Question: HW Score: 0%, 0 Problem 16-4 (static) Question Help Chapte Determine which of the following annual gifts are subject to gift taxes and to what

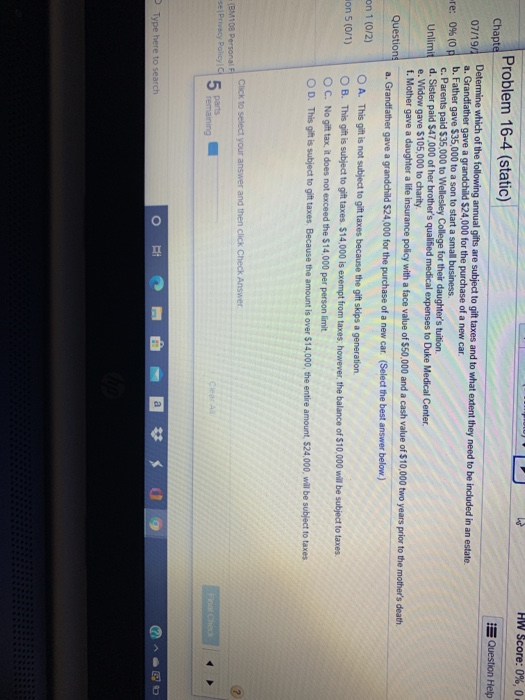

HW Score: 0%, 0 Problem 16-4 (static) Question Help Chapte Determine which of the following annual gifts are subject to gift taxes and to what extent they need to be included in an estate 07/19/1 a. Grandfather gave a grandchild $24,000 for the purchase of a new car re: 0% (0 b. Father gave $35,000 to a son to start a small business c. Parents paid $35,000 to Wellesley College for their daughter's tuition Unlimit d. Sister paid $47.000 of her brother's qualified medical expenses to Duke Medical Center e. Widow gave $105,000 to charity f. Mother gave a daughter a life insurance policy with a face value of $50,000 and a cash value of $10,000 two years prior to the mother's death Questions a. Grandfather gave a grandchild $24,000 for the purchase of a new car. (Select the best answer below.) on 1 (0/2) O A. This gift is not subject to gift taxes because the gift skips a generation on 5 (0/1) OB. This gift is subject to gift taxes $14,000 is exempt from taxes, however, the balance of $10,000 will be subject to taxes OC. No gift tax, it does not exceed the $14,000 per person limit OD. This gift is subject to gift taxes Because the amount is over $14,000, the entire amount. 524,000, will be subject to taxes Click to select your answer and then click Check Answer - (BM108 Personal se Privacy Policy 5 parts remaining Clear Al O Type here to search BE a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts