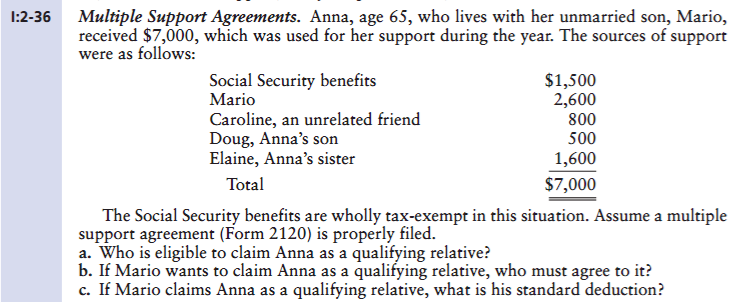

Question: I: 2 - 3 6 Multiple Support Agreements. Anna, age 6 5 , who lives with her unmarried son, Mario, received $ 7 , 0

I: Multiple Support Agreements. Anna, age who lives with her unmarried son, Mario,

received $ which was used for her support during the year. The sources of support

were as follows:

The Social Security benefits are wholly taxexempt in this situation. Assume a multiple

support agreement Form is properly filed.

a Who is eligible to claim Anna as a qualifying relative?

b If Mario wants to claim Anna as a qualifying relative, who must agree to it

c If Mario claims Anna as a qualifying relative, what is his standard deduction?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock