Question: HW 8, Q1 Please help me solve this. I only have 1 attempt and after that is it not possible to get full points, so

HW 8, Q1

Please help me solve this. I only have 1 attempt and after that is it not possible to get full points, so please double check the answers before you post them. Thank you in advance!

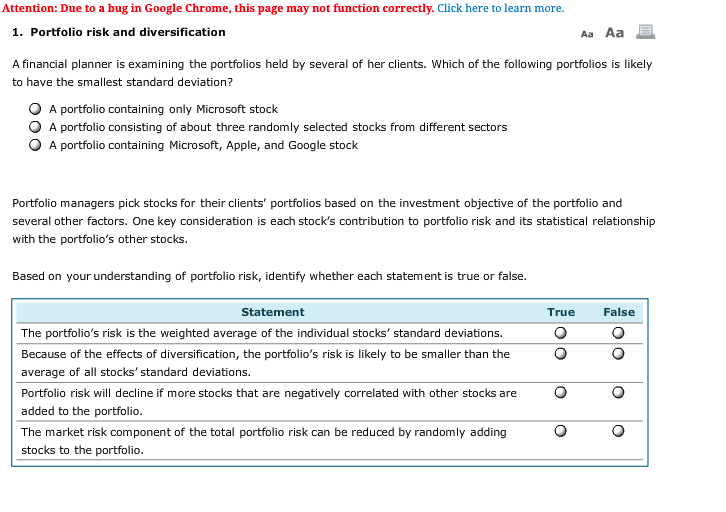

Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more 1. Portfolio risk and diversification Aa Aa A financial planner is examining the portfolios held by several of her clients. Which of the following portfolios is likely to have the smallest standard deviation? A portfolio containing only Microsoft stock A portfolio consisting of about three randomly selected stocks from different sectors A portfolio containing Microsoft, Apple, and Google stock Portfolio managers pick stocks for their clients' portfolios based on the investment objective of the portfolio and several other factors. One key consideration is each stock's contribution to portfolio risk and its statistical relationship with the portfolio's other stocks. Based on your understanding of portfolio risk, identify whether each statement is true or false. Statement True False The portfolio's risk is the weighted average of the individual stocks' standard deviations. Because of the effects of diversification, the portfolio's risk is likely to be smaller than the average of all stocks' standard deviations. Portfolio risk will decline if more stocks that are negatively correlated with other stocks are added to the portfolio The market risk component of the total portfolio risk can be reduced by randomly adding stocks to the portfolio. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts