Question: I already have a answer, but I need explanation why. please provide me detailed explanation please. please provide detailed explanation Question One: Hazelton Corporation uses

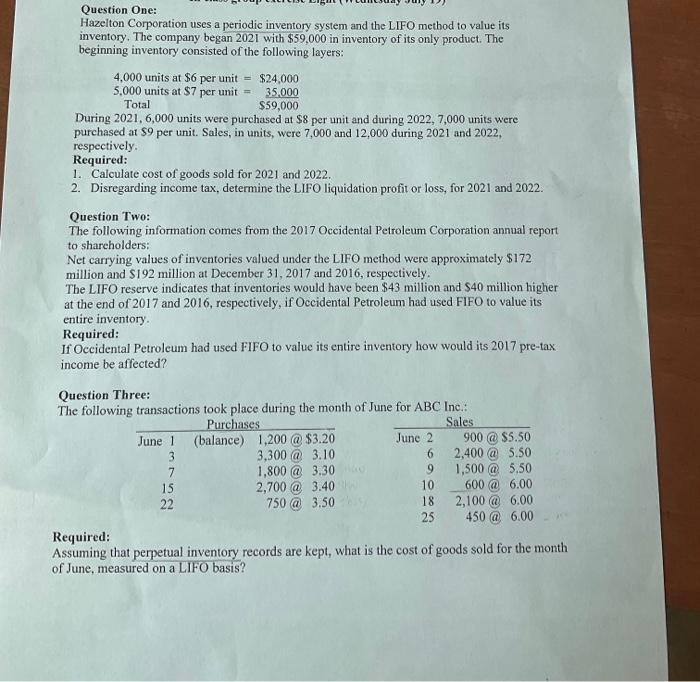

Question One: Hazelton Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2021 with $59,000 in inventory of its only product. The beginning inventory consisted of the following layers: During 2021, 6,000 units were purchased at $8 per unit and during 2022, 7,000 units were purchased at $9 per unit. Sales, in units, were 7,000 and 12,000 during 2021 and 2022, respectively. Required: 1. Calculate cost of goods sold for 2021 and 2022 . 2. Disregarding income tax, determine the LIFO liquidation profit or loss, for 2021 and 2022. Question Two: The following information comes from the 2017 Occidental Petroleum Corporation annual report to shareholders: Net carrying values of inventories valued under the LIFO method were approximately $172 million and \$192 million at December 31, 2017 and 2016, respectively. The LIFO reserve indicates that inventories would have been $43 million and $40 million higher at the end of 2017 and 2016, respectively, if Occidental Petroleum had used FIFO to value its entire inventory. Required: If Oecidental Petroleum had used FIFO to value its entire inventory how would its 2017 pre-tax income be affected? Question Three: The following transactions took place during the month of June for ABC Inc.: Required: Assuming that perpetual inventory records are kept, what is the cost of goods sold for the month of June, measured on a LIFO basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts