo) 10 points a-1. What is Nadia's AMTI this year if she deducted $17,500 of itemized deductions last year and did not owe any AMT last year? (Amounts to be deducted should be indicated by a minus sign.) eBook Print References Amount Description Regular taxable income $ 120,000 Personal exemption Interest from private activity bond 3,000 Real estate taxes 2,500 3,000 State income taxes State tax refund (800) AMTI $ 127,700 HW 8: Ch. 8 i Saved Help Save & Exit Submit 6 Required information Problem 8-55 (LO 8-2) (Algo) (The following information applies to the questions displayed below.) Part 2 of 2 In 2020, Nadia has $120,000 of regular taxable income. She itemizes her deductions as follows: real property taxes of $2,500, state income taxes of $3,000, and mortgage interest expense of $15,000 (acquisition indebtedness of $200,000). In addition, she receives tax-exempt interest of $3,000 from a municipal bond (issued in 2006) that was used to fund a new business building for a (formerly) out- of-state employer. Finally, she received a state tax refund of $800 from the prior year. 10 points Skipped Problem 8-55 Part b (Algo) eBook Print b-1. What is Nadia's AMTI this year if she deducted the standard deduction last year and did not owe any AMT last year? References Description Amount AMTI $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts