Question: I. ( 4 0 points ) Hearthstone Communities, a real estate developer, would like to fund a new affordable housing project for seniors. To do

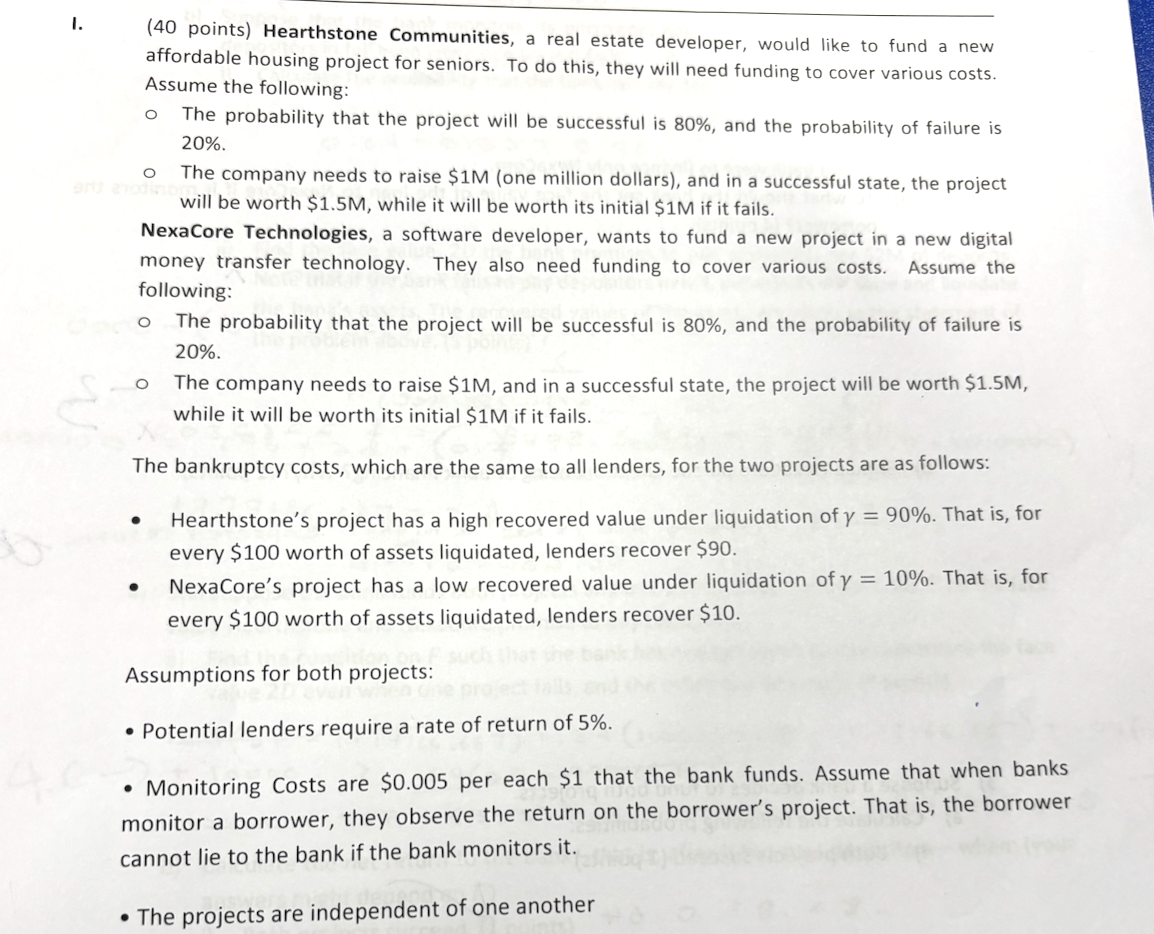

I. points Hearthstone Communities, a real estate developer, would like to fund a new affordable housing project for seniors. To do this, they will need funding to cover various costs. Assume the following: The probability that the project will be successful is and the probability of failure is The company needs to raise $M one million dollars and in a successful state, the project will be worth $M while it will be worth its initial $M if it fails. NexaCore Technologies, a software developer, wants to fund a new project in a new digital money transfer technology. They also need funding to cover various costs. Assume the following: The probability that the project will be successful is and the probability of failure is The company needs to raise $M and in a successful state, the project will be worth $M while it will be worth its initial $M if it fails. The bankruptcy costs, which are the same to all lenders, for the two projects are as follows: Hearthstone's project has a high recovered value under liquidation of gamma That is for every $ worth of assets liquidated, lenders recover $ NexaCore's project has a low recovered value under liquidation of gamma That is for every $ worth of assets liquidated, lenders recover $ Assumptions for both projects: Potential lenders require a rate of return of Monitoring Costs are $ per each $ that the bank funds. Assume that when banks monitor a borrower, they observe the return on the borrower's project. That is the borrower cannot lie to the bank if the bank monitors it The projects are independent of one another Suppose a bank were to finance only Nexacore. To what should the bank set the face value of the loan to Nexacore if it monitors the borrower?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock