Question: Hy is depreciating the building over 25 years using the straight-line method, estimated residual value of $59,000. The furniture and fixtures will be replac me

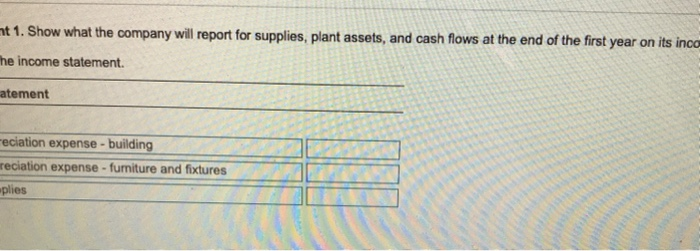

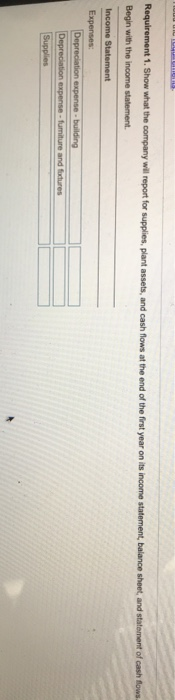

Hy is depreciating the building over 25 years using the straight-line method, estimated residual value of $59,000. The furniture and fixtures will be replac me end of five years and are being depreciated using the ble-declining-balance method, with a residual value of zero. At the end of the year, the company still had dishes and supplies worth $1,800. mt 1. Show what the company will report for supplies, plant assets, and cash flows at the end of the first year on its inco The income statement. atement Feciation expense - building reciation expense - furniture and fixtures plies Hardy is depreciating the building over 25 years using the straight-line method, with estimated residual value of $59,000. The furniture and fixtures will be replaced at the end of five years and are being depreciated using the double-declining-balance method, with a residual value of zero. At the end of the first year, the company still had dishes and supplies worth $1,800. Requirement 1. Show what the company will report for supplies, plant assets, and cash flows at the end of the first year on its income statement, balance sheet, and statement of cash flows Begin with the income statement Income Statement Expenses Depreciation expense building Depreciation expense - fumiture and fixtures Supplies VESEL On January 1, 2018, Hardy Bar & Grill purchased a building, paying 6,000 cash and signing a $107.000 note payable. The company paid another $60,000 to remodel the building Furniture and fixtures cost 552.000, and dishes and current were stained for $0.800. All expenditures were for cash. Assume that all of these expenditures occurred on January 1, 2018 Click the icon to view depreciation information) Read the rements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts