Question: Hye. Can someone show me how to solve this problem. Thank you so much. QUESTION4 Selman Enterprise was formed last year by three enterprising graduates

Hye. Can someone show me how to solve this problem. Thank you so much.

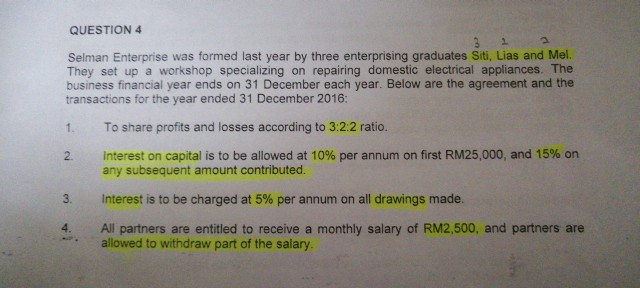

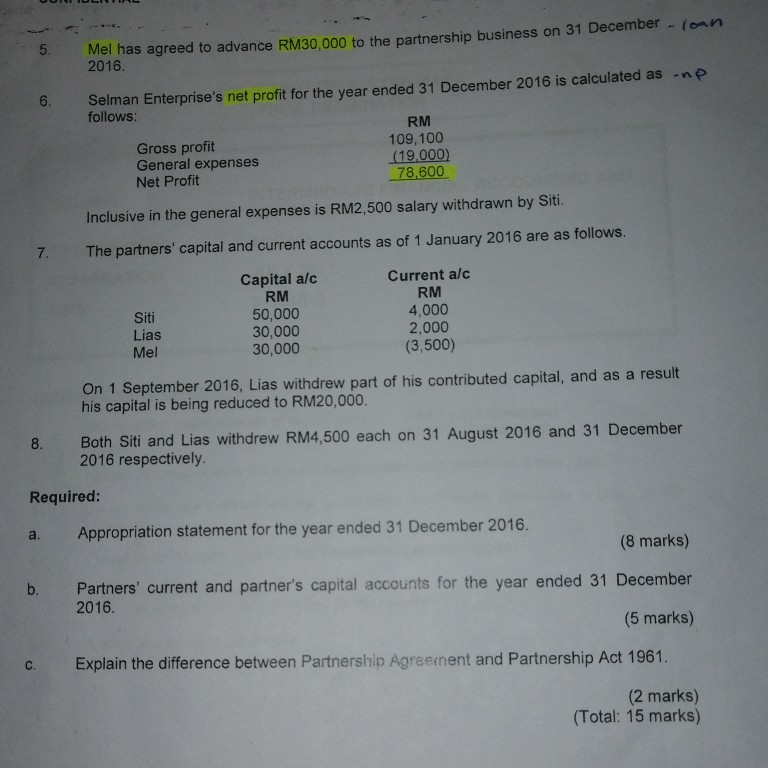

QUESTION4 Selman Enterprise was formed last year by three enterprising graduates Siti, Lias and Mel. They set up a workshop specializing on repairing domestic electrical appliances. The business financial year ends on 31 December each year. Below are the agreement and the transactions for the year ended 31 December 2016: 1. To share profits and losses according to 3:2:2 ratio. 2, interest on capital is to be allowed at 10% per annum on first RM25,000, and 15% on any subsequent amount contributed. interest is to be charged at 5% per annum on all drawings made. All partners are entitled to receive a monthly salary of RM2,500, and partners are 3. 4. allowed to withdraw part of the salary. Mel has agreed to advance RM30,000 to the partnership business on 31 December -(onn 2016. 5. 6. Selman Enterprise's net profit for the year ended 31 December 2016 is calculated as np follows Gross profit General expenses Net Profit RM 109,100 (19.000) 78,600 Inclusive in the general expenses is RM2,500 salary withdrawn by Siti. 7. The partners' capital and current accounts as of 1 January 2016 are as follows. Siti Lias Mel Capital alc RM 50,000 30,000 30,000 Current a/c RM 4,000 2,000 (3,500) On 1 September 2016, Lias withdrew part of his contributed capital, and as a result his capital is being reduced to RM20,000. 8. Both Siti and Lias withdrew RM4,500 each on 31 August 2016 and 31 December Required: a. Appropriation statement for the year ended 31 December 2016 b. Partners' current and partner's capital accounts for the year ended 31 2016 respectively. (8 marks) 2016. (5 marks) C. Explain the difference between Partnership Agrernent and Partnership Act 1961. (2 marks) (Total: 15 marks) QUESTION4 Selman Enterprise was formed last year by three enterprising graduates Siti, Lias and Mel. They set up a workshop specializing on repairing domestic electrical appliances. The business financial year ends on 31 December each year. Below are the agreement and the transactions for the year ended 31 December 2016: 1. To share profits and losses according to 3:2:2 ratio. 2, interest on capital is to be allowed at 10% per annum on first RM25,000, and 15% on any subsequent amount contributed. interest is to be charged at 5% per annum on all drawings made. All partners are entitled to receive a monthly salary of RM2,500, and partners are 3. 4. allowed to withdraw part of the salary. Mel has agreed to advance RM30,000 to the partnership business on 31 December -(onn 2016. 5. 6. Selman Enterprise's net profit for the year ended 31 December 2016 is calculated as np follows Gross profit General expenses Net Profit RM 109,100 (19.000) 78,600 Inclusive in the general expenses is RM2,500 salary withdrawn by Siti. 7. The partners' capital and current accounts as of 1 January 2016 are as follows. Siti Lias Mel Capital alc RM 50,000 30,000 30,000 Current a/c RM 4,000 2,000 (3,500) On 1 September 2016, Lias withdrew part of his contributed capital, and as a result his capital is being reduced to RM20,000. 8. Both Siti and Lias withdrew RM4,500 each on 31 August 2016 and 31 December Required: a. Appropriation statement for the year ended 31 December 2016 b. Partners' current and partner's capital accounts for the year ended 31 2016 respectively. (8 marks) 2016. (5 marks) C. Explain the difference between Partnership Agrernent and Partnership Act 1961. (2 marks) (Total: 15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts