Question: hy can u please answer this question Problem 1-22 Cost Terminology; Contribution Format Income Statement (L01-2, LO1-4, LO1-6] Miller Company's total sales are $198,000. The

hy can u please answer this question

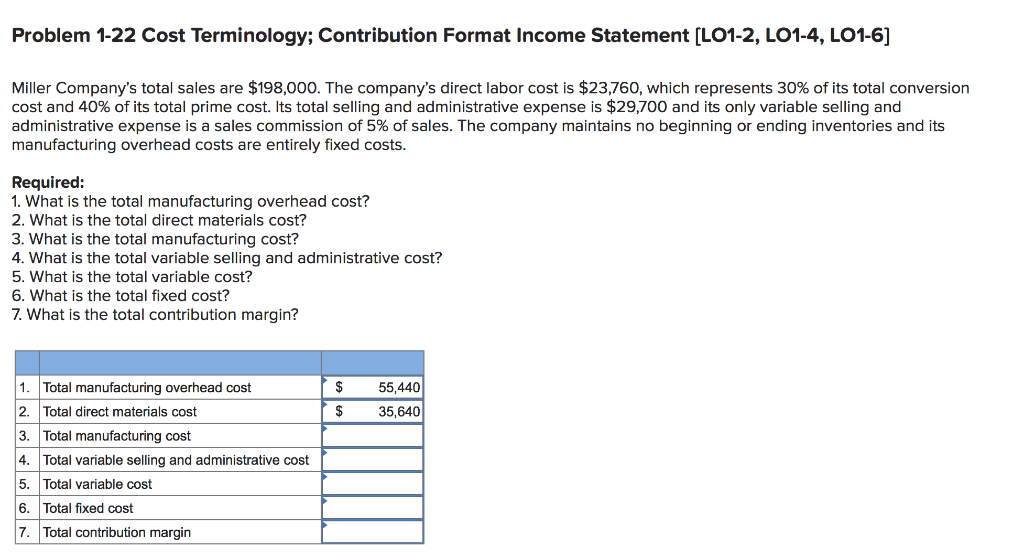

Problem 1-22 Cost Terminology; Contribution Format Income Statement (L01-2, LO1-4, LO1-6] Miller Company's total sales are $198,000. The company's direct labor cost is $23,760, which represents 30% of its total conversion cost and 40% of its total prime cost. Its total selling and administrative expense is $29,700 and its only variable selling and administrative expense is a sales commission of 5% of sales. The company maintains no beginning or ending inventories and its manufacturing overhead costs are entirely fixed costs. Required: 1. What is the total manufacturing overhead cost? 2. What is the total direct materials cost? 3. What is the total manufacturing cost? 4. What is the total variable selling and administrative cost? 5. What is the total variable cost? 6. What is the total fixed cost? 7. What is the total contribution margin? $ $ 55,440 35,640 1. Total manufacturing overhead cost Total direct materials cost Total manufacturing cost 4. Total variable selling and administrative cost | Total variable cost 6. Total fixed cost 7. Total contribution margin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts