Question: HW6 (Chapter 19) Saved Help Save & Exit Submi Check my work 4 A manufacturer reports direct materials of $6 per unit, direct labor of

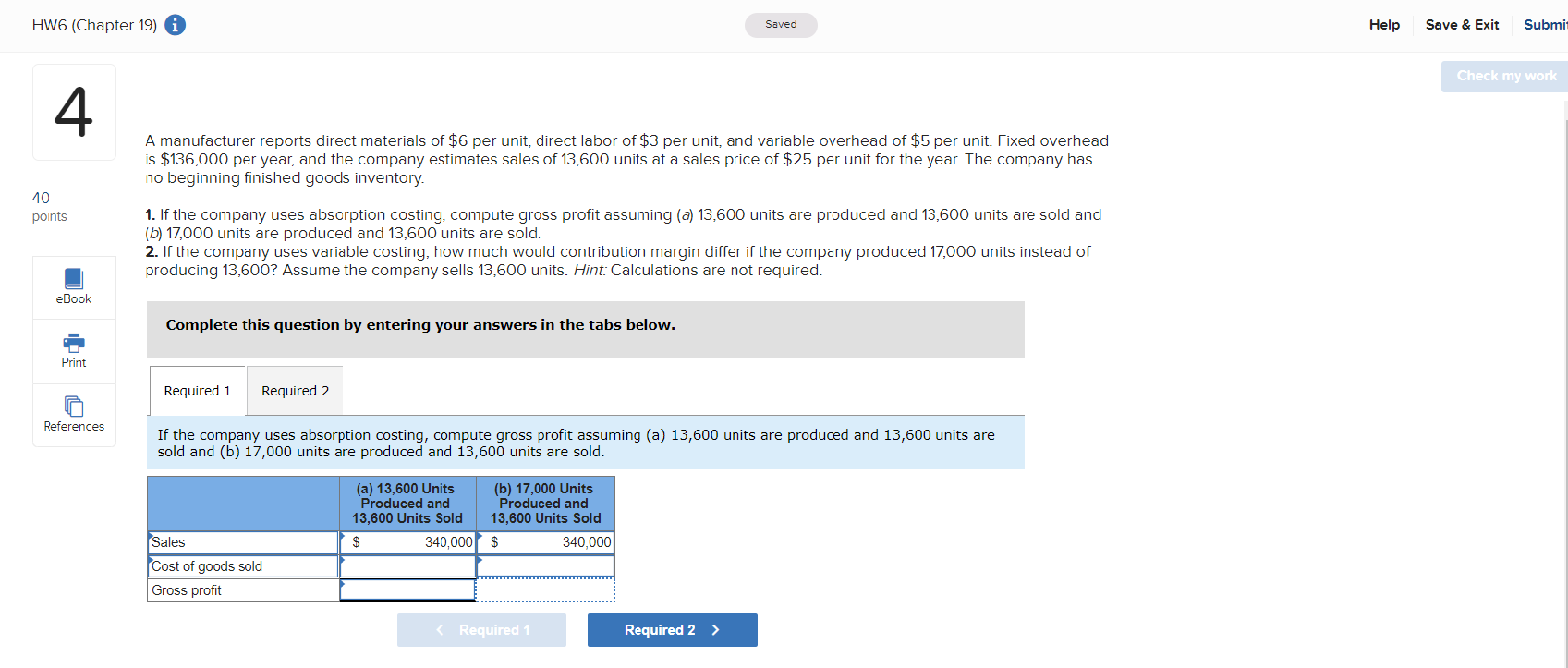

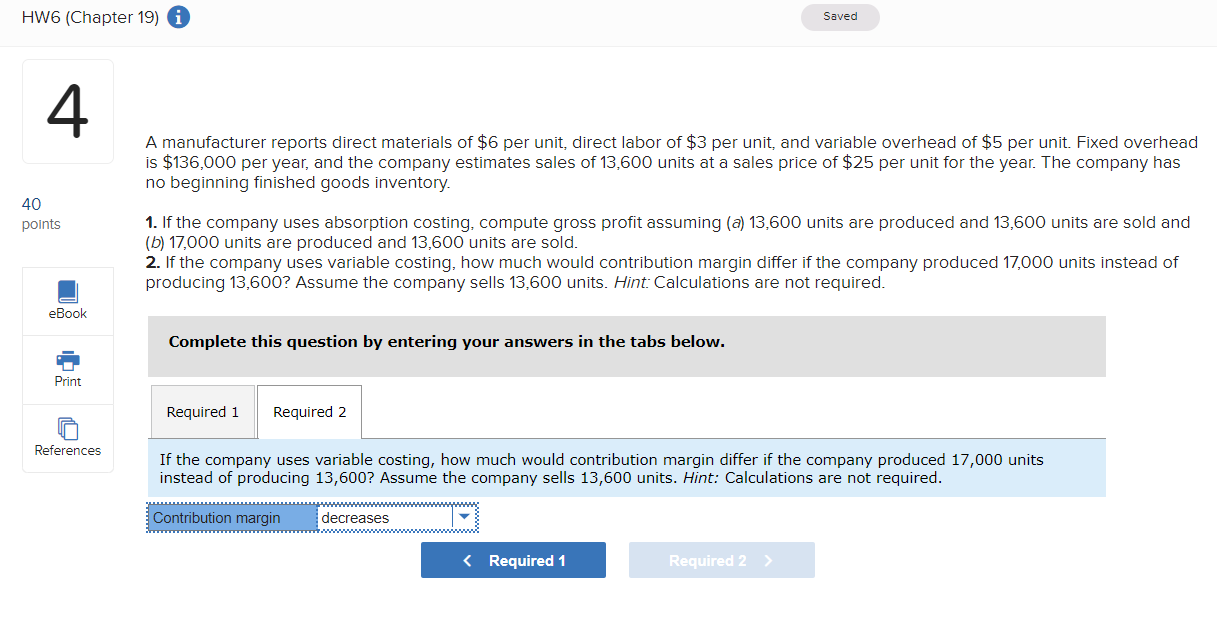

HW6 (Chapter 19) Saved Help Save & Exit Submi Check my work 4 A manufacturer reports direct materials of $6 per unit, direct labor of $3 per unit, and variable overhead of $5 per unit. Fixed overhead is $136,000 per year, and the company estimates sales of 13,600 units at a sales price of $25 per unit for the year. The company has no beginning finished goods inventory. 40 points 1. If the company uses absorption costing, compute gross profit assuming (a) 13,600 units are produced and 13,600 units are sold and b) 17,000 units are produced and 13,600 units are sold. 2. If the company uses variable costing, how much would contribution margin differ if the company produced 17,000 units instead of producing 13,600? Assume the company sells 13,600 units. Hint: Calculations are not required. eBook Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References If the company uses absorption costing, compute gross profit assuming (a) 13,600 units are produced and 13,600 units are sold and (b) 17,000 units are produced and 13,600 units are sold. (a) 13,600 Units (b) 17,000 Units Produced and Produced and 13,600 Units Sold 13,600 Units Sold $ 340,000 $ 340,000 Sales Cost of goods sold Gross profit Required 1 Required 2 > HW6 (Chapter 19) i Saved 4 A manufacturer reports direct materials of $6 per unit, direct labor of $3 per unit, and variable overhead of $5 per unit. Fixed overhead is $136,000 per year, and the company estimates sales of 13,600 units at a sales price of $25 per unit for the year. The company has no beginning finished goods inventory. 40 points 1. If the company uses absorption costing, compute gross profit assuming (a) 13,600 units are produced and 13,600 units are sold and (b) 17,000 units are produced and 13,600 units are sold. 2. If the company uses variable costing, how much would contribution margin differ if the company produced 17,000 units instead of producing 13,600? Assume the company sells 13,600 units. Hint: Calculations are not required. eBook Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References If the company uses variable costing, how much would contribution margin differ if the company produced 17,000 units instead of producing 13,600? Assume the company sells 13,600 units. Hint: Calculations are not required. www Contribution margin decreases

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts