Question: I already knew how to solve this problem. I just need to confirm some variables here. How do I calculate weight A and weight B

I already knew how to solve this problem. I just need to confirm some variables here. How do I calculate weight A and weight B in this example? Please show your work.

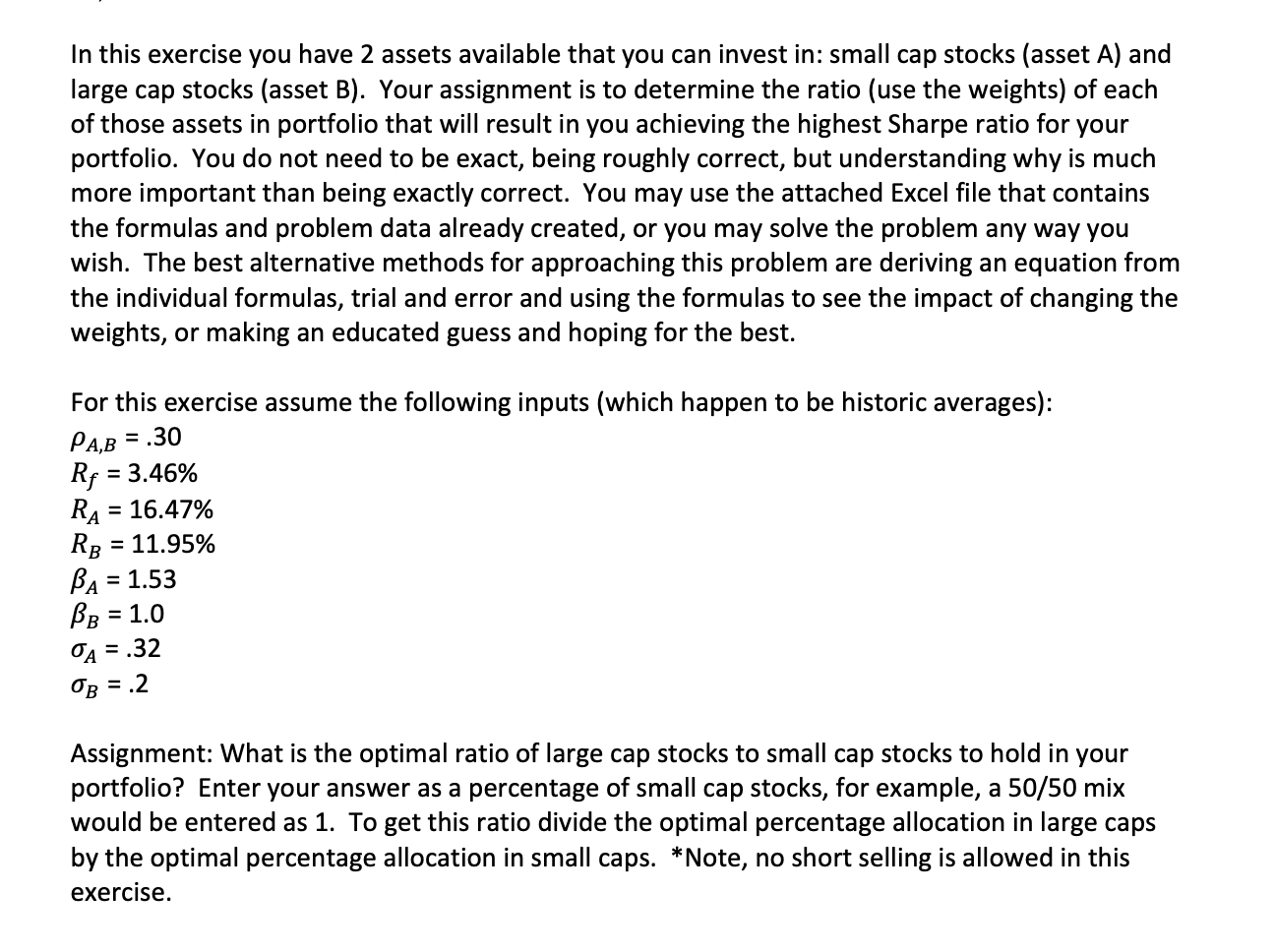

In this exercise you have 2 assets available that you can invest in: small cap stocks (asset A) and large cap stocks (asset B). Your assignment is to determine the ratio (use the weights) of each of those assets in portfolio that will result in you achieving the highest Sharpe ratio for your portfolio. You do not need to be exact, being roughly correct, but understanding why is much more important than being exactly correct. You may use the attached Excel file that contains the formulas and problem data already created, or you may solve the problem any way you wish. The best alternative methods for approaching this problem are deriving an equation from the individual formulas, trial and error and using the formulas to see the impact of changing the weights, or making an educated guess and hoping for the best. For this exercise assume the following inputs (which happen to be historic averages): PA,B = .30 Rf = 3.46% RA = 16.47% RB = = 11.95% BA = 1.53 Br = 1.0 A = .32 = OB = .2 Assignment: What is the optimal ratio of large cap stocks to small cap stocks to hold in your portfolio? Enter your answer as a percentage of small cap stocks, for example, a 50/50 mix would be entered as 1. To get this ratio divide the optimal percentage allocation in large caps by the optimal percentage allocation in small caps. *Note, no short selling is allowed in this exercise. In this exercise you have 2 assets available that you can invest in: small cap stocks (asset A) and large cap stocks (asset B). Your assignment is to determine the ratio (use the weights) of each of those assets in portfolio that will result in you achieving the highest Sharpe ratio for your portfolio. You do not need to be exact, being roughly correct, but understanding why is much more important than being exactly correct. You may use the attached Excel file that contains the formulas and problem data already created, or you may solve the problem any way you wish. The best alternative methods for approaching this problem are deriving an equation from the individual formulas, trial and error and using the formulas to see the impact of changing the weights, or making an educated guess and hoping for the best. For this exercise assume the following inputs (which happen to be historic averages): PA,B = .30 Rf = 3.46% RA = 16.47% RB = = 11.95% BA = 1.53 Br = 1.0 A = .32 = OB = .2 Assignment: What is the optimal ratio of large cap stocks to small cap stocks to hold in your portfolio? Enter your answer as a percentage of small cap stocks, for example, a 50/50 mix would be entered as 1. To get this ratio divide the optimal percentage allocation in large caps by the optimal percentage allocation in small caps. *Note, no short selling is allowed in this exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts