Question: HW1: Valuation, exchange offers: homework problems To solve these problems you need to apply the formula PVo = CF1/(k-g), CF;=cashflow received in period 1 (end

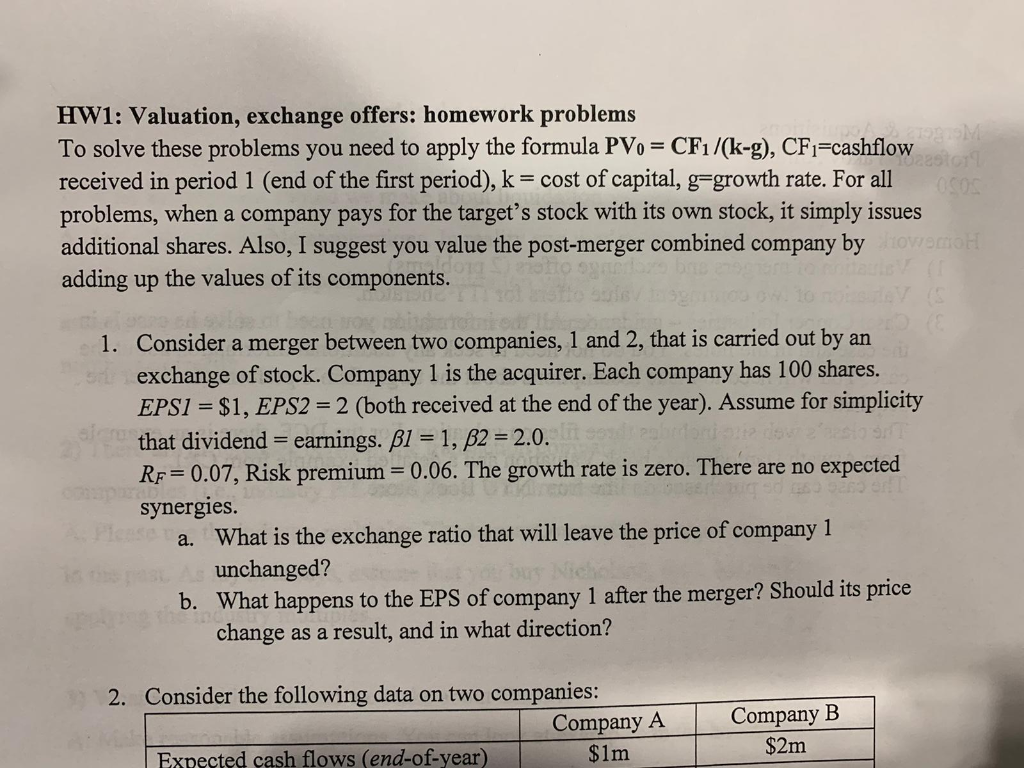

HW1: Valuation, exchange offers: homework problems To solve these problems you need to apply the formula PVo = CF1/(k-g), CF;=cashflow received in period 1 (end of the first period), k = cost of capital, g=growth rate. For all problems, when a company pays for the target's stock with its own stock, it simply issues additional shares. Also, I suggest you value the post-merger combined company bytovremo adding up the values of its components. 1. Consider a merger between two companies, 1 and 2, that is carried out by an 5th exchange of stock. Company 1 is the acquirer. Each company has 100 shares. EPSI = $1, EPS2 = 2 (both received at the end of the year). Assume for simplicity that dividend = earnings. Bl = 1, B2 = 2.0. RE=0.07. Risk premium = 0.06. The growth rate is zero. There are no expected synergies. sea. What is the exchange ratio that will leave the price of company 1 unchanged? b. What happens to the EPS of company 1 after the merger? Should its price change as a result, and in what direction? 2. Consider the following data on two companies: Company A Expected cash flows (end-of-year) $1m Company B $2m

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts