Question: i added the drop down list to help with options. The Good Pick Closed-End Fund turned in the following performance for the year 2019: a.

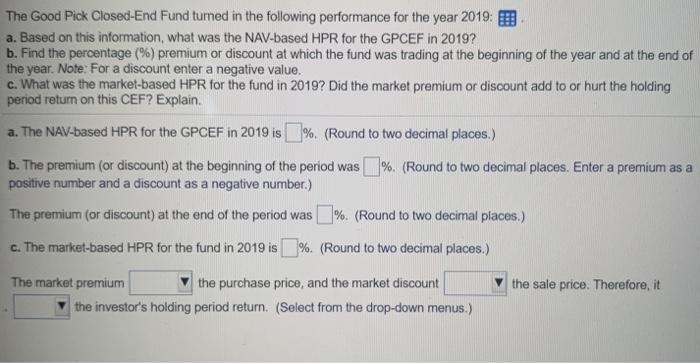

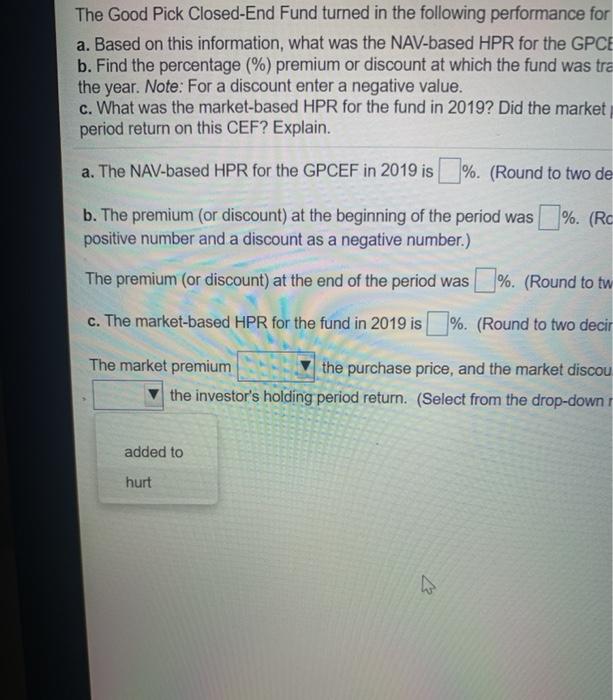

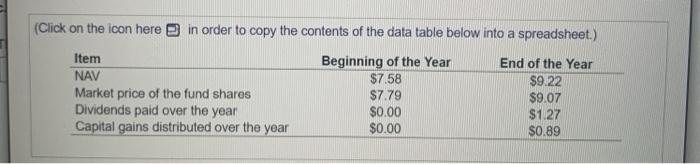

The Good Pick Closed-End Fund turned in the following performance for the year 2019: a. Based on this information, what was the NAV-based HPR for the GPCEF in 2019? b. Find the percentage (%) premium or discount at which the fund was trading at the beginning of the year and at the end of the year. Note: For a discount enter a negative value. c. What was the market-based HPR for the fund in 2019? Did the market premium or discount add to or hurt the holding period return on this CEF? Explain. a. The NAV-based HPR for the GPCEF in 2019 is %. (Round to two decimal places.) b. The premium (or discount) at the beginning of the period was % (Round to two decimal places. Enter a premium as a positive number and a discount as a negative number.) The premium (or discount) at the end of the period was % (Round to two decimal places.) c. The market-based HPR for the fund in 2019 is %. (Round to two decimal places.) The market premium the purchase price, and the market discount the sale price. Therefore, it the investor's holding period return. (Select from the drop-down menus.) Good Pick Closed-End Fund turned in the following performance for the year 2019: Based on this information, what was the NAV-based HPR for the GPCEF in 2019? Find the percentage (%) premium or discount at which the fund was trading at the beginning of the year. Note: For a discount enter a negative value. Nhat was the market-based HPR for the fund in 2019? Did the market premium or discount add to riod return on this CEF? Explain. The NAV-based HPR for the GPCEF in 2019 is 1%. (Round to two decimal places.) The premium (or discount) at the beginning of the period was %. (Round to two decimal places. ositive number and a discount as a negative number.) the premium (or discount) at the end of the period was %. (Round to two decimal places.) The market-based HPR for the fund in 2019 is %. (Round to two decimal places.) the sale pri The market premium the investi the purchase price, and the market discount eturn. (Select from the drop-down menus.) increased reduced nd turned in the following performance for the year 2019: hat was the NAV-based HPR for the GPCEF in 2019? mium or discount at which the fund was trading at the beginning of the year and at the er enter a negative value. HPR for the fund in 2019? Did the market premium or discount add to or hurt the holding plain. GPCEF in 2019 is %. (Round to two decimal places.) at the beginning of the period was %. (Round to two decimal places. Enter a premium as unt as a negative number.) t the end of the period was %. (Round to two decimal places.) or the fund in 2019 is %. (Round to two decimal places.) the purchase price, and the market discount olding period return. (Select from the drop-down me the sale price. Therefore, it increased reduced The Good Pick Closed-End Fund turned in the following performance for a. Based on this information, what was the NAV-based HPR for the GPCE b. Find the percentage (%) premium or discount at which the fund was tra the year. Note: For a discount enter a negative value. c. What was the market-based HPR for the fund in 2019? Did the market period return on this CEF? Explain. a. The NAV-based HPR for the GPCEF in 2019 is %. (Round to two de b. The premium (or discount) at the beginning of the period was % (RO positive number and a discount as a negative number.) The premium (or discount) at the end of the period was %. (Round to tw c. The market-based HPR for the fund in 2019 is %. (Round to two decir The market premium the purchase price, and the market discou the investor's holding period return. (Select from the drop-down added to hurt (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Item NAV Market price of the fund shares Dividends paid over the year Capital gains distributed over the year Beginning of the Year $7.58 $7.79 $0.00 $0.00 End of the Year $9.22 $9.07 $1.27 S0.89

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts