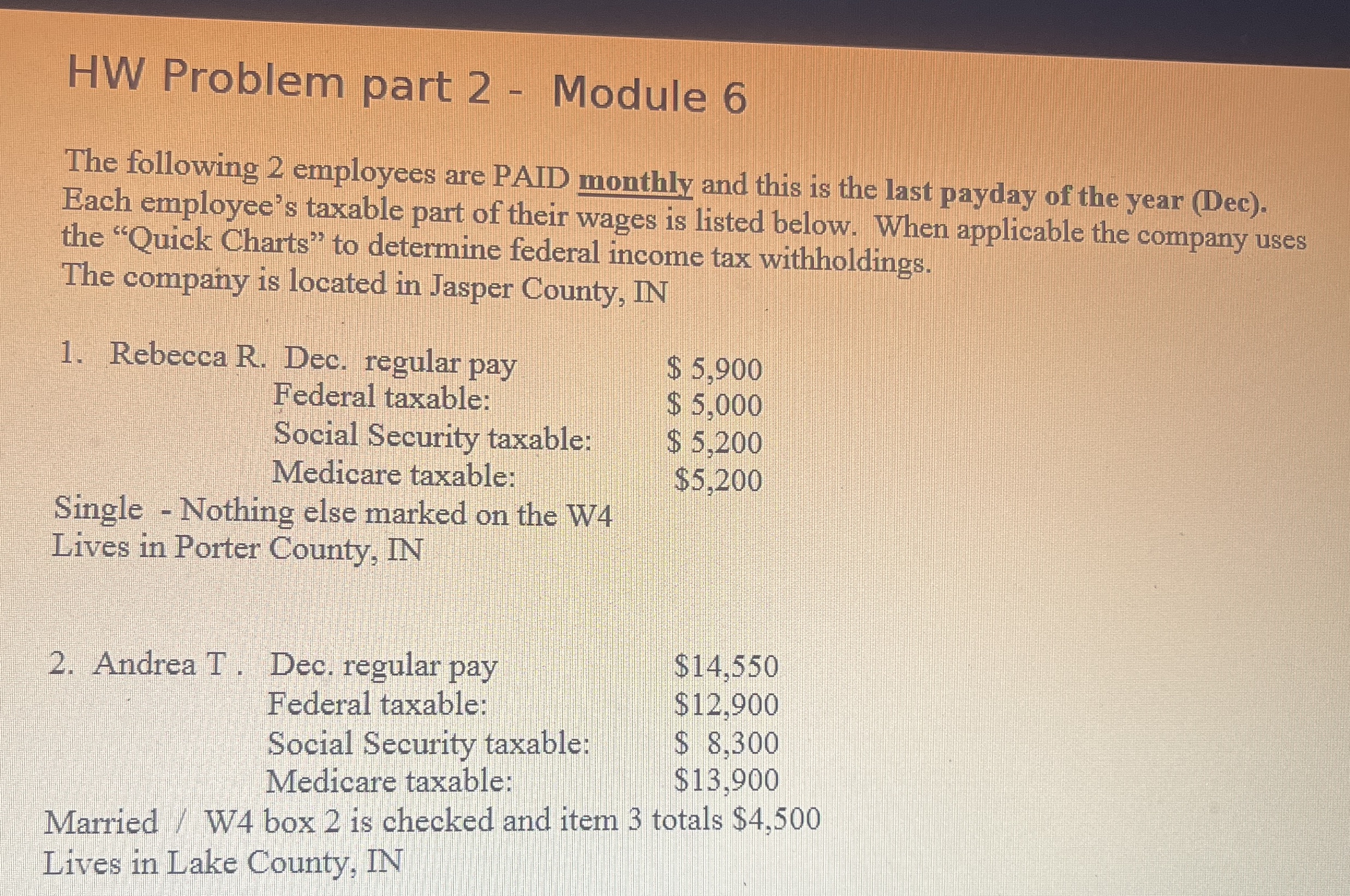

Question: HW Problem part 2 - Module 6 The following 2 employees are PAID monthly and this is the last payday of the year ( Dec

HW Problem part Module

The following employees are PAID monthly and this is the last payday of the year Dec

Each employee's taxable part of their wages is listed below. When applicable the company uses

the "Quick Charts" to determine federal income tax withholdings.

The company is located in Jasper County, IN

Rebecca R Dec. regular pay

Federal taxable:

$

Social Security taxable:

$

Medicare taxable:

$

$

Single Nothing else marked on the W

Lives in Porter County, IN

Andrea T

Married W box is checked and item totals $

Lives in Lake County, IN

HW Problem part Module

The following employees are PAID monthly and this is the last payday of the year Dec

Each employee's taxable part of their wages is listed below. When applicable the company uses

the "Quick Charts" to determine federal income tax withholdings.

The company is located in Jasper County, IN

Rebecca R Dec. regular pay

Federal taxable:

$

Social Security taxable:

$

Medicare taxable:

$

$

Single Nothing else marked on the W

Lives in Porter County, IN

Andrea T

Married W box is checked and item totals $

Lives in Lake County, IN

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock