Question: HW Ch 15 Saved Help Save & Exit Submit 4 Check my work Part 1 of 2 During this year, Weaver sold some equipment for

HW Ch 15\ Saved\ Help\ Save & Exit\ Submit\ 4\ Check my work\ Part 1 of 2\ During this year, Weaver sold some equipment for

$19that had cost

$31and on which there was accumulated\ depreciation of

$10. In addition, the company sold long-term investments for

$12that had cost

$7when purchased several\ years ago. Weaver paid a cash dividend and repurchased

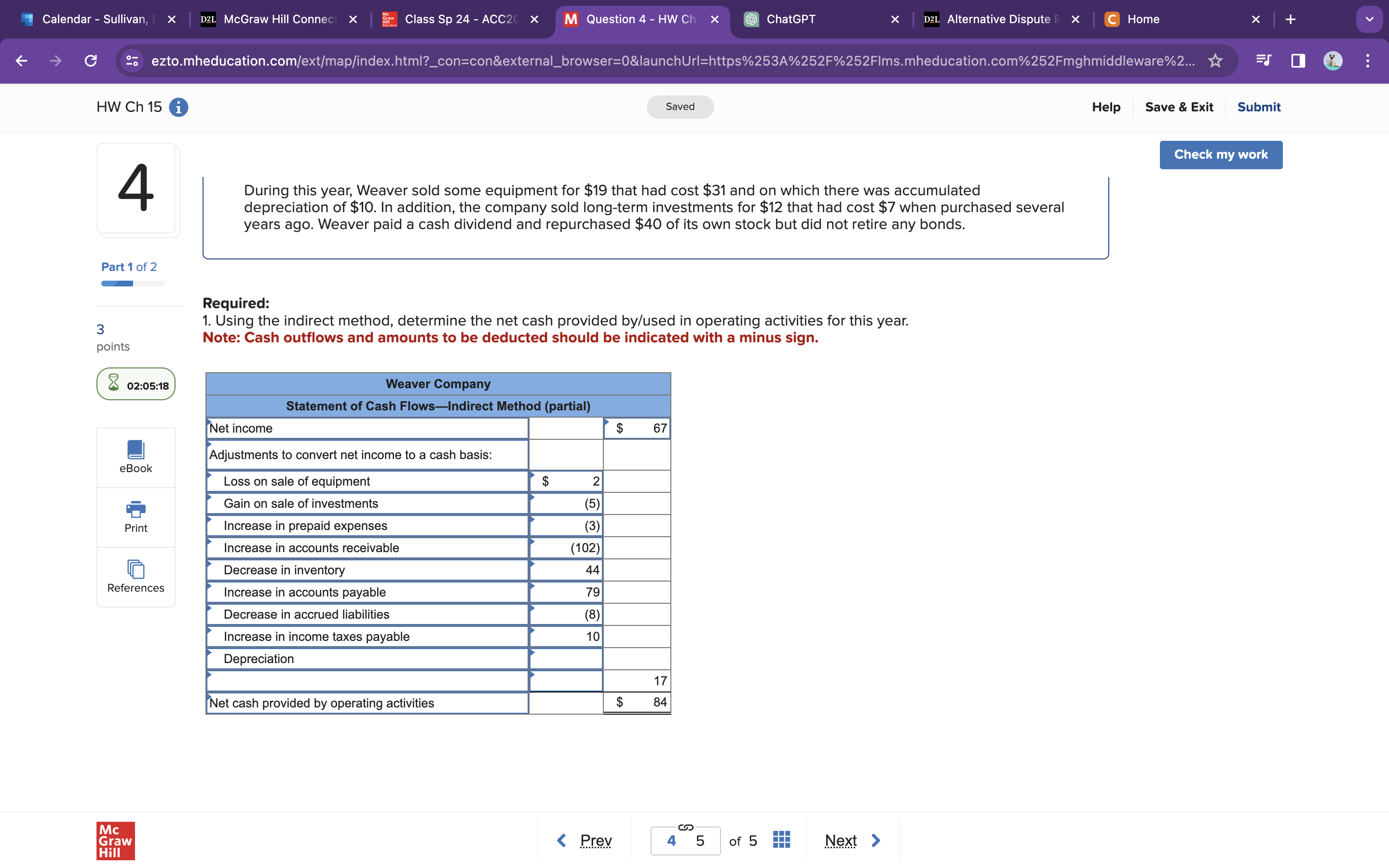

$40of its own stock but did not retire any bonds.\ 3 points\ 02:05:18\ References\ Required:\ Using the indirect method, determine the net cash provided by/used in operating activities for this year.\ Note: Cash outflows and amounts to be deducted should be indicated with a minus sign.\ \\\\table[[Weaver Company],[Statement of Cash Flows-Indirect Method (partial)],[Net income,,

$,67],[Adjustments to convert net income to a cash basis:],[Loss on sale of equipment,

$,,],[Gain on sale of investments,

(5),,],[Increase in prepaid expenses,(3),,],[Increase in accounts receivable,

(102),,],[Decrease in inventory,44,,],[Increase in accounts payable,79,,],[Decrease in accrued liabilities,(8),,],[Increase in income taxes payable,10,,],[Depreciation],[,,,17],[Net cash provided by operating activities,,

$,84]]

During this year, Weaver sold some equipment for $19 that had cost $31 and on which there was accumulated depreciation of $10. In addition, the company sold long-term investments for $12 that had cost $7 when purchased several years ago. Weaver paid a cash dividend and repurchased $40 of its own stock but did not retire any bonds. Required: 1. Using the indirect method, determine the net cash provided by/used in operating activities for this year. Note: Cash outflows and amounts to be deducted should be indicated with a minus sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts