Question: I. (10) The following questions are based on Chapter 9 lecture note. Assume that the dividend will grow at the rate of 5% (not g=4%)

I. (10) The following questions are based on Chapter 9 lecture note. Assume that the dividend will grow at the rate of 5% (not g=4%) in slide #11, but all other values are the same.

a. Find the expected dividends stream for the next 4 years.

b. Estimate the present value of this stock based on the Discounted Dividend Model (set N=4).

c. Estimate the present value (P0) of this stock based on the Constant Growth Model.

d. Estimate the prices at t=1 (P1) and t=2 (P2) using the Constant Growth Model.

e. Find Divined yield, Capital gains yield, and Total return.

Solver a,b,c,d,e

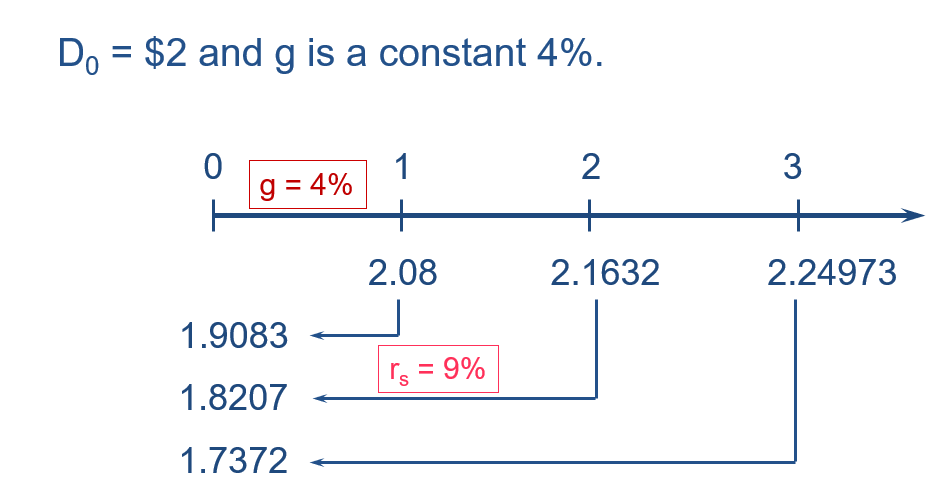

Do = $2 and g is a constant 4%. 0 g = 4% 1 + 2 + 3 + 2.08 2.1632 2.24973 1.9083 rs = 9% 1.8207 1.7372 Do = $2 and g is a constant 4%. 0 g = 4% 1 + 2 + 3 + 2.08 2.1632 2.24973 1.9083 rs = 9% 1.8207 1.7372

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts