Question: I add the who question on next problem that i posted sorry! Paragraph Styles Required a. Evaluate the capital expenditure proposal using the net present

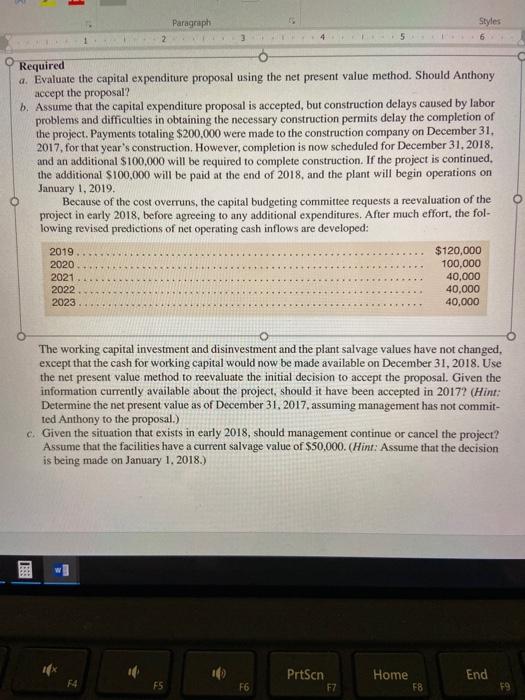

Paragraph Styles Required a. Evaluate the capital expenditure proposal using the net present value method. Should Anthony accept the proposal? b. Assume that the capital expenditure proposal is accepted, but construction delays caused by labor problems and difficulties in obtaining the necessary construction permits delay the completion of the project. Payments totaling $200,000 were made to the construction company on December 31, 2017, for that year's construction. However, completion is now scheduled for December 31, 2018. and an additional $100.000 will be required to complete construction. If the project is continued. the additional $100.000 will be paid at the end of 2018, and the plant will begin operations on January 1, 2019 Because of the cost overruns, the capital budgeting committee requests a reevaluation of the project in early 2018, before agreeing to any additional expenditures. After much effort, the fol- lowing revised predictions of net operating cash inflows are developed: 2019 $120,000 2020 100,000 2021 40,000 2022 40,000 2023 40,000 The working capital investment and disinvestment and the plant salvage values have not changed, except that the cash for working capital would now be made available on December 31, 2018. Use the net present value method to reevaluate the initial decision to accept the proposal. Given the information currently available about the project, should it have been accepted in 2017? (Hint: Determine the net present value as of December 31, 2017, assuming management has not commit- ted Anthony to the proposal.) c. Given the situation that exists in early 2018, should management continue or cancel the project? Assume that the facilities have a current salvage value of $50,000. (Hint: Assume that the decision is being made on January 1, 2018.) PrtScn F7 54 Home F8 End FS F6 19 Paragraph Styles Required a. Evaluate the capital expenditure proposal using the net present value method. Should Anthony accept the proposal? b. Assume that the capital expenditure proposal is accepted, but construction delays caused by labor problems and difficulties in obtaining the necessary construction permits delay the completion of the project. Payments totaling $200,000 were made to the construction company on December 31, 2017, for that year's construction. However, completion is now scheduled for December 31, 2018. and an additional $100.000 will be required to complete construction. If the project is continued. the additional $100.000 will be paid at the end of 2018, and the plant will begin operations on January 1, 2019 Because of the cost overruns, the capital budgeting committee requests a reevaluation of the project in early 2018, before agreeing to any additional expenditures. After much effort, the fol- lowing revised predictions of net operating cash inflows are developed: 2019 $120,000 2020 100,000 2021 40,000 2022 40,000 2023 40,000 The working capital investment and disinvestment and the plant salvage values have not changed, except that the cash for working capital would now be made available on December 31, 2018. Use the net present value method to reevaluate the initial decision to accept the proposal. Given the information currently available about the project, should it have been accepted in 2017? (Hint: Determine the net present value as of December 31, 2017, assuming management has not commit- ted Anthony to the proposal.) c. Given the situation that exists in early 2018, should management continue or cancel the project? Assume that the facilities have a current salvage value of $50,000. (Hint: Assume that the decision is being made on January 1, 2018.) PrtScn F7 54 Home F8 End FS F6 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts