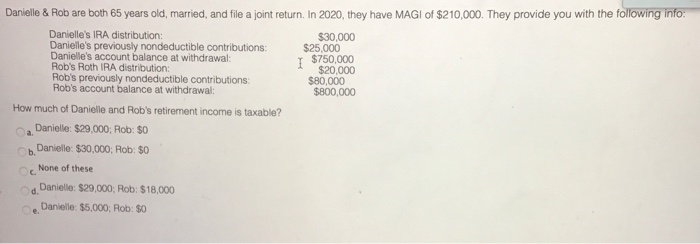

Question: I $750,000 Danielle & Rob are both 65 years old, married, and file a joint return. In 2020, they have MAGI of $210,000. They provide

I $750,000 Danielle & Rob are both 65 years old, married, and file a joint return. In 2020, they have MAGI of $210,000. They provide you with the following info: Danielle's IRA distribution: $30,000 Danielle's previously nondeductible contributions: $25,000 Danielle's account balance at withdrawal: Rob's Roth IRA distribution: $20 000 Rob's previously nondeductible contributions: $80,000 Rob's account balance at withdrawal: $800,000 How much of Danielle and Rob's retirement income is taxable? Danielle: $29,000; Rob: $0 b. Danielle: $30,000; Rob: $0 None of these Danielle: $29,000, Rob: $18,000 Danielle: $5,000: Rob: $0 d. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts