Question: I already have the solution for this. I just need help understanding how to work the problem. PLEASE answer as thoroughly as possible. Please try

I already have the solution for this. I just need help understanding how to work the problem. PLEASE answer as thoroughly as possible. Please try to label steps and all formulas needed. Thank you so so much.

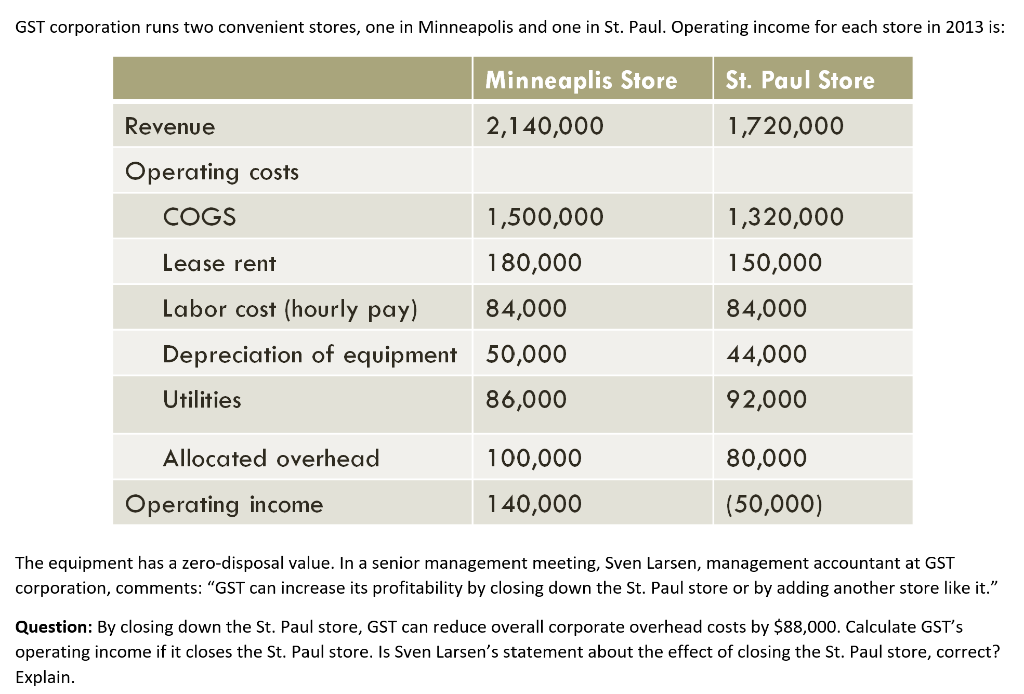

GST corporation runs two convenient stores, one in Minneapolis and one in St. Paul. Operating income for each store in 2013 is: St. Paul Store 1,720,000 Minneaplis Store Revenue 2,140,000 Operating costs COGS 1,500,000 Lease rent 180,000 Labor cost (hourly pay) 84,000 Depreciation of equipment 50,000 Utilities 86,000 1,320,000 150,000 84,000 44,000 92,000 Allocated overhead 80,000 100,000 140,000 Operating income (50,000) The equipment has a zero-disposal value. In a senior management meeting, Sven Larsen, management accountant at GST corporation, comments: "GST can increase its profitability by closing down the St. Paul store or by adding another store like it." Question: By closing down the St. Paul store, GST can reduce overall corporate overhead costs by $88,000. Calculate GST's operating income if it closes the St. Paul store. Is Sven Larsen's statement about the effect of closing the St. Paul store, correct? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts