Question: I added the data about the Alternatives Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below.

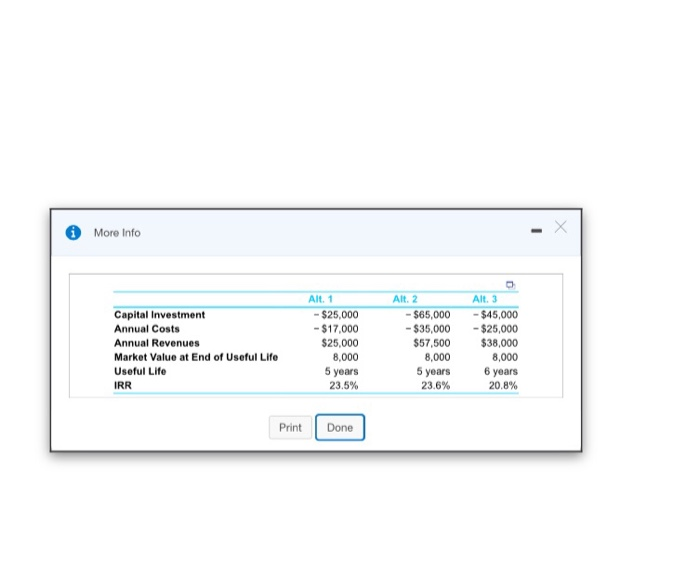

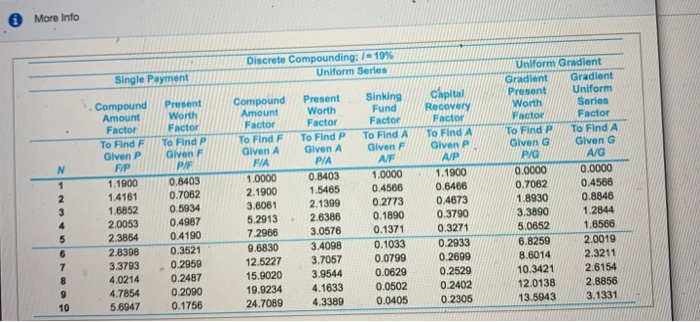

Three mutually exclusive investment alternatives are being considered. The estimated cash flows for each alternative are given below. The study period is 30 years and the firm's MARR is 8% per year. Assume repeatability and reinvestment of positive cash balances at 8% per year. a. What is the simple payback period for Alternative 1? b. What is the annual worth of Alternative 2? c. What is the IRR of the incremental cash flows of Alternative 2 compared to Alternative 1? d. Which alternative should be selected? Click the icon to view the datatable for the additional information about the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. a. The simple payback period for Alternative 1 is years. (Round up to the nearest whole number.) More Info 1 Capital Investment Annual Costs Annual Revenues Market Value at End of Useful Life Useful Life IRR Alt. 1 - $25,000 - $17,000 $25,000 8,000 5 years 23.5% Alt. 2 - $65,000 - $35,000 $57,500 8,000 5 years Alt. 3 - $45,000 - $25,000 $38,000 8,000 6 years 20.8% 23.6% Print Done More Info Discrete Compounding: = 19% Uniform Series Single Payment N 1 2 3 4 5 6 7 8 Compound Amount Factor To Find F Given P FXP 1.1900 1.4161 1.6852 2.0053 2.3884 2.8398 3.3793 4.0214 4.7854 5.6947 Present Worth Factor To Find P Given F PAF 0.8403 0.7062 0.5934 0.4987 0.4190 0.3521 0.2959 0.2487 0.2090 0.1756 Compound Amount Factor To Find F Given A FIA 1.0000 2.1900 3.6061 5.2913 7.2966 9.6830 12.5227 15.9020 19.9234 24.7089 Present Worth Factor To Find P Given A P/A 0.8403 1.5465 2.1399 2.6386 3.0576 3.4098 3.7057 3.9544 4.1633 4.3389 Sinking Fund Factor To Find A Given F AF 1.0000 0.4566 0.2773 0.1890 0.1371 0.1033 0.0799 0.0629 0.0502 0.0405 capital Recovery Factor To Find A Given P AIP 1.1900 0.6486 0.4673 0.3790 0.3271 0.2933 0.2699 0.2529 0.2402 0.2305 Uniform Gradient Gradient Gradient Present Uniform Worth Series Factor Factor To Find P To Find A Given G Given G P/G AIG 0.0000 0.0000 0.7062 0.4586 1.8930 0.8846 3.3890 1.2844 5.0652 1.6566 6.8259 2.0019 8.6014 2.3211 10.3421 2.6154 12.0138 2.8856 13.5943 3.1331 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts