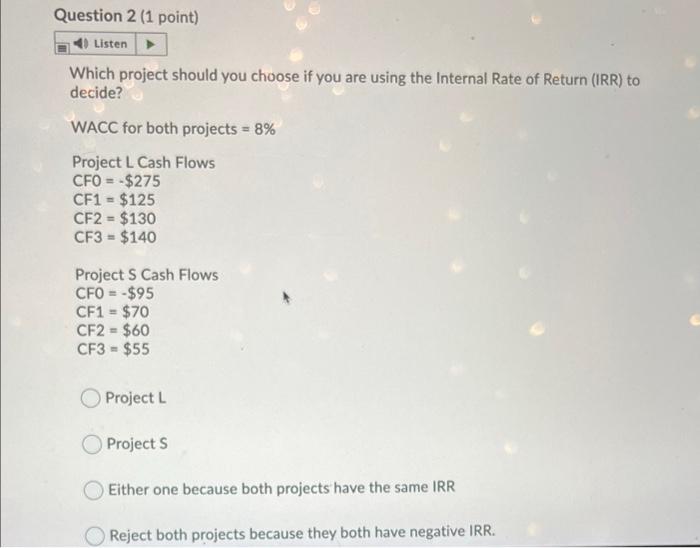

Question: HW Question 2 (1 point) Listen Which project should you choose if you are using the Internal Rate of Return (IRR) to decide? WACC for

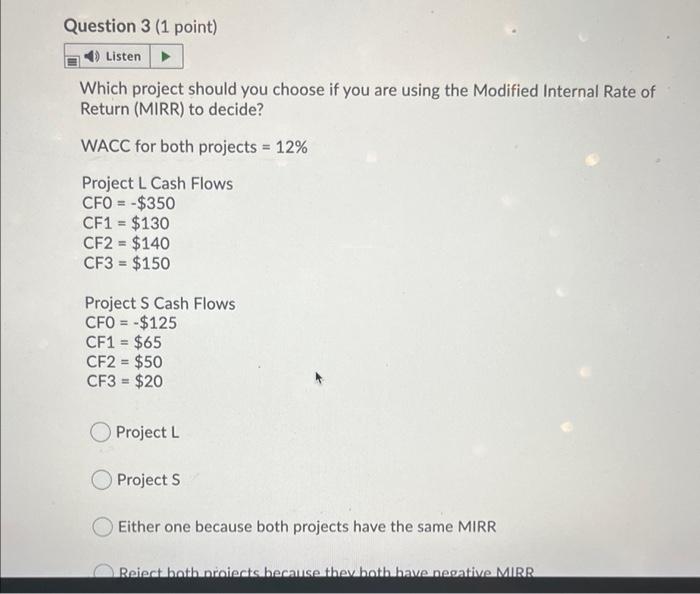

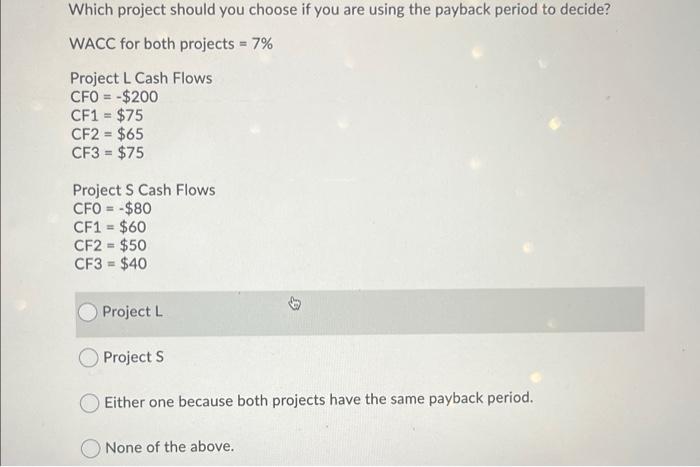

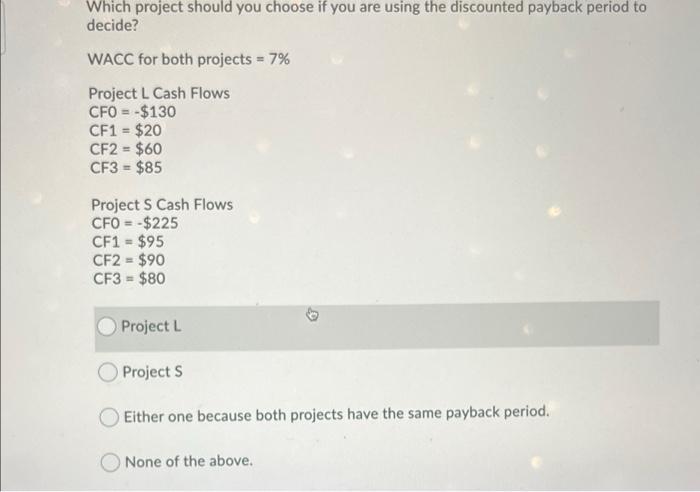

Question 2 (1 point) Listen Which project should you choose if you are using the Internal Rate of Return (IRR) to decide? WACC for both projects = 8% Project L Cash Flows CFO = -$275 CF1 - $125 CF2 = $130 CF3 - $140 Project S Cash Flows CFO = -$95 CF1 - $70 CF2 = $60 CF3 = $55 Project L Projects Either one because both projects have the same IRR Reject both projects because they both have negative IRR. Question 3 (1 point) Listen Which project should you choose if you are using the Modified Internal Rate of Return (MIRR) to decide? WACC for both projects = 12% Project L Cash Flows CFO = -$350 CF1 = $130 CF2 = $140 CF3 = $150 Project S Cash Flows CFO = -$125 CF1 = $65 CF2 = $50 CF3 = $20 Project L Projects Either one because both projects have the same MIRR Raiect both proiecte because the both have negative MIRR Which project should you choose if you are using the payback period to decide? WACC for both projects = 7% Project L Cash Flows CFO = - $200 CF1 = $75 CF2 = $65 CF3 = $75 Project S Cash Flows CFO = -$80 CF1 = $60 CF2 - $50 CF3 = $40 Project L Projects Either one because both projects have the same payback period. None of the above. Which project should you choose if you are using the discounted payback period to decide? WACC for both projects = 7% Project L Cash Flows CFO = -$130 CF1 = $20 CF2 - $60 CF3 = $85 Project S Cash Flows CFO = -$225 CF1 - $95 CF2 = $90 CF3 - $80 Project L Projects Either one because both projects have the same payback period. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts