Question: (I) 5 Multiple choice questions worth 2 pts each where you answer YES or NO: (i) The 5 - period binomial tree model with u

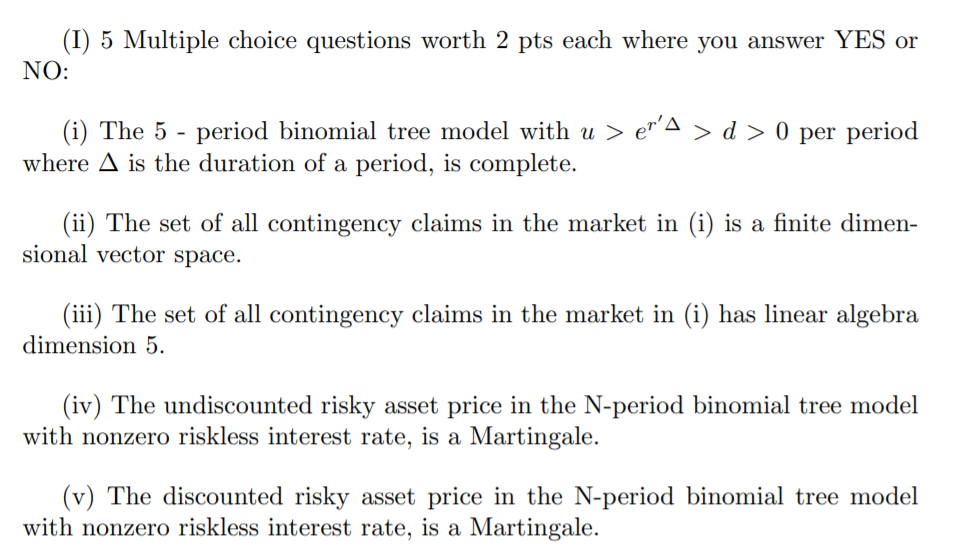

(I) 5 Multiple choice questions worth 2 pts each where you answer YES or NO: (i) The 5 - period binomial tree model with u > er'a > d > 0 per period where A is the duration of a period, is complete. (ii) The set of all contingency claims in the market in (i) is a finite dimen- sional vector space. (iii) The set of all contingency claims in the market in (i) has linear algebra dimension 5. (iv) The undiscounted risky asset price in the N-period binomial tree model with nonzero riskless interest rate, is a Martingale. (v) The discounted risky asset price in the N-period binomial tree model with nonzero riskless interest rate, is a Martingale. (I) 5 Multiple choice questions worth 2 pts each where you answer YES or NO: (i) The 5 - period binomial tree model with u > er'a > d > 0 per period where A is the duration of a period, is complete. (ii) The set of all contingency claims in the market in (i) is a finite dimen- sional vector space. (iii) The set of all contingency claims in the market in (i) has linear algebra dimension 5. (iv) The undiscounted risky asset price in the N-period binomial tree model with nonzero riskless interest rate, is a Martingale. (v) The discounted risky asset price in the N-period binomial tree model with nonzero riskless interest rate, is a Martingale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts