Question: I & *5% & 7 Question 2 Partially correct ~ Mark 1.06 0utof 5.00 Flag question Prepare Common-Size Balance Sheets and Income Statements Following are

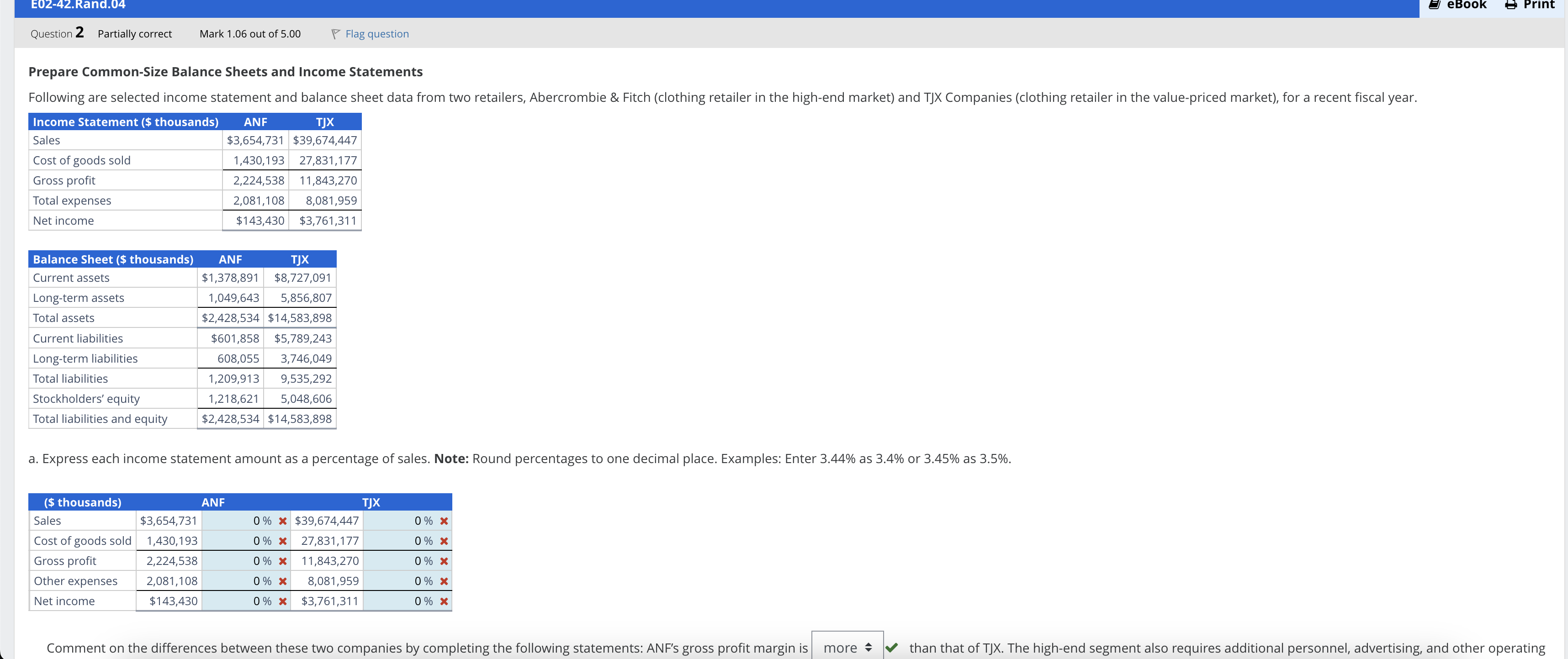

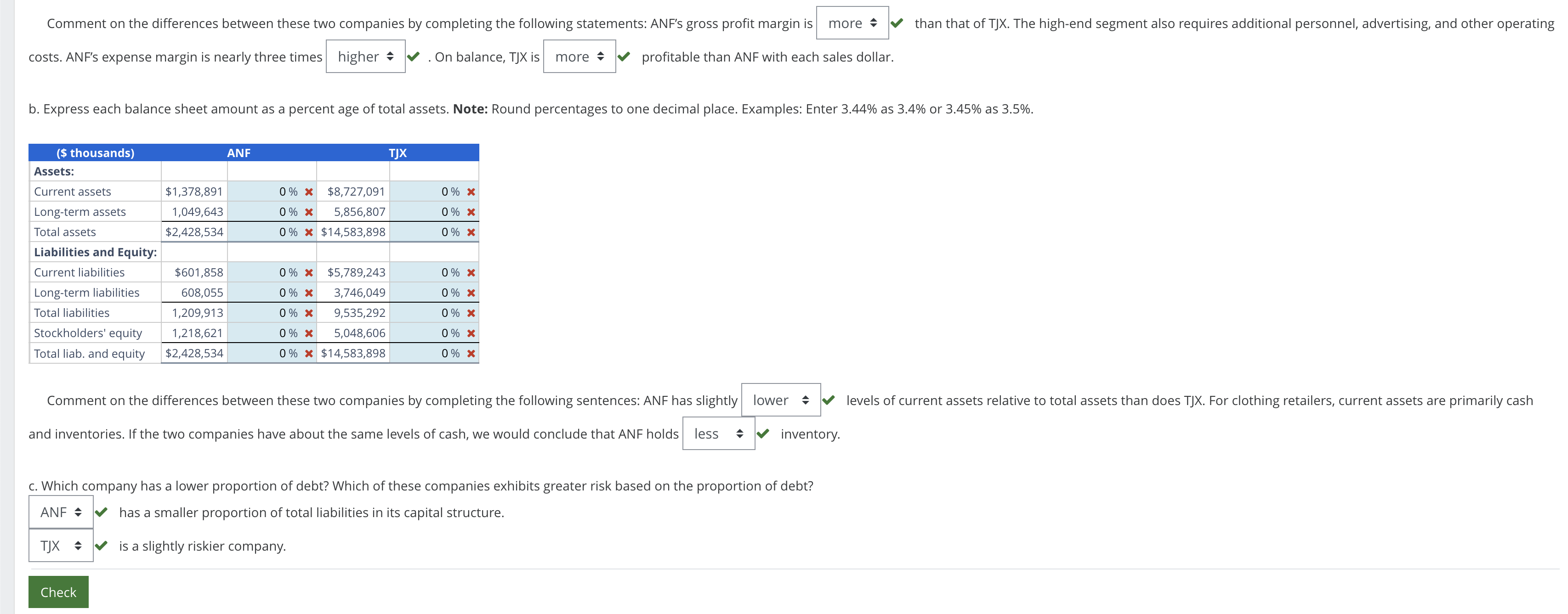

I & *5% & 7 Question 2 Partially correct ~ Mark 1.06 0utof 5.00 Flag question Prepare Common-Size Balance Sheets and Income Statements Following are selected income statement and balance sheet data from two retailers, Abercrombie & Fitch (clothing retailer in the high-end market) and T)X Companies (clothing retailer in the value-priced market), for a recent fiscal year. Income Statement ($ thousands) ANF TIX Sales $3,654,731 $39,674,447 Cost of goods sold 1,430,193 27,831,177 Gross profit 2,224,538 11,843,270 Total expenses 2,081,108 8,081,959 Net income $143,430 $3,761,311 Balance Sheet ($ thousands) L\\ uLs Current assets $1,378,891 | $8,727,091 Long-term assets 1,049,643 5,856,807 Total assets $2,428,534 $14,583,898 Current liabilities $601,858 $5,789,243 Long-term liabilities 608,055 3,746,049 Total liabilities 1,209,913 9,535,292 Stockholders' equity 1,218,621 5,048,606 Total liabilities and equity $2,428,534 | $14,583,898 a. Express each income statement amount as a percentage of sales. Note: Round percentages to one decimal place. Examples: Enter 3.44% as 3.4% or 3.45% as 3.5%. R X3 TIX Sales $3,654,731 0% % $39,674,447 0% % Cost of goods sold | 1,430,193 0% % 27,831,177 0% %X Gross profit 2,224,538 0% % 11,843,270 0% % Other expenses 2,081,108 0% % 8,081,959 0% % Net income $143,430 0% % $3,761,311 0% % Comment on the differences between these two companies by completing the following statements: ANF's gross profit marginis| more + | than that of TJX. The high-end segment also requires additional personnel, advertising, and other operating Comment on the differences between these two companies by completing the following statements: ANF's gross profit marginis| more % | than that of TJX. The high-end segment also requires additional personnel, advertising, and other operating costs. ANF's expense margin is nearly three times | higher | .On balance, T)Xis| more % | profitable than ANF with each sales dollar. b. Express each balance sheet amount as a percent age of total assets. Note: Round percentages to one decimal place. Examples: Enter 3.44% as 3.4% or 3.45% as 3.5%. ($ thousands) Y3 L3 Assets: Current assets. $1,378,891 0% % $8,727,091 0% x Long-term assets 1,049,643 0% %X 5,856,807 0% %X Total assets $2,428,534 0% % $14,583,898 0% % Liabilities and Equity: Current liabilities $601,858 0% % $5,789,243 0% % Long-term liabilities 608,055 0% %X 3,746,049 0% %X Total liabilities 1,209,913 0% % 9535292 0% % Stockholders' equity 1,218,621 0% % 5,048,606 0% % Total liab. and equity | $2,428,534 0% % $14,583,898 0% % Comment on the differences between these two companies by completing the following sentences: ANF has slightly| lower # | levels of current assets relative to total assets than does TJX. For clothing retailers, current assets are primarily cash and inventories. If the two companies have about the same levels of cash, we would conclude that ANF holds| less % | inventory. c. Which company has a lower proportion of debt? Which of these companies exhibits greater risk based on the proportion of debt? ANF | has a smaller proportion of total liabilities in its capital structure. TX & | isaslightly riskier company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts