Question: HW Chapter 25 Question 1: Deep Blue manufactures flotation vests in Charleston, South Carolina. Deep Blue's contribution margin income statement for the month ended October

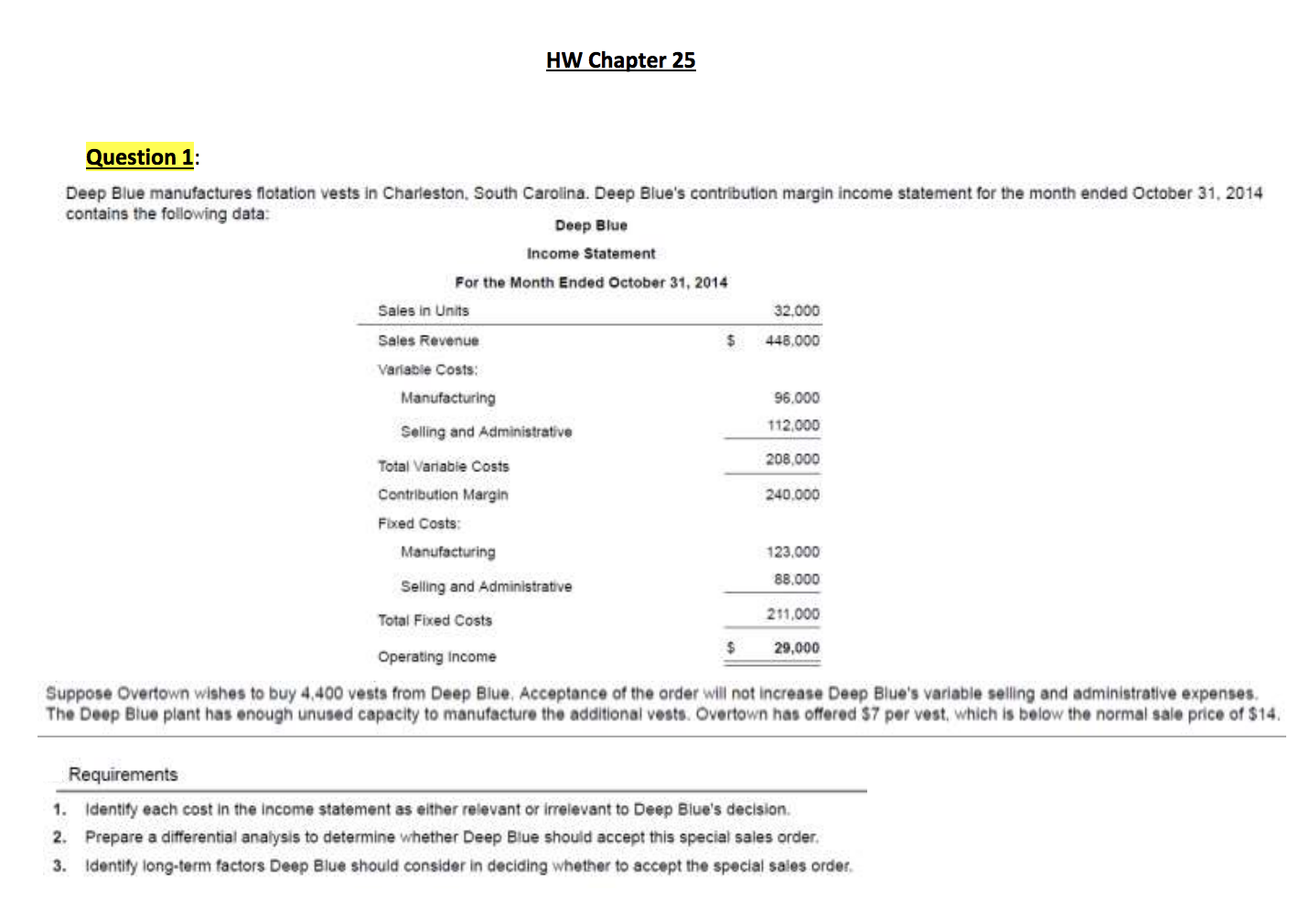

HW Chapter 25 Question 1: Deep Blue manufactures flotation vests in Charleston, South Carolina. Deep Blue's contribution margin income statement for the month ended October 31, 2014 contains the following data: Deep Blue Income Statement For the Month Ended October 31, 2014 32,000 Sales in Units $ Sales Revenue 448,000 Variable Costs: Manufacturing 96.000 112,000 Selling and Administrative 208,000 Total Variable Costs Contribution Margin 240,000 Fixed Costs: Manufacturing 123.000 88.000 Selling and Administrative 211,000 Total Fixed Costs 29,000 Operating Income Suppose Overtown wishes to buy 4,400 vests from Deep Blue. Acceptance of the order will not increase Deep Blue's variable selling and administrative expenses. The Deep Blue plant has enough unused capacity to manufacture the additional vests. Overtown has offered $7 per vest, which is below the normal sale price of $14 Requirements 1. Identity each cost in the income statement as either relevant or irrelevant to Deep Blue's decision. 2. Prepare a differential analysis to determine whether Deep Blue should accept this special sales order. 3. Identity long-term factors Deep Blue should consider in deciding whether to accept the special sales order

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts