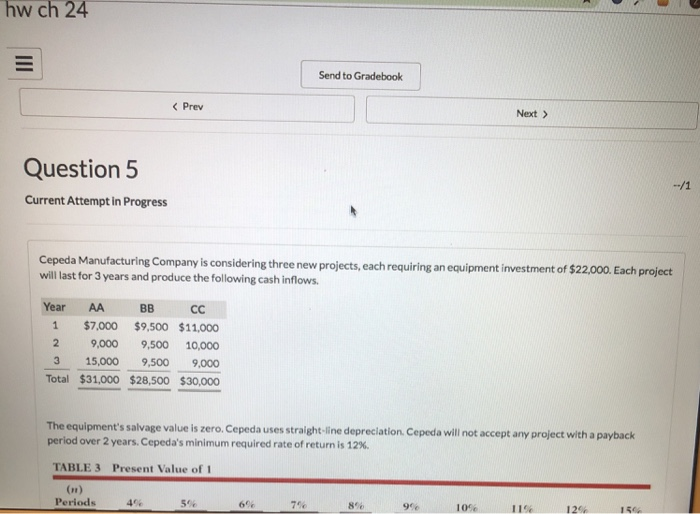

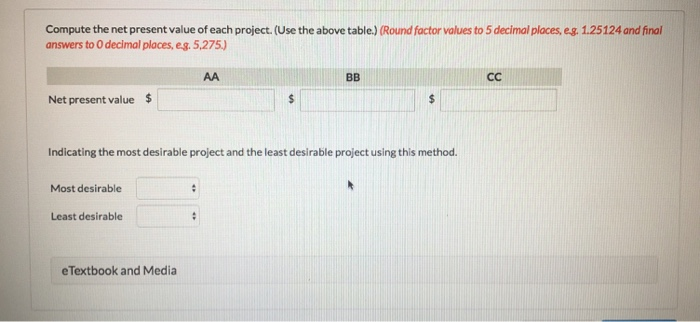

Question: hw ch 24 Send to Gradebook Question 5 Current Attempt in Progress Cepeda Manufacturing Company is considering three new will last for 3 years and

hw ch 24 Send to Gradebook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts