Question: HW Assignment 1 (Chapter 14) Start Assignment Attempts 0 Due Thursday by 11am Allowed Attempts 1 Points 15 Submitting a file upload Available until Jan

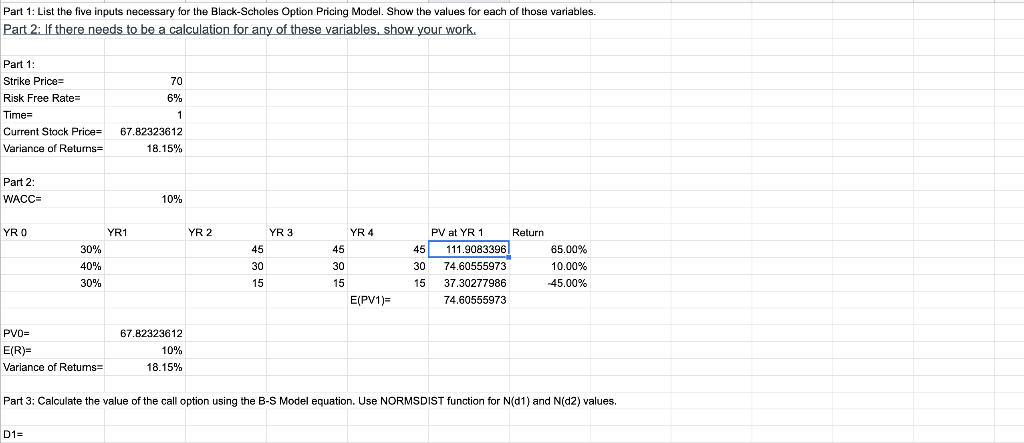

HW Assignment 1 (Chapter 14) Start Assignment Attempts 0 Due Thursday by 11am Allowed Attempts 1 Points 15 Submitting a file upload Available until Jan 27 at 11am You will be valuing a timing option with the Black-Scholes Option Pricing Model, using the example we worked on while going over Chapter 14 slides in class. The example is between slides #20 - #40. Please complete the assignment using Microsoft Excel. Part 1: List the five inputs necessary for the Black-Scholes Option Pricing Model. Show the values for each of those variables. Part 2: If there needs to be a calculation for any of these variables, show your work. Part 3: Calculate the value of the call option using the B-S Model equation. Use NORMSDIST function for N(D1) and N(D2) values. Part 4: Explain the meaning of the final number. Part 1: List the five inputs necessary for the Black-Scholes Option Pricing Model. Show the values for each of those variables. Part 2: If there needs to be a calculation for any of these variables, show your work 70 6% Part 1: Strike Price Risk Free Rate= Time Current Stock Price Variance of Returns= 1 67.82323612 18.15% Part 2: WACC= 10% YR O YR 2 YR 3 YR 4 YR1 30% 40% 30% 45 30 45 30 PV at YR 1 Return 45 111.9083396 65.00% 30 74.60555973 10.00% 15 37.30277986 45.00% 74.60555973 15 15 E(PV1)= PVON E(R) Variance of Returns 67.82323612 10% 18.15% Part 3: Calculate the value of the call option using the B-S Model equation. Use NORMSDIST function for N(D1) and N(D2) values. D1=

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts