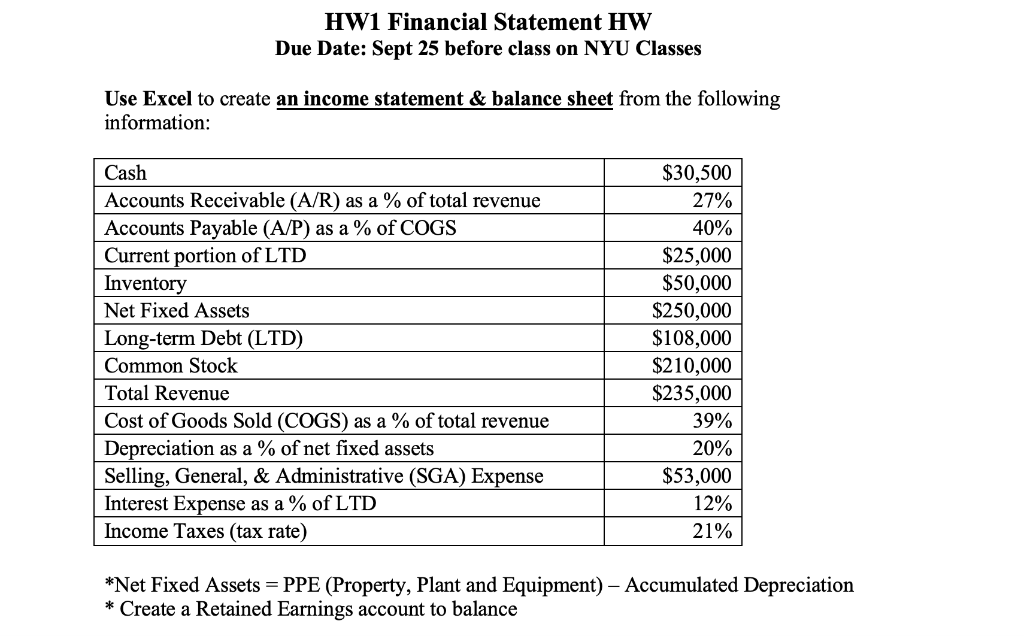

Question: HW1 Financial Statement HW Due Date: Sept 25 before class on NYU Classes Use Excel to create an income statement & balance sheet from the

HW1 Financial Statement HW Due Date: Sept 25 before class on NYU Classes Use Excel to create an income statement & balance sheet from the following information: Cash Accounts Receivable (A/R) as a % of total revenue Accounts Payable (A/P) as a % of COGS Current portion of LTD Inventory Net Fixed Assets Long-term Debt (LTD) Common Stock Total Revenue Cost of Goods Sold (COGS) as a % of total revenue Depreciation as a % of net fixed assets Selling, General, & Administrative (SGA) Expense Interest Expense as a % of LTD Income Taxes (tax rate) $30,500 27% 40% $25,000 $50,000 $250,000 $108,000 $210,000 $235,000 39% 20% $53,000 12% 21% *Net Fixed Assets = PPE (Property, Plant and Equipment) - Accumulated Depreciation * Create a Retained Earnings account to balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts