Question: I. (A nice inheritance) Suppose S1 were invested in 1776 at 3.3% interest compounded yearly. (a) Approximately how much would that investment be worth

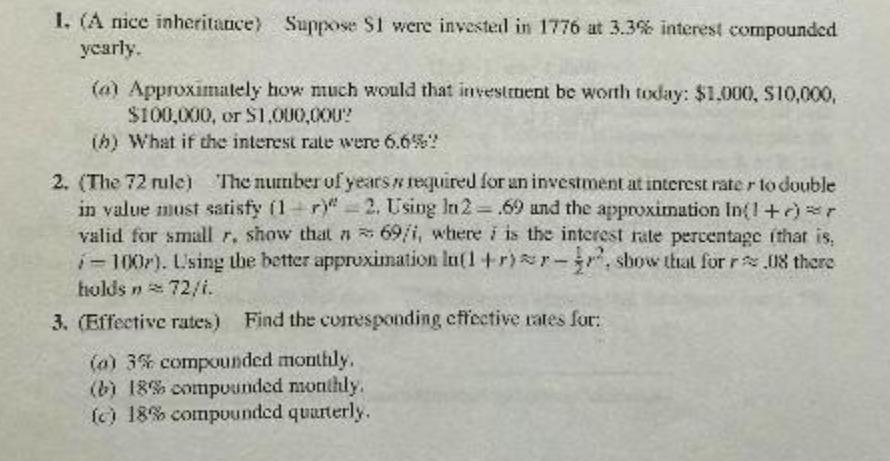

I. (A nice inheritance) Suppose S1 were invested in 1776 at 3.3% interest compounded yearly. (a) Approximately how much would that investment be worth today: $1,000, $10,000, $100,000, or $1,000,000? (b) What if the interest rate were 6.6%! 2. (The 72 rule) The number of years required for an investment at interest rate r to double in value must satisfy (1r)" r)" 2. Using In2= .69 and the approximation In(1+)=r valid for small r. show that a 69/i, where i is the interest rate percentage that is, -100r). Using the better approximation ln(1+r)r-, show that for r 18 there holds n 72/i. 3. (Effective rates) Find the corresponding effective rates for: (a) 3% compounded monthly. (b) 18% compounded monthly. (c) 18% compounded quarterly.

Step by Step Solution

There are 3 Steps involved in it

An... View full answer

Get step-by-step solutions from verified subject matter experts